Cash America 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Cash America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cash America International, Inc.

2009 Annual Report

Staying Focused

Table of contents

-

Page 1

Cash America International, Inc. 2009 Annual Report Staying Focused -

Page 2

... Executed ...Cash America is pleased to be a notable, laser-focused business - now for 25 years. This year, as we celebrate our 25th anniversary of leading the pawn lending and small loan industry, we commend the ability of our team...customer needs have evolved - all in order to bring customer solutions... -

Page 3

-

Page 4

... Payday Advance" and "Cashland," and 120 unconsolidated franchised and six Company-owned check cashing centers operating in 16 states in the United States under the name "Mr. Payroll." Additionally, as of December 31, 2009, the Company offered short-term cash advances over the Internet to customers... -

Page 5

... 29,156,020 (a) See "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Financial Statements and Supplementary Data" for amounts related to the gain on the sale of foreign notes in 2007. (b) Returns based on Net Income for the 12-month period divided by the... -

Page 6

... the value opportunity of our core businesses while we also pursue new opportunities to innovate and redeï¬ne our business model and the markets we serve. Canada, and the ongoing maturation of our online business in the United Kingdom. Loss rates for our shortterm unsecured cash advance products... -

Page 7

...the value proposition for those customers in both the U.S. and new international markets. At the same time, we will invest in new technologies and product development in positioning ourselves to ï¬ll the void for newly disenfranchised bank customers. Navigating the mineï¬eld of nagging government... -

Page 8

Cash America International, Inc. Customer Service Cash America has, throughout our history, consistently zeroed in on new ways to make short-term credit manageable for our customers. We know that our customers are looking for more than alternative ï¬nancial options - they're also looking for a ... -

Page 9

...In 2009, we saw the addition of jewelry pawn lending, gold-buying and additional ancillary services to these storefront cash advance locations. The cash advance loan process is also simple for our customers. They provide paperwork such as current pay stubs and bank statements in order to apply. Once... -

Page 10

Cash America International, Inc. Appearance When we began our business in 1984 with one small pawn shop in Irving, Texas, it wasn't easy to make the pawn industry look good. This oft-misperceived world, with its movie images of dimly lit, smoke-ï¬lled storefronts and corruption, lacked both focus ... -

Page 11

... to new heights. Before Cash America, the pawn industry was closely guarded, but we were the ï¬rst company to raise capital, including public equity, to build a chain of pawn lending locations, the ï¬rst to develop formal training systems for employees, and the ï¬rst to network stores with... -

Page 12

... 60 new stores in Mexico in 2010, which would then represent 30 percent of our total pawn lending locations at the coming year-end. The pawn business in Mexico is predominantly based on gold jewelry. This is a less complex business model than a full-scale pawn shop that Cash America operates in the... -

Page 13

... consumer trafï¬c among a value-conscious audience as we expand the campaign into additional markets. Composition of Net Revenue, Net of Loan Loss Expense (12 months ended December 31, 2009) Pawn Service Charges 35% Profit on Merchandise 27% Cash Advance Fees, Net of Loan Losses 36% Check Cashing... -

Page 14

... has long concentrated on making a positive impact in the communities we serve. In 2009 alone, Cash America employees raised over $300,000 for the Juvenile Diabetes Research Foundation, and we were named the nonproï¬t's top corporate team. In addition, our employee family has supported food banks... -

Page 15

...-edge management-training program that includes in-class instruction, partnerships with mentor managers and basic jewelry appraisal education. Our performance management tool also allows employees to design their own career paths. Many members of our operations team also participate in Cash America... -

Page 16

.... The Company reached new all-time highs in both revenue and earnings despite the setbacks of lost cash advance markets that contributed to 2008 results. Notwithstanding the headwinds in the cash advance markets entering 2009, our online cash advance business increased its volume of loans written by... -

Page 17

... 71 percent of Cash America's consolidated operating income. Our cash advance storefront lending locations recovered during 2009 due to strong customer demand and the introduction of gold-buying and jewelry pawn lending in most of our locations. Earnings growth in the cash advance segment is also... -

Page 18

... are abundant, correlated to customer demand for pawn loans and short-term cash advances, plus the ability to sell value-priced merchandise from unredeemed pawn loans. The expansion of Prenda Fácil and CashNetUSA, plus the addition of other online customercentric solutions, will continue expanding... -

Page 19

...small short-term loans have retreated from this market. Cash America remains committed to ï¬lling the void to help our customers meet their needs with credit solutions that cost less than alternatives available to them. We've spent 25 years developing our core competencies, values and solutions. We... -

Page 20

... International, Inc. Cash America Market Coverage Cash America Pawn, SuperPawn, Prenda Fácil, CashNetUSA, Quick Quid, Dollars Direct, Cashland and Cash America Payday Advance locations and market coverage as of December 31. Lending Locations As of December 31 U.S. PAWN 2009 Texas ...200 Florida... -

Page 21

...$100 Payday Advance Overdraft Protection Fee on $100 Transaction Credit Card Late Fee on $100 Bill Bounced Check + NSF Merchant Fee on $100 Transaction $58 Fee 1449% APR $37 Fee 986% APR $29 Fee 755% APR $15 Fee 391% APR Source: Community Financial Services Association of America. Proud Members... -

Page 22

.... Applying an annual percentage rate, or APR, to a shortterm loan is a misleading and inaccurate way to assess the product's relative cost. For every $100 borrowed, our customers pay a typical fee of $15 to $20. What the scholars say about the short-term cash advance product: "The default policy... -

