Dollar Tree 2011 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2011 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

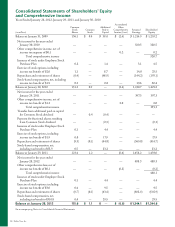

(in millions)

Common

Stock

Shares

Common

Stock

Additional

Paid-in

Capital

Accumulated

Other

Comprehensive

Income (Loss)

Retained

Earnings

Shareholders’

Equity

Balance at January 31, 2009

136.1 $ 0.9 $ 38.0 $ (2.6) $ 1,216.9 $ 1,253.2

Net income for the year ended

January 30, 2010 ———— 320.5 320.5

Other comprehensive income, net of

income tax expense of $0.1 — — — 0.2 — 0.2

Total comprehensive income 320.7

Issuance of stock under Employee Stock

Purchase Plan

0.2 — 1.4 — 3.1 4.5

Exercise of stock options, including

income tax benefit of $2.0

1.1 — 8.7 — 14.8 23.5

Repurchase and retirement of shares

(6.4) — (48.9) — (144.2) (193.1)

Stock-based compensation, net, including

income tax benefit of $1.9 0.3 — 0.8 — 19.6 20.4

Balance at January 30, 2010 131.3 0.9 — (2.4) 1,430.7 1,429.2

Net income for the year ended

January 29, 2011 ———— 397.3 397.3

Other comprehensive income, net of

income tax benefit of $1.3 — — — 2.0 — 2.0

Total comprehensive income 399.3

Transfer from additional paid-in capital

for Common Stock dividend — 0.4 (0.4) — — —

Payment for fractional shares resulting

from Common Stock dividend — — (0.3) — — (0.3)

Issuance of stock under Employee Stock

Purchase Plan 0.1 —

4.4 — — 4.4

Exercise of stock options, including

income tax benefit of $1.9 0.8 — 17.9 — — 17.9

Repurchase and retirement of shares (9.3) (0.1) (44.8) — (369.8) (414.7)

Stock-based compensation, net,

including tax benefit of $5.9 0.5 — 23.2 — — 23.2

Balance at January 29, 2011 123.4 1.2 — (0.4) 1,458.2 1,459.0

Net income for the year ended

January 28, 2012 ———— 488.3 488.3

income tax benefit of $0.1 — — — (0.2) — (0.2)

Total comprehensive income 488.1

Issuance of stock under Employee Stock

Purchase Plan 0.1 —

4.4 — — 4.4

Exercise of stock options, including

income tax benefit of $3.0 0.4 — 9.5 — — 9.5

Repurchase and retirement of shares (8.7) (0.1) (43.4) — (602.4) (645.9)

Stock-based compensation, net,

including tax benefit of $10.8 0.4 — 29.5 — — 29.5

Balance at January 28, 2012 115.6 $ 1.1 $ — $ (0.6) $ 1,344.1 $ 1,344.6

See accompanying Notes to Consolidated Financial Statements.

&RQVROLGDWHG6WDWHPHQWVRI6KDUHKROGHUV·(TXLW\

DQG&RPSUHKHQVLYH,QFRPH

30 Dollar Tree, Inc.

Other comprehensive loss, net of

Years Ended January 28, 2012, January 29, 2011, and January 30, 2010