Dollar Tree 2011 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2011 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

0DQDJHPHQW·V'LVFXVVLRQ$QDO\VLVRI

)LQDQFLDO&RQGLWLRQDQG5HVXOWVRI2SHUDWLRQV

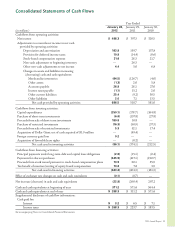

Funding Requirements

Overview, Including Off-Balance Sheet Arrangements

We expect our cash needs for opening new stores and expanding existing stores in fiscal 2012 to total approximately

$205.9 million, which includes capital expenditures, initial inventory and pre-opening costs.

Our estimated capital expenditures for fiscal 2012 are between $330.0 and $340.0 million, including planned expendi-

tures for our new and expanded stores, the addition of freezers and coolers to approximately 325 stores and approximately

$80.0 million to construct a new distribution center in the Northeast United States. We believe that we can adequately fund

our working capital requirements and planned capital expenditures for the next few years from net cash provided by opera-

tions and potential borrowings under our existing credit facility.

e following tables summarize our material contractual obligations at January 28, 2012, including both on- and

off-balance sheet arrangements, and our commitments, including interest on long-term borrowings (in millions):

Contractual Obligations Total 2012 2013 2014 2015 2016 Thereafter

Lease Financing

Operating lease obligations $ 1,929.0 $ 452.9 $ 401.1 $ 337.5 $ 264.4 $ 182.1 $ 291.0

Capital lease obligations 0.3 0.3 — ——— —

Long-term Borrowings

Credit Agreement 250.0 — 250.0——— —

Revenue bond financing 15.5 15.5———— —

Interest on long-term borrowings 2.1 1.9 0.2——— —

Total obligations $ 2,196.9 $ 470.6 $ 651.3 $ 337.5 $ 264.4 $ 182.1 $ 291.0

Commitments

Total

Expiring

in 2012

Expiring

in 2013

Expiring

in 2014

Expiring

in 2015

Expiring

in 2016

Thereafter

Letters of credit and surety bonds $ 170.7 $ 170.7 $ — $ — $ — $ — $ —

Freight contracts 222.3 143.3 58.6 20.4 — — —

Technology assets 8.9 8.9 — — — — —

Telecom contracts 3.3 — — 3.3 — — —

Total commitments $ 405.2 $ 322.9 $ 58.6 $ 23.7 $ — $ — $ —

2011 Annual Report 21