Cash America 2009 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2009 Cash America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cash America should head and how

to navigate the journey. If we wind up

someplace else, we will have fallen victim

to either poor execution or shortsighted

government interference; it won’t be for

lack of vision or thoughtful planning.

In last year’s annual message to

you, I first introduced my theory that the

worldwide recession surfacing in 2007

had launched a real and lasting change

in the provision of consumer credit. Gone

are the days of the daily mailbox delivery

of pre-approved credit cards with $10,000

limits for your children and domestic

animals. Market forces – particularly

driven by the mismatch of pricing and

risk in the subprime mortgage market –

have led to a retrenchment in credit

modeling and a resulting contraction

of available credit.

Government intervention in the

form of new rules and regulations

has accelerated the transition and

exacerbated its effects. Recently

passed federal legislation in the U.S.

covering credit cards and overdraft

protection will likely result in the

unintended consequence of driving

millions of consumers from their

long-standing “banked” status into the

unfamiliar ranks of the “underbanked.”

Consequently, I argue that those

with the most experience serving the

underbanked stand to gain a significant

share of consumers.

I am hesitant to characterize this

shift as permanent, as I have painfully

learned in my long career that very little

permanence exists in the business world.

I do believe the transition of consumer

status will be gradual, and the greatest

opportunity will develop as the general

economy recovers to pre-recession

employment and consumer confidence

levels. Even then, I don’t expect consumers

to return to their old borrow-and-spend

habits. I suspect the impact of the recession

will leave a lasting imprint on the psyche

of the consumer, and the recent reversal

we have seen in the 25-year decline of

the personal savings rate will likely be

sustainable for the foreseeable future.

I also expect the nomadic crowd will

be seeking credit options that appear

different than the products currently

offered to the underbanked. These

customers will astutely recognize that new

options will likely be more expensive, but

I doubt they will anxiously embrace the

products offered by the industry over the

past 25 years. Those companies currently

serving the underbanked will be foolish

to assume otherwise. Innovation driven

by technology and sophisticated data

management will be the key to meeting

the needs of the new marketplace.

Our current demographic base

of customers is not going away, and

we will continue to leverage our skill

and experience to enhance the value

proposition for those customers in both

the U.S. and new international markets.

At the same time, we will invest in new

technologies and product development in

positioning ourselves to fill the void for

newly disenfranchised bank customers.

Navigating the minefield of nagging

government interference will be an

integral part of the journey, and we are

prepared for that challenge.

The opportunity for us to leverage

the cash flow strength of our legacy

business as we redefine ourselves for

the new realities of the consumer credit

market has invigorated our already highly

charged organization. I have argued for

some time that Cash America enjoys a

competitive advantage in the pursuit

of an evolving marketplace. Some of

our competitors can match individual

strengths of our organization, but I find

none that can match the breadth of our

strategic presence – a presence that

includes a dominant and expanding

position for secured consumer lending,

robust multiple delivery channels,

innovative research and development

capabilities, international diversification

and a highly experienced management

team. This combination provides us a

significant edge in creating new value

on your behalf.

Thank you for the confidence and trust

you have placed in us.

Daniel R. Feehan

Chief Executive Officer and President

February 2010

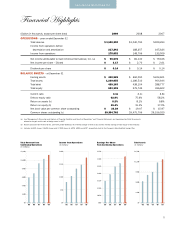

$1.20

$1.00

$0.80

$0.60

$0.40

$0.20

$0.0

Quarterly Earnings Per Share

Continuing Operations

05

Q -1 Q -2 Q -3 Q -4

06 07 08 09

3

Cash America International, Inc.