XM Radio 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.cause, or by the executive for good reason, within two years following a change in control, then in

accordance with the Plans, their equity awards are subject to accelerated vesting.

We believe that these severance arrangements mitigate some of the risk that exists for

executives working in our highly competitive industry. These arrangements are intended to attract

and retain qualified executives who could have other job alternatives that may appear to them, in

the absence of these arrangements, to be less risky, and such arrangements allow the executives

to focus exclusively on our interests.

Fiscal Year 2014 Pay Implications

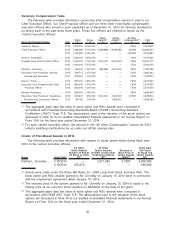

2014 Base Salary Decisions

We have entered into employment agreements with each of our named executive officers. In

2014, Mr. Donnelly’s base salary was increased as part of the negotiation of his continued

employment agreement. In 2014, no other base salary increases were made for our named

executive officers.

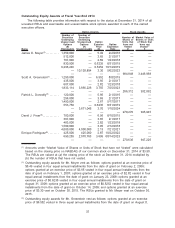

Payment of Performance-Based Discretionary Annual Bonuses for 2014

In 2014, the Compensation Committee again adopted, under the Sirius XM Radio Inc. 2009

Long-Term Stock Incentive Plan, a bonus program designed to qualify as “performance-based

compensation” within the meaning of Section 162(m) of the Internal Revenue Code (the “NEO

Bonus Plan”). Pursuant to the NEO Bonus Plan, a bonus pool was established for our Chief

Executive Officer and the other named executive officers, other than our Chief Financial Officer,

consisting of 2.75% of our EBITDA for 2014. The maximum bonus that a named executive officer

could receive under the NEO Bonus Plan was limited to a percentage of the bonus pool (which

percentages were not changed during the performance year) and could not exceed the cash

equivalent of 120 million shares of our common stock (based on the closing price of our common

stock as of the last trading day of 2014). In addition, no amounts could be paid under the NEO

Bonus Plan unless a threshold amount of EBITDA was achieved for 2014.

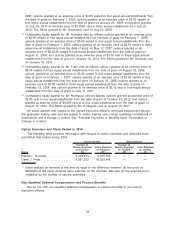

Following the end of 2014, the Compensation Committee met to consider bonuses for our

named executive officers with respect to 2014 and whether to award bonuses for other employees.

The Compensation Committee carefully reviewed our performance against key metrics in our budget

and bonus plan, including the generation of EBITDA, as required by the NEO Bonus Plan, and our

efforts to increase subscribers, revenue, adjusted EBITDA and free cash flow.

Following its review of our 2014 performance, which the Compensation Committee determined

to be exceptional, the Compensation Committee:

•approved a cash bonus pool to be divided among our employees, other than the named

executive officers;

•reviewed the NEO Bonus Plan pool and exercised its negative discretion and approved the

individual bonus amounts granted to each of the named executive officers under the NEO

Bonus Plan as well as other executive officers; and

•reviewed and approved the payment to our Chief Financial Officer whose bonus, pursuant to

Section 162(m) of the Internal Revenue Code, is not included in the NEO Bonus Plan.

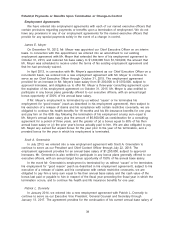

The actual amount of the bonus paid to each named executive officer was based on a

combination of factors, including our 2014 corporate performance, their individual contributions and

performance in their functional areas of responsibility and, with respect to all named executive

officers other than himself, recommendations made by Mr. Meyer. Various specific factors taken

into consideration in determining the bonus amounts for the named executive officers are set forth

below. The annual bonus for Mr. Meyer is discussed below under the heading “Related Policies and

Considerations—Compensation of our Chief Executive Officer.”

32