Dollar Tree 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

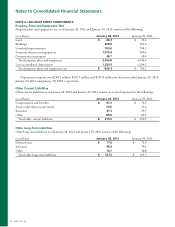

1RWHVWR&RQVROLGDWHG)LQDQFLDO6WDWHPHQWV

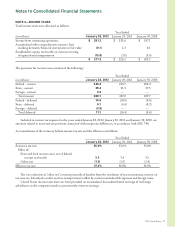

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets

and liabilities for financial reporting purposes and the amounts used for income tax purposes. Deferred tax assets and

liabilities are classified on the accompanying consolidated balance sheets based on the classification of the underlying

asset or liability. Significant components of the Company’s net deferred tax assets (liabilities) follow:

(in millions) January 28, 2012 January 29, 2011

Deferred tax assets:

Deferred rent $31.5 $ 31.4

Accrued expenses

31.4 25.4

Net operating losses and credit carryforwards

9.1

6.4

Accrued compensation expense

27.0

22.5

Other

1.5

1.9

Total deferred tax assets

100.5

87.6

Valuation allowance

(3.5)

(4.8)

Deferred tax assets, net

97.0

82.8

Deferred tax liabilities:

Property and equipment

(34.0)

(4.6)

Goodwill

(15.1)

(15.8)

Prepaid expenses

(0.4)

(3.8)

Inventory

(4.5)

(4.3)

Total deferred tax liabilities

(54.0)

(28.5)

Net deferred tax asset $ 43.0 $ 54.3

A valuation allowance of $3.5 million, net of federal

tax benefits, has been provided principally for certain

state credit carryforwards and net operating loss carryfor-

wards. In assessing the realizability of deferred tax assets,

the Company considers whether it is more likely than

not that some portion or all of the deferred taxes will not

be realized. Based upon the availability of carrybacks of

future deductible amounts to the past two years’ taxable

income and the Company’s projections for future taxable

income over the periods in which the deferred tax assets

are deductible, the Company believes it is more likely

than not the remaining existing deductible temporary

differences will reverse during periods in which carry-

backs are available or in which the Company generates

net taxable income.

e company is participating in the Internal Revenue

Service (“IRS”) Compliance Assurance Program (“CAP”)

for the 2011 fiscal year and has applied to participate for

fiscal year 2012. is program accelerates the examination

of key transactions with the goal of resolving any issues

before the tax return is filed. Our federal tax returns

have been examined and all issues have been settled

through our fiscal 2010 tax year. In addition, several

states completed their examination during the fiscal year.

In general, fiscal years 2008 and forward are within the

statute of limitations for state tax purposes. e statute of

limitations is still open prior to 2008 for some states.

ASC 740 prescribes a recognition threshold and

measurement attribute for a tax position taken or

expected to be taken in a tax return. Under the guidelines

of ASC 740, an entity should recognize a financial

statement benefit for a tax position if it determines that it

is more likely than not that the position will be sustained

upon examination.

38 Dollar Tree, Inc.