Page 23

Cash America International, Inc. Independent studies and reports Regulation and Bans Consumers Fare Worse Under Payday Loan Bans: Research from Georgia, North Carolina and Oregon Shows Harm by Federal Reserve Bank of New York Research Ofï¬cer Donald P. Morgan and Cornell University graduate ... -

Page 24

... Return Performance 200 150 Index Value 100 Cash America International, Inc. S&P 500 Russell 2000 Cash America 2009 Peer Group* 50 12/31/04 12/31/05 12/31/06 12/31/07 12/31/08 12/31/09 Period Ending Index Cash America International, Inc. S&P 500 Russell 2000 Cash America 2009 Peer Group... -

Page 25

... principal executive offices) 76102 - 2599 (Zip Code) Registrant's telephone number, including area code: (817) 335-1100 Securities Registered Pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock, $.10 par value per share New York Stock... -

Page 26

... with Accountants on Accounting and Financial Disclosure ...123 Item 9A. Controls and Procedures...123 Item 9B. Other Information ...123 PART III Item 10. Directors, Executive Officers and Corporate Governance ...124 Item 11. Executive Compensation ...124 Item 12. Security Ownership of Certain... -

Page 27

... advance customers, the actions of third-parties who offer products and services to or for the Company, fluctuations in the price of gold, changes in competition, the ability of the Company to open new operating units in accordance with its plans, changes in economic conditions, real estate market... -

Page 28

-

Page 29

... and franchised lending locations and check cashing centers and via the internet. These services include secured non-recourse loans, commonly referred to as pawn loans, short-term unsecured cash advances, installment loans, credit services, check cashing and related financial services. A related... -

Page 30

... check cashing locations operating in 16 states in the United States under the name "Mr. Payroll." Pawn Lending Segment The Company offers pawn loans through its pawn lending locations in the United States and Mexico, where it began offering pawn loans in 2008. (See "Item 8. Financial Statements... -

Page 31

... increase or decrease in the market price of gold can cause a related increase or decrease in the amount of the pawn lending location's loan portfolio and related finance and service charge revenue. Pawn loans at the Company's Mexico operations are generally made for a term of four weeks, with... -

Page 32

...to the high incidence of unpaid balances beyond stated terms. The Company operates centralized collection centers to coordinate a consistent approach to customer service and collections. Although cash advance transactions may take the form of loans or deferred check deposit transactions, this report... -

Page 33

... this product as cash advance fees. In connection with the Company's card services business, the Company provides marketing and loan processing services for a third-party bank issued line of credit on certain stored-value debit cards the bank issues ("Processing Program"). The Company also acquires... -

Page 34

... locations, cash advance storefront locations and through its Mr. Payroll subsidiary. Other financial services include the sale of stored-value cards, money orders and money transfers, among others. When the Company provides a check cashing service to its customers, it charges check cashing fees... -

Page 35

..."), employs 603 persons who provide full-time services to Prenda Fácil. Future Expansion Storefront Expansion The Company historically has expanded both by acquiring existing pawnshops and cash advance storefront locations (collectively referred to as "lending locations") and by establishing new... -

Page 36

... in these markets, in late 2008 and early 2009, Cash America began gold buying services and gold-based pawn lending in many of its cash advance storefront locations. Through the addition of these services, the Company expanded its customers' available alternatives for short-term credit or cash while... -

Page 37

...the customer's credit needs. Expansion Considerations The Company's expansion program is subject to numerous unpredictable factors, such as the availability of attractive acquisition candidates or sites on suitable terms, market and regulatory conditions in the pawn or cash advance business, general... -

Page 38

... customers underserved through traditional credit providers and the limited number of large pawnshop operators in the country. Cash Advance Operations The Company offers cash advance loans via its internet channel and in most of its storefront locations. According to the Community Financial Services... -

Page 39

... under various federal, state and local statutes, ordinances and regulations. (For a geographic breakdown of operating locations, see "Item 2. Properties.") Recent Regulatory Developments. Legislation permitting short-term unsecured cash advances, or payday lending, in Arizona is scheduled to expire... -

Page 40

...disclosure requirements under the Federal Truth in Lending Act (and Federal Reserve Regulation Z under that Act) in connection with disclosing the interest, fees, total payments and annual percentage rate related to each pawn loan transaction. Additional federal regulations governing pawn operations... -

Page 41

...U.S. pawn lending locations, in all of its cash advance storefront locations and over the internet. Each state in which the Company originates cash advance products, including cash advances made online, has specific laws dealing with the conduct of this business. The same regulations generally apply... -

Page 42

... of the service fee amount as both a dollar amount and as an annual percentage rate, as required by the Federal Truth in Lending Act and applicable state laws; Providing customers who are unable to repay a loan according to its original terms an opportunity, at least once in a 12-month period, to... -

Page 43

... cash advances, though it does not apply to pawn loans. The Company does not have any loan products bearing an interest rate of 36% per annum or less, as the Company believes the losses and servicing costs associated with lending to the Company's traditional customer base would exceed the revenue... -

Page 44

...its operations are conducted in material compliance with all federal, state and local laws and ordinances applicable to its business. Company and Website Information. The Company's principal executive offices are located at 1600 West 7th Street, Fort Worth, Texas 76102-2599, and its telephone number... -

Page 45

...was a Vice President in the Corporate Banking Division of a major money center bank where he started his professional career in 1981. Mr. Bessant holds a Bachelor of Business Administration degree in accounting and finance from Texas Tech University and a Masters of Business Administration degree in... -

Page 46

... for, or impose other restrictions on pawn lending locations or cash advance lenders could have a material adverse effect on the Company's business, results of operations and financial condition. Media reports and public perception of short-term consumer loans as being predatory or abusive could... -

