XM Radio 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$725,000 and an opportunity to earn an annual bonus in an amount determined by Chief Executive

Officer, the board of directors or the Compensation Committee.

If Mr. Donnelly’s employment is terminated by us without “cause” or he terminates his

employment for “good reason” (each as described in his employment agreement), then, subject to

his execution of a release of claims, we are obligated to pay him a lump sum in an amount equal

to the sum of his annual base salary as of the date of termination plus an amount equal to the

bonus last paid or payable to him in respect of the fiscal year preceding the fiscal year in which the

termination occurs, continue his health insurance benefits for 18 months at our expense and

continue his life insurance benefits for one year.

The agreement is generally consistent with Mr. Donnelly’s prior employment agreement with us,

except that it no longer provides for a so-called golden parachute excise tax gross up. The

agreement also includes a compensation clawback provision, pursuant to which any incentive-based

or other compensation paid to Mr. Donnelly by us or any of our affiliates is subject to deductions

and clawback as required by applicable law, regulation or stock exchange listing requirement, or

any company policy adopted pursuant thereto.

David J. Frear

In July 2011, we entered into an employment agreement with David J. Frear to continue to

serve as our Executive Vice President and Chief Financial Officer through July 20, 2015. The

employment agreement provides for an annual base salary of $850,000, subject to approved

increases.

If Mr. Frear’s employment is terminated by us without “cause” or he terminates his employment

for “good reason” (each as described in his employment agreement), subject to his execution of a

release of claims, we are obligated to pay him a lump sum equal to his annual salary as of the

date of the termination and the cash value of the bonus last paid or payable to him in respect of

the preceding fiscal year and to continue his health and life insurance benefits for one year.

In the event that any payment we make, or benefit we provide, to Mr. Frear would require him

to pay an excise tax under Section 280G of the Internal Revenue Code, we have agreed to pay

Mr. Frear the amount of such tax and such additional amount as may be necessary to place him in

the exact same financial position that he would have been in if the excise tax was not imposed.

Enrique Rodriguez

In August 2013, we entered into an employment agreement with Enrique Rodriguez to serve as

our Executive Vice President, Operations, Products and Connected Vehicle, with an annual base

salary of $625,000, subject to approved increases. Mr. Rodriguez is also entitled to participate in

any bonus plans generally offered to our executive officers, with an annual target bonus opportunity

of 150% of his annual base salary.

In the event Mr. Rodriguez’s employment is terminated by us without “cause” or he terminates

his employment for “good reason” (each as described in his employment agreement), subject to his

execution of a release of claims, we are obligated to pay him for one year his annual base salary

and an amount equal to the bonus last paid to him in respect of the fiscal year immediately

preceding the fiscal year in which the termination occurs, and to continue his health insurance

benefits for one year.

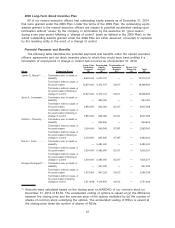

2003 Long-Term Stock Incentive Plan

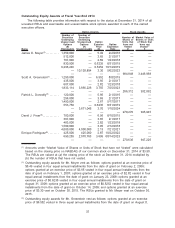

Messrs. Meyer, Greenstein, Donnelly and Frear also have outstanding options as of

December 31, 2014 that were granted under our 2003 Long-Term Stock Incentive Plan. Under the

2003 Long-Term Stock Incentive Plan, the outstanding equity awards granted to these named

executive officers are subject to potential accelerated vesting upon a change of control. All of the

outstanding options granted under the 2003 plan were vested as of December 31, 2014, and,

therefore, are not included in the table of potential payments and benefits below.

40