Cash America 2009 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2009 Cash America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178

|

|

Traditional banking penetration in Mexico varies

widely among income segments, with a clearly underserved

low-income bracket. Of the approximately 14.5 million

households included in lower-income segments, an

estimated 10.2 million, or 75 percent, are not served by

banks. Therefore, the opportunity for continued expansion

in Mexico is significant. The resulting advantages for Cash

America are momentous, with the potential to reap

substantial benefits, and illustrate once more how Cash

America fills the void created when traditional banks don’t

meet customer needs. As we see continued success with

Prenda Fácil, we have the opportunity to leverage our

experience in Mexico to pursue expansion into Central and

South America, where markets and cultures are similar.

But our growth potential isn’t limited to geographic

boundaries; we also remain focused on growing customer

interest and demand within the markets we already serve.

Our domestic pawn business is expected to experience

continued growth – a sagging economy, high gold prices

and the tightening of credit by banks have created additional

demand for the core products on which we’ve retained focus.

In addition, our new consumer marketing campaign with a

“why pay retail” message was a success targeting the

Las Vegas market. In 2010, we hope to generate increased

consumer traffic among a value-conscious audience as we

expand the campaign into additional markets.

9

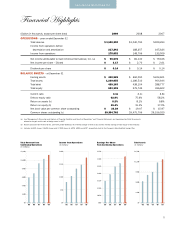

Pawn Service Charges 35%

Profit on Merchandise 27%

Cash Advance Fees,

Net of Loan Losses 36%

Check Cashing/Other 2%

Pawn-

Related

Total

62%

Composition of Net Revenue,

Net of Loan Loss Expense

(12 months ended December 31, 2009)