Page 47

... affect pawn loan balances, pawn loan redemption rates, inventory balances, inventory mixes and gross profit margins. Current and future litigation or regulatory proceedings could have a material adverse effect on the Company's business, prospects, results of operations and financial condition... -

Page 48

... quality and consistency, the Company could lose customers and related revenue from those products or services. The Company also uses third parties to support and maintain certain of its communication systems and computerized point-of-sale and information systems. The failure of such third parties... -

Page 49

... the Company's credit facilities, senior unsecured notes and 2009 Convertible Notes as more fully described under "Item 8. Financial Statements and Supplementary Data - Note 8." If the Company is unable to generate sufficient cash flow or otherwise obtain funds necessary to make required payments on... -

Page 50

... internet cash advances, perform efficient storefront lending and merchandise disposition activities, provide customer service, perform collections activities, or perform other necessary business functions. Any such interruption could materially adversely affect the Company's business, prospects... -

Page 51

... loans, and in the balance of pawn loans secured by gold jewelry. Any such change in the value of gold could materially adversely affect the Company's business, prospects, results of operations and financial condition. Increased competition from banks, savings and loans, other short-term consumer... -

Page 52

... and financial condition. Adverse real estate market fluctuations could affect the Company's profits. The Company leases most of its locations. A significant rise in real estate prices or real property taxes could result in an increase in store lease costs as the Company opens new locations and... -

Page 53

... into or exercisable for common stock for capital-raising or other business purposes. Future sales of substantial amounts of common stock, or the perception that sales could occur, could have a material adverse effect on the price of the Company's common stock. ITEM 1B. UNRESOLVED STAFF COMMENTS... -

Page 54

.... The Company also operates six Company-owned Mr. Payroll check cashing locations in Texas. Cash Advance Storefront Locations 23 31 16 12 - Pawn Lending Locations United States: Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware Florida Georgia Hawaii Idaho Illinois Indiana... -

Page 55

...Financial Statements and Supplementary Data â"€ Note 10". Item 3. Legal Proceedings On August 6, 2004, James E. Strong filed a purported class action lawsuit in the State Court of Cobb County, Georgia against Georgia Cash America, Inc., Cash America International, Inc. (together with Georgia Cash... -

Page 56

Organizations Act. Community State Bank ("CSB") for some time made loans to Georgia residents through Cash America's Georgia operating locations. The complaint in this lawsuit claims that Cash America was the true lender with respect to the loans made to Georgia borrowers and that CSB's involvement ... -

Page 57

...against Cash America International, Inc., Cash America Net of Nevada, LLC ("CashNet Nevada"), Cash America Net of Pennsylvania, LLC and Cash America of PA, LLC, d/b/a CashNetUSA.com (collectively, "CashNetUSA"). The lawsuit alleges, among other things, that CashNetUSA's internet cash advance lending... -

Page 58

Item 4. Submission of Matters to a Vote of Security Holders There were no matters submitted to the Company's security holders during the fourth quarter ended December 31, 2009. 30 -

Page 59

... 2010. The high, low and closing sales prices of common stock as quoted on the composite tape of the New York Stock Exchange and cash dividend declared per share during 2009 and 2008 were as follows: First Quarter 2009 High Low Close Cash dividend declared per share 2008 High Low Close Cash dividend... -

Page 60

...369 1,320 423,170 Average Price Paid Per Share $27.66 $17.84 $18.04 $23.37 $22.09 $25.27 $27.82 $29.12 $26.82 $32.12 $32.95 $26.84 a a a a a Includes shares purchased on the open market relating to compensation deferred by a director under the 2004 Long-Term Incentive Plan and participants in the... -

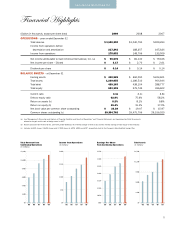

Page 61

... (b) Pawn loans Cash advances, net Merchandise held for disposition, net Working capital Total assets Total debt Total equity Ratio Data at End of Year (a) Current ratio Debt to equity ratio Owned and Franchised Locations at Year End (a) Pawn lending operations (c) Cash advance operations (d) Check... -

Page 62

...-owned and franchised lending locations and check cashing centers and via the internet. These services include secured non-recourse loans, commonly referred to as pawn loans, short-term unsecured cash advances, installment loans, credit services, check cashing and related financial services. Finance... -

Page 63

... expectations, revenue for the next reporting period would be likewise affected. Due to the short-term nature of pawn loans, the Company can quickly identify performance trends. For 2009, $227.7 million, or 98.5%, of recorded finance and service charges represented cash collected from customers and... -

Page 64

of cost (cash amount loaned) or market. Management provides an allowance for returns and valuation based on its evaluation of the merchandise and historical shrinkage rates. Because pawn loans are made without recourse to the borrower, the Company does not investigate or rely upon the borrower's ... -

Page 65

... reporting units: pawn lending operations, cash advance operations and check cashing operations. These reporting units offer products with similar economic characteristics and have discrete financial information which is regularly reviewed by executive management. See "Item 8. Financial Statements... -

Page 66

... and estimates relating to future cash flows, including the Company's interpretation of current economic indicators and market valuations and assumptions about the Company's strategic plans with regard to the Company's operations. To the extent additional information arises, market conditions change... -

Page 67

... the periods indicated. Year Ended December 31, 2008 2007 2009 Revenue Finance and service charges Proceeds from disposition of merchandise Cash advance fees Check cashing fees, royalties and other Total Revenue Cost of Revenue Disposed merchandise Net Revenue Expenses Operations Cash advance loss... -

