Dollar Tree 2011 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2011 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTE 1—SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

Description of Business

Dollar Tree, Inc. (the Company) is the leading operator

of discount variety retail stores offering merchandise

at the fixed price of $1.00 or less with 4,351 discount

variety retail stores in the United States and Canada at

January 28, 2012. Below are those accounting policies

considered by the Company to be significant.

Principles of Consolidation

e consolidated financial statements include the

financial statements of Dollar Tree, Inc., and its wholly

owned subsidiaries. All significant intercompany balances

and transactions have been eliminated in consolidation.

Foreign Currency

e functional currencies of the Company’s international

subsidiaries are primarily the local currencies of the

countries in which the subsidiaries are located. Foreign

currency denominated assets and liabilities are translated

into U.S. dollars using the exchange rates in effect at the

consolidated balance sheet date. Results of operations

and cash flows are translated using the average exchange

rates throughout the period. e effect of exchange

rate fluctuations on translation of assets and liabilities

is included as a component of shareholders’ equity in

accumulated other comprehensive income (loss). Gains

and losses from foreign currency transactions, which are

included in non-operating income (expense), have not

been significant.

Stock Dividend

On May 26, 2010, the Company’s Board of Directors

approved a 3-for-2 stock split in the form of a 50%

common stock dividend. New shares were distributed on

June 24, 2010 to shareholders of record as of the close of

business on June 10, 2010. As a result, all share and per

share data in these consolidated financial statements and

accompanying notes have been retroactively adjusted to

reflect these dividends, each having the effect of a 3-for-2

stock split.

Segment Information

e Company’s retail stores represent a single operating

segment based on the way the Company manages its

business. Operating decisions are made at the Company

level in order to maintain a consistent retail store

presentation. e Company’s retail stores sell similar

products and services, use similar processes to sell those

products and services, and sell their products and services

to similar classes of customers. e amounts of long-

lived assets and net sales outside of the U.S. were not

significant for any of the periods presented.

Fiscal Year

e Company’s fiscal year ends on the Saturday closest

to January 31. Any reference herein to “2011” or “Fiscal

2011,” “2010” or “Fiscal 2010,” and “2009” or “Fiscal

2009,” relates to as of or for the years ended January

28, 2012, January 29, 2011, and January 30, 2010,

respectively.

Use of Estimates

e preparation of financial statements in conformity

with U.S. generally accepted accounting principles

requires management to make estimates and assumptions

that affect the reported amounts of assets and liabilities

and disclosures of contingent assets and liabilities at the

date of the consolidated financial statements and the

reported amounts of revenues and expenses during the

reporting period. Actual results could differ from those

estimates.

Cash and Cash Equivalents

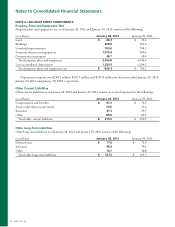

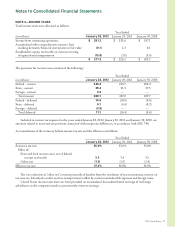

Cash and cash equivalents at January 28, 2012 and

January 29, 2011 includes $249.3 million and $271.4

million, respectively, of investments primarily in money

market securities which are valued at cost, which

approximates fair value. For purposes of the consolidated

statements of cash flows, the Company considers all

highly liquid debt instruments with original maturities of

three months or less to be cash equivalents. e majority

of payments due from financial institutions for the settle-

ment of debit card and credit card transactions process

within three business days, and therefore are classified as

cash and cash equivalents.

Short-Term Investments

At January 28, 2012 the Company held no short-term

investments. e Company’s short-term investments at

January 29, 2011 were $174.8 million. ese investments

consisted primarily of government-sponsored municipal

bonds which were convertible into cash on the dates that

the interest rates for these bonds reset, which was typi-

cally weekly or monthly, depending on the terms of the

underlying agreement. ese investments were classified

as available for sale and were recorded at fair value, which

approximated cost.

1RWHVWR&RQVROLGDWHG)LQDQFLDO6WDWHPHQWV

32 Dollar Tree, Inc.