Dollar Tree 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1RWHVWR&RQVROLGDWHG)LQDQFLDO6WDWHPHQWV

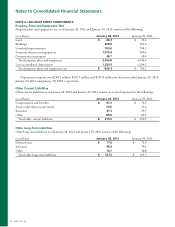

NOTE 5—LONG-TERM DEBT

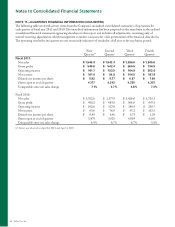

Long-term debt at January 28, 2012 and January 29, 2011 consists of the following:

(in millions) January 28, 2012 January 29, 2011

$550.0 million Unsecured Credit Agreement, interest payable

monthly at LIBOR, plus 0.50%, which was 0.77% at

January 28, 2012, principal payable upon

expiration of the facility in February 2013 $250.0 $ 250.0

Demand Revenue Bonds, interest payable monthly at a

variable rate which was 0.27% at January 28, 2012,

principal payable on demand, maturing June 2018 15.5 16.5

Total long-term debt $265.5 $ 266.5

Less current portion 15.5 16.5

Long-term debt, excluding current portion $250.0 $ 250.0

Maturities of long-term debt are as follows: 2012 – $15.5 million and 2013 – $250.0 million.

Unsecured Credit Agreement

In 2008, the Company entered into the Agreement

which provides for a $300.0 million revolving line of

credit, including up to $150.0 million in available letters

of credit, and a $250.0 million term loan. e interest

rate on the facility is based, at the Company’s option, on

a LIBOR rate, plus a margin, or an alternate base rate,

plus a margin. e revolving line of credit also bears a

facilities fee, calculated as a percentage, as defined, of

the amount available under the line of credit, payable

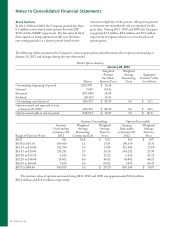

In all of the remaining cases, plaintiffs also assert various

state law claims for which they seek class treatment. e

Georgia suit seeks statewide class certification for those

assistant managers similarly situated during the relevant

time periods and the Florida, Colorado, Michigan and

Illinois cases seek nationwide certifications for those

assistant store managers similarly situated during the

relevant time periods. e Illinois case also includes

a purported class of all other hourly store associates,

making the same allegations on their behalf. e

Company has commenced its investigation and has filed

motions to dismiss and motions to transfer venue to the

Eastern District of Virginia in all cases. No rulings on

these motions have been made to date. e Plaintiffs

filed a motion with the federal court Multi-District

Litigation Panel to consolidate all these and other related

cases which motion was denied. To date, the only cases

in which class certification motions have been filed is in

the Illinois and Colorado actions. None of the cases have

been assigned a trial date.

e Company will vigorously defend itself in these

matters. e Company does not believe that any of

these matters will, individually or in the aggregate, have

a material effect on its business or financial condition.

e Company cannot give assurance, however, that one

or more of these lawsuits will not have a material effect

on its results of operations for the period in which they

are resolved. Based on the information available to the

Company, including the amount of time remaining before

trial, the results of discovery and the judgment of internal

and external counsel, the Company is unable to express

an opinion as to the outcome of those matters which are

not settled and cannot estimate a potential range of loss

on the outstanding matters.

quarterly. e term loan is due and payable in full at the

five year maturity date of the Agreement. e Agreement

also bears an administrative fee payable annually. e

Agreement, among other things, requires the maintenance

of certain specified financial ratios, restricts the payment

of certain distributions and prohibits the incurrence of

certain new indebtedness. As of January 28, 2012, the

Company had the $250.0 million term loan outstanding

under the Agreement and no amounts outstanding under

the $300.0 million revolving line of credit.

2011 Annual Report 41