Page 68

..., owned Acquired Start-ups Combined or closed End of period, owned Franchise locations at end of period (a) Total pawn lending locations at end of period (a) (e) Average number of owned pawn lending locations (e) Cash advance segment locations in operation (excludes online lending and card services... -

Page 69

... of period(c) States and other U.S. jurisdictions Storefront Internet Card services Foreign countries1 Internet Pawn Lending Activities(f) Annualized yield on pawn loans Pawn lending segment: Domestic Foreign (e) Combined pawn lending segment (e) Cash advance segment - storefront operations Combined... -

Page 70

... 2007 2009 Average pawn loan amount at end of period (not in thousands) Pawn lending segment: Domestic Foreign (e) Combined pawn lending segment (e) Cash advance segment - storefront operations Combined average pawn loan amount at end of period (e) Disposition of merchandise - domestic - (g) Profit... -

Page 71

... number of cash advances written - (a) (c) Cash advance segment - storefront Cash advance segment - internet lending Cash advance segment - card services Total cash advance segment Pawn lending segment - domestic Combined aggregate number of cash advances written (a) (c) Cash advance customer... -

Page 72

...: Check cashing segment Cash advance segment Pawn lending segment Combined company-owned locations Franchised locations - check cashing segment (a) Combined face amount of checks cashed (a) Fees collected from customers Company-owned locations: Check cashing segment Cash advance segment Pawn lending... -

Page 73

... these cash advances under a line of credit offered by such lender on certain stored-value and payroll cards issued by such lender. In its card services channel, the Company acquires a participation interest in the receivables originated by the third party lender and cash advance fees associated... -

Page 74

... of merchandise plus cash advance fees less cash advance loss provision plus other revenue. Other revenue is composed of check cashing fees, royalties and miscellaneous other revenue items, such as ancillary products offered in stores. The contribution from pawn lending activities for 2009, 2008... -

Page 75

...primarily due to the growth in the Company's internet lending channel and card services business, partially offset by a decrease in net revenue from cash advance storefront locations. The following table sets forth net revenue by operating segment for 2009 and 2008 (dollars in thousands): Year ended... -

Page 76

... Company's cash advance storefront locations. The profit margin on the disposition of refined gold increased to 30.1% in 2009 from 29.4% in 2008 due to a combination of increased gold sales volumes and a higher average sales price of gold sold, which offset the higher costs of gold sold in 2009. 48 -

Page 77

... number of short-term unsecured cash advance loans, which resulted in reduced cash advance fees at the Company's cash advance storefront locations, and, to a lesser extent, reduced growth at the Company's internet channel. As of December 31, 2009, cash advance products were available in 680 lending... -

Page 78

...in the consolidated financial statements for December 31, 2009 and 2008, respectively. Management notes that cash advance fees could be negatively impacted in future periods if legislation related to the cash advance product reduces the yield or revenue from the product to the point that the Company... -

Page 79

... stimulus payments, which caused a higher than normal check cashing volume in 2008. Management believes the decrease in 2009 was also due to the closure of cash advance storefront locations that offered check cashing services in late 2008 and potentially due to higher unemployment rates in 2009. The... -

Page 80

... and internationally, as well as expenses for new product development activities. These higher expenses at the Company's internet channel were partially offset by lower operating expenses for storefront activities due to locations that were closed in 2008 and the absence of costs related to... -

Page 81

... and a lower concentration of customers with no performance history, lower defaults (loans not paid when due) and a higher percentage of collections on loans that were past due. Due to the short-term nature of the cash advance product and the high velocity of loans written, seasonal trends are... -

Page 82

... Company, and (ii) cash advances written by third-party lenders that were marketed, processed, or aarranged by the Company on behalf of the third-party lenders, all at the Company's pawn lending and cash advance storefront locations and through the Company's internet and card services channels. 54 -

Page 83

... that were marketed, processed or arranged by the Company on behalf of the third-party alenders, all at the Company's pawn and cash advance storefront locations and through the Company's internet and card services achannels. (Note: The Company commenced business in the card services channel in... -

Page 84

... 10.5 % (16.7) % 19.8 N/A 4.9 % (6.4) 7.7 % 2008 Pawn lending segment components: Domestic Foreign Total pawn lending segment Cash advance segment components: Storefront Internet lending Card services Total cash advance segment Check cashing segment Consolidated net revenue $ $ $ 392,291 $ 356,275... -

Page 85

... loan term from 90 days to 60 days in 198 pawn storefront locations in the last half of 2007 contributed to higher reported pawn loan yields and contributed to better performance in the portfolio, as customer payments of finance and service charges occurred earlier and the maximum amount of fees... -

Page 86

...pawn loans secured by jewelry and the sale of gold items purchased directly from customers increased the volume of refined gold sold by the Company. The profit margin on the disposition of refined gold decreased to 29.4% in 2008, from 31.6% in 2007, primarily due to the higher advance rates on loans... -

Page 87

...16,585 42,018 (7,178) $ 355,196 $ 9,407 (17.3) % 19.8 N/A 5.3 % (17.1) 2.6 % 2008 Cash advance segment components: Storefront Internet lending Card services Total cash advance segment Pawn lending segment Consolidated cash advance fees $ 106,294 221,319 2,150 329,763 34,840 364,603 $ $ The amount... -

Page 88

... and the closing of cash advance storefront locations during 2008. The components of these fees are as follows (dollars in thousands): Year Ended December 31, 2008 Pawn Lending Cash Advance Check Cashing Total Pawn Lending 2007 Cash Advance Check Cashing Total Check cashing fees Royalties Other... -

