JVC 2001 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2001 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

0

10

20

30

40

97 0198 99 00

0

200

400

600

800

97 0198 99 00

< 22 VICTOR COMPANY OF JAPAN, LIMITED 23 >

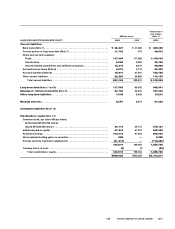

effective from the year under review. The other was the

recording of an unrealized holding gain of securities result-

ing from the application of accounting standards for finan-

cial instruments. As a result of these and other factors,

stockholders’ equity as a percentage of total assets fell 6.1

percentage points to 30.8%.

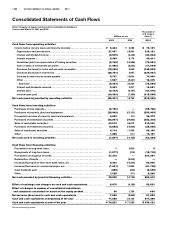

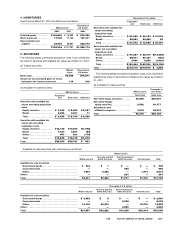

CASH FLOWS

Operating activities used net cash of ¥26.4 billion (US$213.0

million). This was mainly due to an increase in inventories,

reflecting the effects of the slowdown in the U.S. economy at

the start of 2001, and an increase in notes and accounts

receivable resulting from higher sales in March.

Investing activities used net cash of ¥7.9 billion (US$63.4

million), reflecting mainly cash used for the purchases of

property, plant and equipment offset to a large extent by

net proceeds from sales of marketable securities.

Financing activities provided net cash of ¥35.2 billion

(US$283.9 million). This reflected a net increase in short-term

bank loans and proceeds from the issuance of bonds to fund

upcoming redemptions of bonds, offset in part by a decrease

in commercial paper.

As a result of the foregoing, cash and cash equivalents at

end of the year were ¥79.3 billion (US$639.1 million), ¥7.7

billion higher than a year ago.

Notes: 1. Effective from the fiscal year ended March 31, 2001, JVC has 5 busi-

ness segments—Consumers Electronics, Professional Electronics,

Components & Devices, Entertainment Softwares & Medias, and

Other—reflecting the adoption of a “Company-in-Company” system

in April 2000. Previously, there were 2 business segments: Audiovisual

and Information-related Businesses, and Entertainment Business.

Segment information for the previous fiscal year has been restated

to conform with the presentation in the year under review.

2. The Company prepared the 2001 and 2000 consolidated statements

of cash flows in accordance with accounting standards that took

effect on April 1, 1999. The 1999 consolidated statement of cash

flows has not been restated.

0

20

10

30

40

50

97 0198 99 00

STOCKHOLDERS’ EQUITY/

TOTAL ASSETS

(Billions of yen)

DEPRECIATION AND

AMORTIZATION/

CAPITAL EXPENDITURES

(Billions of yen)

R&D EXPENDITURES

(Billions of yen)

Stockholders’ equity

Total assets

Depreciation & amortization

Capital expenditures