Dollar Tree 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

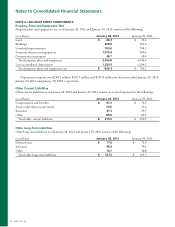

1RWHVWR&RQVROLGDWHG)LQDQFLDO6WDWHPHQWV

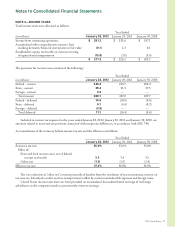

e balance for unrecognized tax benefits at January

28, 2012, was $15.5 million. e total amount of unrecog-

nized tax benefits at January 28, 2012, that, if recognized,

would affect the effective tax rate was $10.2 million (net

of the federal tax benefit). e following is a reconciliation

of the Company’s total gross unrecognized tax benefits for

the year ended January 28, 2012:

(in millions)

Balance at January 29, 2011 $ 15.2

Additions, based on tax positions

related to current year 0.8

Additions for tax positions of

prior years 0.6

Reductions for tax positions of

prior years —

Settlements —

Lapses in statutes of limitations (1.1)

Balance at January 28, 2012 $ 15.5

During fiscal 2011, the Company accrued potential

interest of $0.4 million, related to these unrecognized

tax benefits. No potential penalties were accrued during

2011 related to the unrecognized tax benefits. As of

January 28, 2012, the Company has recorded a liability

for potential penalties and interest of $0.1 million and

$4.1 million, respectively.

It is possible that state tax reserves will be reduced for

audit settlements and statute expirations within the next

12 months. At this point it is not possible to estimate a

range associated with the resolution of these audits.

NOTE 4—COMMITMENTS AND CONTINGENCIES

Operating Lease Commitments

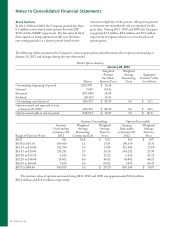

Future minimum lease payments under noncancelable store operating leases are as follows:

(in millions)

2012 $ 452.9

2013 401.1

2014 337.5

2015 264.4

2016 182.1

ereafter 291.0

Total minimum lease payments $ 1,929.0

e above future minimum lease payments include amounts for leases that were signed prior to January 28, 2012 for

stores that were not open as of January 28, 2012.

Minimum rental payments for operating leases do not include contingent rentals that may be paid under certain

store leases based on a percentage of sales in excess of stipulated amounts. Future minimum lease payments have not

been reduced by expected future minimum sublease rentals of $1.6 million under operating leases.

Minimum and Contingent Rentals

Rental expense for store and distribution center operating leases (including payments to related parties) included in the

accompanying consolidated statements of operations are as follows:

(in millions)

Year Ended

January 28, 2012 January 29, 2011 January 30, 2010

Minimum rentals $421.8 $ 381.5 $ 349.9

Contingent rentals 1.8 1.4 1.0

2011 Annual Report 39