Page 89

...customers with no performance history, and a higher percentage of collections on loans that were past due. In addition, the Company adjusted its underwriting criteria late in 2007 in an effort to reduce bad debt. Due to the short-term nature of the cash advance product and the high velocity of loans... -

Page 90

... behalf of the third-party lenders, all at the Company's pawn lending and cash advance storefront locations a cand through the Company's internet and card services channels. (Note: The Company commenced business in the card services channel in a cthe third quarter of 2008.) a CNon-GAAP presentation... -

Page 91

... (net of recoveries) as a % of combined cash advances written (a) (b)(d) Cash advances written by the Company for its own account in pawn lending locations, cash advance storefront locations and athrough the internet channel. (b) Non-GAAP presentation. Management evaluates and measures the cash... -

Page 92

... due to accelerated depreciation costs related to planned store closures as well as accelerated depreciation on computer hardware that will be replaced during the deployment of the Company's new point-ofsale system. Interest Expense. Interest expense as a percentage of total revenue was 1.6% in 2008... -

Page 93

... cash flows and the utilization of borrowings under the Company's long-term committed unsecured bank line of credit. Longer-term refinancing risk is managed by staggering the Company's debt maturities and issuing new long-term debt securities from time to time as market conditions permit. Long-term... -

Page 94

...from the pawn lending segment and an increase in net income of 14.9% from the cash advance segment. The Company's cash flows from operating activities benefited from an increase in non-cash expenses of $4.8 million from $43.1 million in 2008 to $47.9 million in 2009 related primarily to depreciation... -

Page 95

...Services, Inc. (collectively, "PBSI"). The Company also agreed to pay up to eight supplemental earn-out payments during the four-year period after the closing. The first supplemental payment required a minimum payment of $2.7 million and was made on April 1, 2009. Based on the terms of the agreement... -

Page 96

... was used for general corporate purposes. In the prior year, net cash provided by financing activities increased $94.3 million, or 223.3%, from $42.2 million in 2007 to $136.5 million in 2008 due to the issuance of long term debt, additional borrowings under bank lines of credit and a reduction in... -

Page 97

... compensation programs are an important element of the Company's compensation structure, and all forms of equity-based awards are valued and included, as appropriate, in results of operations. The following table provides a reconciliation between net income attributable to Cash America International... -

Page 98

...when market conditions permit or the Company's financial condition may require. Off-Balance Sheet Arrangements The Company arranges for consumers to obtain cash advance products from multiple independent thirdparty lenders through the CSO program. When a consumer executes a credit services agreement... -

Page 99

... ended December 31, 2009. See "Item 8. Financial Statements and Supplementary Data-Note 8." Gold Price Risk. The Company periodically uses forward sale contracts with a major gold bullion bank to sell a portion of the expected amount of refined gold produced in the normal course of business from its... -

Page 100

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA Index to Consolidated Financial Statements Report of Independent Registered Public Accounting Firm...Report of Management on Internal Control over Financial Reporting...Consolidated Balance Sheets - December 31, 2009 and 2008...Consolidated ... -

Page 101

... on these financial statements and on the Company's internal control over financial reporting based on our integrated audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform... -

Page 102

... internal control over financial reporting as of December 31, 2009 has been audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, as stated in their report which appears in this Form 10-K. /s/ DANIEL R. FEEHAN Daniel R. Feehan President and Chief Executive Officer... -

Page 103

...payment Customer deposits Income taxes currently payable Current portion of long-term debt Total current liabilities Deferred tax liabilities Noncurrent income tax payable Other liabilities Long-term debt Total liabilities Equity: Cash America International, Inc. equity: Common stock, $.10 par value... -

Page 104

... 79,346 79,346 2009 Revenue Finance and service charges Proceeds from disposition of merchandise Cash advance fees Check cashing fees, royalties and other Total Revenue Cost of Revenue Disposed merchandise Net Revenue Expenses Operations Cash advance loss provision Administration Depreciation and... -

Page 105

... Shares issued under stock based plans Stock-based compensation expense Income tax benefit from stock based compensation Issuance of convertible debt Balance at end of period Retained earnings Balance at beginning of year Net income attributable to Cash America International, Inc. Dividends paid... -

Page 106

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in thousands) Year Ended December 31, 2009 2008 2007 Net income Other comprehensive gain (loss), net of tax: Unrealized derivatives gain (loss) (1) Foreign currency translation gain (loss) (2) Total ... -

Page 107

... notes Proceeds from property insurance Net cash used in investing activities Cash Flows from Financing Activities Net (repayments) borrowings under bank lines of credit Issuance of long-term debt Net proceeds from shares issued under stock-based plans Loan costs paid Payments on notes payable and... -

Page 108

... certain line of credit receivables originated by the bank. In addition, the Company provides check cashing and related financial services through many of its lending locations and through its franchised and Company-owned check cashing centers. The Company offers shortterm cash advances exclusively... -

Page 109

... amount loaned) or market. Revenue is recognized at the time merchandise is sold. Interim customer payments for layaway sales are recorded as customer deposits and subsequently recognized as revenue during the period in which the final payment is received. In the Company's foreign pawn loan business... -

Page 110

..., the carrying value is held in "Pawn loans" on the Company's consolidated balance sheets until sold. Cash Advances • The Company offers cash advance products through its cash advance storefront locations, its internet channel, its card services business and many of its pawn lending locations. In... -

Page 111

... its pawn lending and cash advance storefront locations in the period in which the check cashing service is provided. It records royalties derived from franchise locations on an accrual basis. Revenue derived from other financial services such as money order commissions, prepaid debit card fees, etc... -

Page 112

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Property and Equipment Property and equipment is recorded at cost. The cost of property retired or sold and the related accumulated depreciation are removed from the accounts, and any resulting gain or loss... -

