CompUSA 2015 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2015 CompUSA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

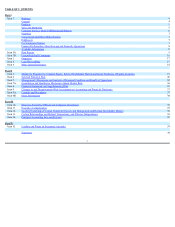

Table of Contents

·The establishment and integration of our shared service center in Hungary exposes us to various technology, regulatory and economic risks.

WeopenedoursharedservicescenterinBudapest,Hungaryduringthesecondquarterof2013tofacilitatethecontinuedgrowthofourEMEAbusiness

through operational efficiencies and enhanced internal processes. This facility provides administrative and back office services for the existing

Europeanbusiness.AsanincentivetolocateinHungary,theHungarianInvestmentandTradeAgency(“HITA”)agreedtoreimbursetheCompanyfor

approximately8%ofpayrollcosts,uptoamaximumofapproximately$3.1million,forthefirst505employeeshiredatthesharedservicecenter.The

reimbursementislimitedtothefirsttwentyfourmonthsofemploymentforemployeeshiredbyDecember2015(orsuchlowernumberofemployeesas

isnegotiatedwithHITA)withallsuchreimbursementsbeingcompletedbyDecember2017.Inreturnforthisincentive,theCompanyhascommitted

tomaintainingcertainemployment levels through 2020. Theongoing commitment is for less than 505 employees and accordingly the payroll cost

reimbursementwillbeproportionallyless.FailurebytheCompanytomaintaintheseemploymentlevelswillresultintherepaymentofaportionorall

oftherelatedreimbursementswemayreceivewithinterest.

Our efforts to operate our European business in a more centralized manner, rather than on an individual country by country basis, requires us to

implement changes in our business processes, eliminate redundancies, relocate and/or hire new personnel, transition our information management

systems, and integrate the new operation into our existing business seamlessly and without disruption to our operations, customers and vendors.

However,delaysoroperationalproblemsintransitioningourinformationmanagementsystems,alowerthanexpectedimpactofthefacilityonthe

Company’s European operations, costs and capital expenditures, the ability to timely hire and train new employees in Hungary, and delays,

impedimentsorotherproblemsassociatedwithitsestablishment couldhaveamaterialadverseeffectonourEuropeanoperationsandourresultsof

operations.

·We rely on third party suppliers for most of our products and services. The loss or interruption of these relationships could impact our sales volumes,

the levels of inventory we must carry, and/or result in sales delays and/or higher inventory costs from new suppliers. Co-operative advertising and

other sales incentives provided by our suppliers have decreased and could decrease further in the future thereby increasing our expenses and adversely

affecting our results of operations and cash flows.

We purchase a substantial portion of our products from major distributors and directly from large manufacturers who may deliver those products

directlytoourcustomers.Theserelationshipsenableustomakeavailabletoourcustomersawideselectionofproductswithouthavingtomaintain

large amounts of inventory. The termination or interruption of our relationships with any of these suppliers could materially adversely affect our

business.

WepurchaseanumberofourproductsfromvendorsoutsideoftheUnitedStates.Difficultiesencounteredbyoneorseveralofthesesupplierscould

halt or disrupt production and delaycompletion or cause the cancellation of our orders. Delays orinterruptions in the transportation network could

resultinlossordelayoftimelyreceiptofproductrequiredtofulfillcustomerorders.Ourabilitytofindqualifiedvendorswhomeetourstandardsand

supplyproductsinatimelyandefficientmannerisasignificantchallenge,especiallywithrespecttogoodssourcedfromoutsidetheU.S.Politicalor

financialinstability,merchandisequality issues, product safetyconcerns,traderestrictions,workstoppages, tariffs, foreign currency exchangerates,

transportationcapacityandcosts,inflation,civilunrest,outbreaksofpandemicsandotherfactorsrelatingtoforeigntradearebeyondourcontrol.These

andotherissuesaffectingourvendorscouldmateriallyadverselyaffectourrevenueandgrossprofit.

Manyproductsuppliersprovideuswithco-operativeadvertisingsupportinexchangeforfeaturingtheirproductsinourcatalogsandonourinternet

sites. Certain suppliers provide us with other incentives such as rebates, reimbursements, payment discounts, price protection and other similar

arrangements.Theseincentives are offset againstcostofgoodssold or selling, general and administrativeexpenses,as applicable. The level ofco-

operativeadvertising support andotherincentivesreceivedfrom suppliers hasdeclinedandmay decline further inthefuture,increasing our costof

goodssoldorselling,generalandadministrativeexpensesandhaveanadverseeffectonresultsofoperationsandcashflows.

·Goodwill and intangible assets may become impaired resulting in a charge to earnings.

The Company has made acquisitions in the past of other businesses and these acquisitions resulted in the recording of significant intangible assets

and/orgoodwill.Wearerequiredtotestgoodwillandintangibleassetsannuallytodetermineifthecarryingvaluesoftheseassetsareimpairedorona

morefrequentbasisifindicatorsofimpairmentexist.Ifanyofourgoodwillorintangibleassetsaredeterminedtobeimpairedwemayberequiredto

record a significant charge to earnings in the period during which the impairment is discovered. Previously, impairment charges on goodwill and

intangibleassetsoccurredin2014and2013fortheNATGbusiness.NoimpairmentchargeshaveoccurredinIPGandEMEA.Althoughthecarrying

amountsofintangibleassetsandgoodwillarerelatively smallasofDecember31,2015,totheextenttheCompanymakesacquisitionsinthefuture

therecouldagainbematerialamountsofsuchassetsrecordedandsubjecttofutureimpairmenttesting.

12