Dollar Tree 2011 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2011 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1RWHVWR&RQVROLGDWHG)LQDQFLDO6WDWHPHQWV

Merchandise Inventories

Merchandise inventories at the Company’s distribu-

tion centers are stated at the lower of cost or market,

determined on a weighted-average cost basis. Cost is

assigned to store inventories using the retail inventory

method on a weighted-average basis. Under the retail

inventory method, the valuation of inventories at cost

and the resulting gross margins are computed by applying

a calculated cost-to-retail ratio to the retail value of

inventories. From its inception through fiscal 2009, the

Company used one inventory pool for this calculation.

Because of investments over the years in retail technology

systems, the Company was able to refine the estimate of

inventory cost under the retail method. On January 31,

2010, the first day of fiscal 2010, the Company began

using approximately thirty inventory pools in its retail

inventory calculation. As a result of this change, the

Company recorded a non-recurring, non-cash charge to

gross profit and a corresponding reduction in inventory,

at cost, of approximately $26.3 million in the first quarter

of 2010. is was a prospective change and did not

have any effect on prior periods. is change in estimate

to include thirty inventory pools in the retail method

calculation is preferable to using one pool in the calcula-

tion as it gives the Company a more accurate estimate of

cost of store level inventories.

Costs directly associated with warehousing and

distribution are capitalized as merchandise inventories.

Total warehousing and distribution costs capitalized into

inventory amounted to $34.5 million and $30.8 million

at January 28, 2012 and January 29, 2011, respectively.

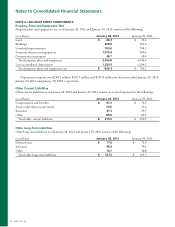

Property, Plant and Equipment

Property, plant and equipment are stated at cost and

depreciated using the straight-line method over the

estimated useful lives of the respective assets as follows:

Buildings 39 to 40 years

Furniture, fixtures and equipment 3 to 15 years

Leasehold improvements and assets held under capital

leases are amortized over the estimated useful lives of the

respective assets or the committed terms of the related

leases, whichever is shorter. Amortization is included

in “selling, general and administrative expenses” in the

accompanying consolidated statements of operations.

Costs incurred related to software developed for

internal use are capitalized and amortized generally over

three years.

Goodwill

Goodwill is not amortized, but rather tested for impair-

ment at least annually. In addition, goodwill will be tested

on an interim basis if an event or circumstance indicates

that it is more likely than not that an impairment loss

has been incurred. e Company performed its annual

impairment testing in November 2011 and determined

that no impairment loss existed.

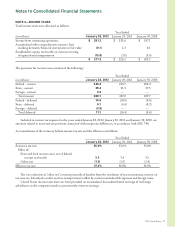

Other Assets, Net

Other assets, net consists primarily of restricted invest-

ments and intangible assets. Restricted investments were

$83.6 million and $72.1 million at January 28, 2012

and January 29, 2011, respectively and were purchased

to collateralize long-term insurance obligations. ese

investments consist primarily of government-sponsored

municipal bonds, similar to the Company’s short-term

investments held at the end of fiscal 2010 and money

market securities. ese investments are classified as

available for sale and are recorded at fair value, which

approximates cost. Intangible assets primarily include

favorable lease rights with finite useful lives and are

amortized over their respective estimated useful lives.

Impairment of Long-Lived Assets and

Long-Lived Assets to Be Disposed Of

e Company reviews its long-lived assets and certain

identifiable intangible assets for impairment whenever

events or changes in circumstances indicate that the

carrying amount of an asset may not be recoverable.

Recoverability of assets to be held and used is measured

by comparing the carrying amount of an asset to future

net undiscounted cash flows expected to be generated by

the asset. If such assets are considered to be impaired, the

impairment to be recognized is measured as the amount

by which the carrying amount of the assets exceeds the

fair value of the assets based on discounted cash flows or

other readily available evidence of fair value, if any. Assets

to be disposed of are reported at the lower of the carrying

amount or fair value less costs to sell. In fiscal 2011, 2010

and 2009, the Company recorded charges of $0.9 million,

$1.1 million and $1.3 million, respectively, to write down

certain assets. ese charges are recorded as a component

of “selling, general and administrative expenses” in the

accompanying consolidated statements of operations.

2011 Annual Report 33