Page 113

...directly related to the pawn lending, cash advance and check cashing operations. These costs are incurred within the lending locations and the Company's call centers for customer service and collections. In addition, costs related to management supervision, oversight of locations and other costs for... -

Page 114

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS directly related to corporate administrative functions. Marketing Expenses Costs of advertising and direct customer procurement are expensed at the time of first occurrence and included in operating expenses... -

Page 115

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS a There were no anti-dilutive shares for the years ended December 31, 2009, 2008 and 2007. Recent Accounting Pronouncements The FASB issued ASC 105-10-05, Generally Accepted Accounting Principles, which ... -

Page 116

... Interim Disclosures about Fair Value of Financial Instruments ("ASC 825-10-65"), which requires disclosures about fair value of financial instruments for interim reporting periods as well as in annual financial statements for interim reporting periods ending after June 15, 2009. The Company adopted... -

Page 117

...effect on its consolidated financial statement footnote disclosures. 3. Acquisitions Prenda Fácil Pursuant to its business strategy of expanding its reach into new markets with new customers and new financial services, the Company, through its wholly-owned subsidiary, Cash America of Mexico, Inc... -

Page 118

.... (collectively, "PBSI"), a group of companies in the business of, among other things, providing marketing and loan processing services for, and participating in receivables associated with, a bank issued line of credit made available by the bank on certain stored-value debit cards the bank issues... -

Page 119

... earn-out payment made in April 2009. CashNetUSA Pursuant to its business strategy of expanding its reach into new markets with new customers and new financial services, on September 15, 2006, the Company, through its wholly-owned subsidiary Cash America Net Holdings, LLC, purchased substantially... -

Page 120

... foreign pawn lending locations made during 2009, 2008 and 2007 (excluding Prenda Fácil, Primary Innovations, LLC and CashNetUSA) (dollars in thousands): 2009 Number of stores acquired: Pawnshops Purchase price allocated to: Pawn loans Finance and service charges receivable Cash advances and fees... -

Page 121

... 60 days, or sooner if deemed uncollectible. Recoveries on losses previously charged to the allowance are credited to the allowance when collected. The Company's internet channel periodically sells selected cash advances that have been previously charged off. Proceeds from these sales are recorded... -

Page 122

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS included in "Accounts payable and accrued liabilities" on the Company's balance sheet. The components of Company-owned cash advances and receivables at December 31, 2009 and 2008 were as follows (in ... -

Page 123

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 5. Property and Equipment Major classifications of property and equipment at December 31, 2009 and 2008 were as follows (in thousands): 2009 Cost Land Buildings and leasehold improvements Furniture, ... -

Page 124

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Goodwill • Changes in the carrying value of goodwill for the years ended December 31, 2009 and 2008 were as follows (in thousands): Pawn Lending 205,009 $ (1,937) 3,563 206,635 $ 143,556 $ 64,108 (2,655) ... -

Page 125

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Amortization • Amortization expense for the acquired intangible assets is as follows (in thousands): Actual amortization expense for the years ended December 31: 2009 ...2008 ...2007 ...Estimated future ... -

Page 126

... the amended agreement. The Company also pays a fee on the unused portion ranging from 0.25% to 0.30% (0.30% at December 31, 2009) based on the Company's cash flow leverage ratios. The weighted average interest rate (including margin) on the USD Line of Credit for each of the one-year periods ending... -

Page 127

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Company's option, at either LIBOR plus a margin of 10.0% or at the agent's base rate plus a margin of 10.0% through March 31, 2010 at which time the pricing was to increase through rate and fee changes. The ... -

Page 128

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Conversion (Including Partial Cash Settlement) ("ASC 470-20-65"). ASC 470-20-65 requires the proceeds from the issuance of convertible debt be allocated between a debt component and an equity component. The ... -

Page 129

... Tax over book accrual of finance and service charges Allowance for cash advance losses Deferred compensation Net operating losses Deferred state credits Other Total deferred tax assets Deferred tax liabilities: Amortization of acquired intangibles Property and equipment Convertible debt Other... -

Page 130

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS The components of the provision for income taxes and the income to which it relates for the years ended December 31, 2009, 2008 and 2007 are shown below (in thousands): 2009 Income before income taxes: ... -

Page 131

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS On January 1, 2007 the Company adopted the provisions of ASC 740-10-25, which prescribes the accounting for uncertain tax positions. The aggregate change in the balance of the unrecognized tax benefits is ... -

Page 132

...advance loans in Georgia in violation of Georgia's usury law, the Georgia Industrial Loan Act and Georgia's Racketeer Influenced and Corrupt Organizations Act. Community State Bank ("CSB") for some time made loans to Georgia residents through Cash America's Georgia operating locations. The complaint... -

Page 133

...charges on its internet cash advance loans. On January 8, 2009, the Company brought suit against the Pennsylvania Department of Banking in the Pennsylvania Commonwealth Court, arguing that the notice was invalid because it was adopted in violation of applicable procedural requirements and because it... -

Page 134

...against Cash America International, Inc., Cash America Net of Nevada, LLC ("CashNet Nevada"), Cash America Net of Pennsylvania, LLC and Cash America of PA, LLC, d/b/a CashNetUSA.com (collectively, "CashNetUSA"). The lawsuit alleges, among other things, that CashNetUSA's internet cash advance lending... -

Page 135

...: Number of shares Aggregate amount (in thousands) 1,916 45 2008 6,874 234 2007 4,596 180 $ $ $ $ 28,612 553 $ 4,619 84 $ 6,697 112 12. Employee Benefit Plans The Cash America International, Inc. 401(k) Savings Plan is open to substantially all employees. Beginning January 1, 2006, new... -

