XM Radio 2014 Annual Report Download - page 93

Download and view the complete annual report

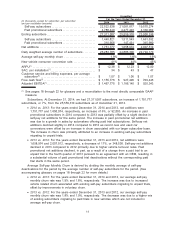

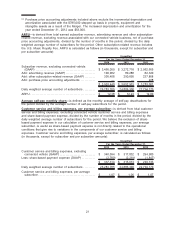

Please find page 93 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.New Vehicle Consumer Conversion Rate is the percentage of owners and lessees of new

vehicles that receive our service and convert to become self-paying subscribers after an initial

promotional period. The metric excludes rental and fleet vehicles. (See accompanying glossary on

pages 18 through 22 for more details).

•2014 vs. 2013: For the years ended December 31, 2014 and 2013, the new vehicle

consumer conversion rate was 41% and 44%, respectively. The decrease in the new vehicle

consumer conversion rate was primarily due to an increased penetration rate and lower

conversion of first-time satellite enabled car buyers and lessees.

•2013 vs. 2012: For the years ended December 31, 2013 and 2012, the new vehicle

consumer conversion rate was 44% and 45%, respectively. The decrease in the new vehicle

consumer conversion rate was primarily due to the mix of sales by OEMs.

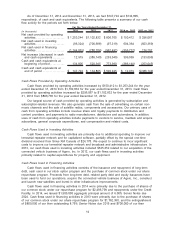

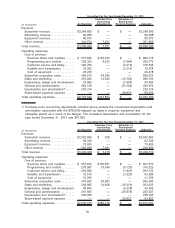

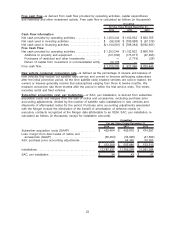

ARPU is derived from total earned subscriber revenue (excluding revenue derived from our

connected vehicle services business), net advertising revenue and other subscription-related

revenue, net of purchase price accounting adjustments, divided by the number of months in the

period, divided by the daily weighted average number of subscribers for the period. (For a

reconciliation to GAAP see the accompanying glossary on pages 18 through 22 for more details.)

•2014 vs. 2013: For the years ended December 31, 2014 and 2013, ARPU was $12.38 and

$12.23, respectively. The increase was driven primarily by the contribution of the U.S. Music

Royalty Fee, and the impact of the increase in certain of our subscription rates beginning in

January 2014. The positive result was partially offset by growth in subscription discounts and

limited channel line-up plans offered through our customer acquisition and retention

programs, lifetime subscription plans that have reached full revenue recognition and changes

in contracts with an automaker and a rental car company.

•2013 vs. 2012: For the years ended December 31, 2013 and 2012, ARPU was $12.23 and

$12.00, respectively. The increase was driven primarily by the contribution of the U.S. Music

Royalty Fee, the impact of the increase in certain of our subscription rates beginning in

January 2012, and an increase in subscriptions to premium services, partially offset by

subscription discounts offered through customer acquisition and retention programs, and

lifetime subscription plans that have reached full revenue recognition.

SAC, Per Installation, is derived from subscriber acquisition costs and margins from the sale of

radios, components and accessories, excluding purchase price accounting adjustments, divided by

the number of satellite radio installations in new vehicles and shipments of aftermarket radios for

the period. (For a reconciliation to GAAP see the accompanying glossary on pages 18 through 22

for more details.)

•2014 vs. 2013: For the years ended December 31, 2014 and 2013, SAC, per installation,

was $34 and $43, respectively. The decrease was primarily due to improvements in

contractual OEM rates.

•2013 vs. 2012: For the years ended December 31, 2013 and 2012, SAC, per installation,

was $43 and $47, respectively. The decrease was primarily due to lower subsidies per

vehicle.

Customer Service and Billing Expenses, Per Average Subscriber, is derived from total customer

service and billing expenses, excluding connected vehicle customer service and billing expenses

and share-based payment expense, divided by the number of months in the period, divided by the

daily weighted average number of subscribers for the period. (For a reconciliation to GAAP see the

accompanying glossary on pages 18 through 22 for more details.)

•2014 vs. 2013: For the years ended December 31, 2014 and 2013, customer service and

billing expenses, per average subscriber, were $1.07 and $1.06, respectively. The increase

was primarily driven by increased bad debt expense.

•2013 vs. 2012: For the years ended December 31, 2013 and 2012, customer service and

billing expenses, per average subscriber, were $1.06 and $1.07, respectively. The decrease

12