Dollar Tree 2011 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2011 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

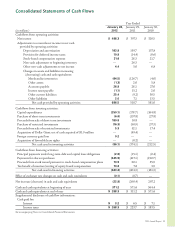

&RQVROLGDWHG6WDWHPHQWVRI&DVK)ORZV

(in millions)

Year Ended

January 28,

2012

January 29,

2011

January 30,

2010

Cash flows from operating activities:

Net income $ 488.3 $ 397.3 $ 320.5

Adjustments to reconcile net income to net cash

provided by operating activities:

Depreciation and amortization 163.9 159.7 157.8

Provision for deferred income taxes 10.9 (14.4) (0.6)

Stock-based compensation expense 31.6 28.3 21.7

Non-cash adjustment to beginning inventory — 26.3 —

Other non-cash adjustments to net income 4.4 5.0 6.8

C hanges in assets and liabilities increasing

(decreasing) cash and cash equivalents:

Merchandise inventories (64.5) (126.7) (4.0)

Other assets (1.3) 2.0 5.8

Accounts payable 26.9 28.1 27.0

Income taxes payable (1.1) 15.2 2.0

Other current liabilities 25.4 (9.2) 30.5

Other liabilities 2.0 7.1 13.5

Net cash provided by operating activities 686.5 518.7 581.0

Cash flows from investing activities:

Capital expenditures (250.1) (178.7) (164.8)

Purchase of short-term investments (6.0) (157.8) (27. 8)

Proceeds from sale of short-term investments 180.8 10.8 —

Purchase of restricted investments (16.3) (50.9) (37.3)

Proceeds from sale of restricted investments 5.3 52.1 17.4

Acquisition of Dollar Giant, net of cash acquired of $1.9 million — (49.4) —

Foreign currency gain/loss 0.2 — —

Acquisition of favorable lease rights — (0.2) —

Net cash used in investing activities (86.1) (374.1) (212.5)

Cash flows from financing activities:

Principal payments under long-term debt and capital lease obligations (2.0) (15.1) (0.4)

Payments for share repurchases (645.9) (417.1) (190.7)

Proceeds from stock issued pursuant to stock-based compensation plans 10.9 20.1 25.9

Tax benefit of exercises/vesting of equity-based compensation 13.8 7.8 3.9

Net cash used in financing activities (623.2) (404.3) (161.3)

Effect of exchange rate changes on cash and cash equivalents (0.1) (0.7) —

Net increase (decrease) in cash and cash equivalents (22.9) (260.4) 207.2

Cash and cash equivalents at beginning of year 311.2 571.6 364.4

Cash and cash equivalents at end of year $ 288.3 $ 311.2 $ 571.6

Supplemental disclosure of cash flow information:

Cash paid for:

Interest $ 3.2 $ 6.5 $ 7.1

Income taxes $ 268.3 $ 223.7 $ 183.5

See accompanying Notes to Consolidated Financial Statements.

2011 Annual Report 31