Page 136

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS compensation expense of $0.8 million, $0.7 million and $0.7 million for contributions to the SERP during 2009, 2008 and 2007, respectively. The Nonqualified Savings Plan and the SERP are non-qualified tax-... -

Page 137

...time to time pursuant to an authorization from the Board of Directors of the Company and reissued those shares upon stock option exercises and stock unit conversions under its stock-based compensation plans. During 2009, 394,476 shares were purchased on the open market with an average purchase price... -

Page 138

... Company has granted restricted stock units ("RSUs, or singularly, RSU") to Company officers and to the non-management members of the Board of Directors annually since 2003. RSUs granted in December 2003 and January 2004 were granted under the 1994 Long-Term Incentive Plan; subsequent RSUs have been... -

Page 139

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS on the day before the grant date, and the grant date fair value of performance RSUs is based on the maximum amount of the award expected to be achieved. The amount attributable to RSU grants is amortized to ... -

Page 140

... three reportable operating segments: pawn lending, cash advance and check cashing. The cash advance and check cashing segments are managed separately due to the different operational strategies required and, therefore, are reported as separate segments. For comparison purposes, all prior periods in... -

Page 141

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Information concerning the operating segments is set forth below (in thousands): Pawn Lending (2) $ 230,433 $ 488,402 31,420 3,971 754,226 315,198 439,028 236,405 7,109 42,721 28,822 315,057 123,971 $ (5,... -

Page 142

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Year Ended December 31, 2008 Revenue Finance and service charges Proceeds from disposition of merchandise Cash advance fees Check cashing fees, royalties and other Total revenue Cost of revenue - disposed ... -

Page 143

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Year Ended December 31, 2007 Revenue Finance and service charges Proceeds from disposition of merchandise Cash advance fees Check cashing fees, royalties and other Total revenue Cost of revenue - disposed ... -

Page 144

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Year Ended December 31, 2009 Revenue Finance and service charges Proceeds from disposition of merchandise Cash advance fees Check cashing fees, royalties and other Total revenue Cost of revenue - disposed ... -

Page 145

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Year Ended December 31, 2007 Revenue Finance and service charges Proceeds from disposition of merchandise Cash advance fees Check cashing fees, royalties and other Total revenue Cost of revenue - disposed ... -

Page 146

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Year Ended December 31, 2008 Revenue Proceeds from disposition of merchandise Cash advance fees Check cashing fees, royalties and other Total revenue Cost of revenue - disposed merchandise Net revenue ... -

Page 147

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 17. Pro Forma Financial Information (unaudited) The following unaudited pro forma financial information reflects the consolidated results of operations of the Company as if the Prenda Fácil acquisition had... -

Page 148

... fair values of financial instruments at December 31, 2009 and 2008 were as follows (in thousands): 2009 Carrying Value Financial assets: Cash and cash equivalents Pawn loans Cash advances, net Interest rate cap Financial liabilities: Bank lines of credit Senior unsecured notes 2009 Convertible... -

Page 149

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS assets and liabilities carried at fair value to be classified and disclosed in one of the following three categories: Level 1: Quoted market prices in active markets for identical assets or liabilities. ... -

Page 150

... of the quarterly results of operations for the years ended December 31, 2009 and 2008 (in thousands, except per share data): First Quarter 2009 Total revenue Cost of revenue Net revenue Net income attributable to Cash America International, Inc. Diluted net income per share (1) Diluted weighted... -

Page 151

...accumulated and communicated to management, including the Company's Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosures. The Report of Management on Internal Control Over Financial Reporting is included in Item 8 of this Annual Report on Form... -

Page 152

..." in the Proxy Statement. Information concerning executive officers is contained in this report under "Item 1. Business- Executive Officers of the Registrant." The Company has adopted a Code of Business Conduct and Ethics that applies to all of its directors, officers, and employees. This Code is... -

Page 153

... following consolidated financial statements and schedule are filed in Item 8 of Part II of this report: Financial Statements: Report of Independent Registered Public Accounting Firm Report of Management on Internal Control over Financial Reporting Consolidated Balance Sheets - December 31, 2009 and... -

Page 154

...Asset Purchase Agreement dated July 9, 2006 by and among Cash America Net Holdings, LLC and certain of its subsidiaries and The Check Giant, LLC, its subsidiaries and members Articles of Incorporation of Cash America Investments, Inc. filed in the office of the Secretary of State of Texas on October... -

Page 155

... to "Cash America International, Inc." Articles of Amendment to the Articles of Incorporation of the Company filed in Office of the Secretary of State of Texas on May 21, 1993 Amended and Restated Bylaws of the Company effective January 1, 2010 Form of Stock Certificate Indenture dated May 19, 2009... -

Page 156

... 2008 to Employment Agreement by and among the Company, Cash America Management L.P., a wholly-owned subsidiary of the Company, and Daniel R. Feehan * Form of Executive Change-in-Control Severance Agreement between the Company, its Division Presidents and each of its Executive Vice Presidents * Form... -

Page 157

...and Restated 2004 Long-Term Incentive Plan, as amended * Form of 2009 Long-Term Incentive Plan Award Agreement for Executive Officers under the Cash America International, Inc. 2004 Long-Term Incentive Plan * (1) Form of 2009 Restricted Stock Unit Award Agreement for Non-Employee Directors under the... -

Page 158

... January 28, 2009 * Cash America International, Inc. Senior Executive Bonus Plan * Cash America International, Inc. Severance Pay Plan For Executives dated December 31, 2008 * Subsidiaries of the Company Consent of PricewaterhouseCoopers LLP Certification of Chief Executive Officer Certification of... -

Page 159

... duly authorized. CASH AMERICA INTERNATIONAL, INC. Date: February 26, 2010 By: /s/ DANIEL R. FEEHAN Daniel R. Feehan Chief Executive Officer and President Pursuant to the requirements of the Securities and Exchange Act of 1934, the report has been signed by the following persons on behalf of... -

Page 160

... STATEMENT SCHEDULE To the Board of Directors and Stockholders of Cash America International, Inc. Our audits of the consolidated financial statements and of the effectiveness of internal control over financial reporting referred to in our report dated February 26, 2010 appearing in the 2009 Annual... -

Page 161

... Company's modifications to its methodology for assessing the reasonableness of its inventory allowance. See "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" for further discussion. (b) Represents amounts related to business discontinued in 2001. 133 -

Page 162

...Asset Purchase Agreement dated July 9, 2006 by and among Cash America Net Holdings, LLC and certain of its subsidiaries and The Check Giant, LLC, its subsidiaries and members Articles of Incorporation of Cash America Investments, Inc. filed in the office of the Secretary of State of Texas on October... -

Page 163

... to "Cash America International, Inc." Articles of Amendment to the Articles of Incorporation of the Company filed in Office of the Secretary of State of Texas on May 21, 1993 Amended and Restated Bylaws of the Company effective January 1, 2010 Form of Stock Certificate Indenture dated May 19, 2009... -

Page 164

... 2008 to Employment Agreement by and among the Company, Cash America Management L.P., a wholly-owned subsidiary of the Company, and Daniel R. Feehan * Form of Executive Change-in-Control Severance Agreement between the Company, its Division Presidents and each of its Executive Vice Presidents * Form... -

Page 165

...and Restated 2004 Long-Term Incentive Plan, as amended * Form of 2009 Long-Term Incentive Plan Award Agreement for Executive Officers under the Cash America International, Inc. 2004 Long-Term Incentive Plan * (1) Form of 2009 Restricted Stock Unit Award Agreement for Non-Employee Directors under the... -

Page 166

... January 28, 2009 * Cash America International, Inc. Senior Executive Bonus Plan * Cash America International, Inc. Severance Pay Plan For Executives dated December 31, 2008 * Subsidiaries of the Company Consent of PricewaterhouseCoopers LLP Certification of Chief Executive Officer Certification of... -

Page 167

... Carolina North Carolina Tennessee Delaware Florida Georgia Delaware Delaware Delaware Subsidiaries Cash America Financial Services, Inc...Cash America Franchising, Inc...Cash America Global Financing, Inc...Cash America Global Services, Inc...Cash America Holding, Inc...Mr. Payroll Corporation... -

Page 168

... America Net of Wisconsin, LLC ...Cash America Net of Wyoming, LLC ...CashEuroNet UK, LLC ...CashNet CSO of Maryland, LLC ...CashNetUSA of Florida, LLC ...CNU DollarsDirect Canada Inc...CNU DollarsDirect Inc...CNU DollarsDirect Services Inc...DollarsDirect, LLC ...Ohio Consumer Financial Solutions... -

Page 169

... OF CASH AMERICA INTERNATIONAL, INC. (Continued) Jurisdiction of Incorporation/ Organization Subsidiaries Primary Innovations, LLC...Debit Plus Technologies, LLC ...Primary Payment Solutions, LLC ...Primary Credit Services, LLC...Mexican Structure Delaware Delaware Delaware Delaware Cash America... -

Page 170

...-18150, 033-59733, 033-29658, 03336430 and 333-161366) of Cash America International, Inc. of our report dated February 26, 2010 relating to the consolidated financial statements and the effectiveness of internal control over financial reporting, which appears in this Form 10-K. We also consent to... -

Page 171

... information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. b) Date: February 26, 2010 /s/ Daniel R. Feehan Daniel R. Feehan Chief Executive Officer and President... -

Page 172

..., whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. b) Date: February 26, 2010 /s/ Thomas A. Bessant, Jr. Thomas A. Bessant, Jr. Executive Vice President and Chief Financial Officer 144 -

Page 173

...In connection with the Annual Report of Cash America International, Inc. (the "Company") on Form 10K for the year ended December 31, 2009, as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Daniel R. Feehan, Chief Executive Officer and President of the Company... -

Page 174

... with the Annual Report of Cash America International, Inc. (the "Company") on Form 10K for the year ended December 31, 2009, as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Thomas A. Bessant, Jr., Executive Vice President and Chief Financial Officer of the... -

Page 175

-

Page 176

... Services Division Vice President - Global Initiatives - Internet Services Division Alex K. Vaughn Vice President - Government Relations Clint D. Jaynes Sr. Vice President - Human Resources O. Doak Raulston III Aditya K. Garg Vice President - Real Estate - Retail Services Division Vice President... -

Page 177

...Vice President, General Counsel and Secretary Dennis J. Weese President - Retail Services Division Other Information Corporate Address Cash America International Building 1600 West 7th Street Fort Worth, Texas 76102-2599 (817) 335-1100 www.cashamerica.com www.enovaï¬nancial.com www.cashnetusa.com... -

Page 178

1600 West 7th Street Fort Worth, Texas 76102-2599 (817) 335-1100 www.cashamerica.com www.enovaï¬nancial.com www.cashnetusa.com www.quickquid.co.uk www.dollarsdirect.com.au www.dollarsdirect.ca www.strikegoldnow.com www.cashlandloans.com www.mrpayroll.com www.primaryinnovations.net