XM Radio 2014 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

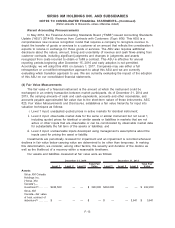

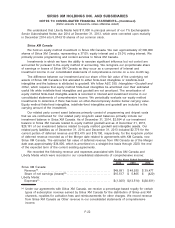

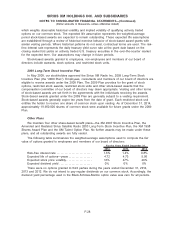

(b) During the year ended December 31, 2014, our share of Sirius XM Canada’s net earnings

included a gain of $1,251 related to the fair value received in excess of the carrying value

associated with the redemption of our investment in Sirius XM Canada’s 8% convertible

unsecured subordinated debentures in February 2014. Sirius XM Canada declared dividends to

us of $43,492, $16,796 and $7,749 during the years ended December 31, 2014, 2013 and 2012,

respectively. These dividends are first recorded as a reduction to our investment balance in

Sirius XM Canada to the extent a balance exists and then as Interest and investment income for

the remaining portion. This amount includes amortization related to the equity method intangible

assets of $363, $1,454 and $974 for the years ended December 31, 2014, 2013 and 2012,

respectively.

(c) We recognized Interest expense associated with the portion of the 7% Exchangeable Senior

Subordinated Notes due 2014, the portion of the 7.625% Senior Notes due 2018, and the portion

of the 8.75% Senior Notes due 2015 held by Liberty Media through December 2014, October

2013 and August 2013, respectively.

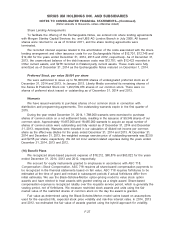

M-Way

During the year ended December 31, 2014, we evaluated our investment in M-Way Solutions

GmbH (“M-Way”) and determined that there was an other than temporary decline in its fair value.

As a result, we reduced our investment balance to zero and recognized a loss of $2,342 in Other

(loss) income in our consolidated statements of comprehensive income during the year ended

December 31, 2014. In November 2014, we sold our investment in M-Way and recognized a loss of

$353 in Engineering, design and development in connection with this transaction in our consolidated

statements of comprehensive income during the year ended December 31, 2014.

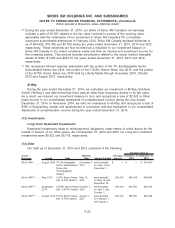

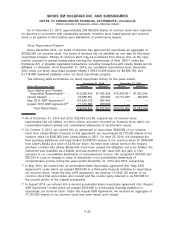

(13) Investments

Long Term Restricted Investments

Restricted investments relate to reimbursement obligations under letters of credit issued for the

benefit of lessors of our office space. As of December 31, 2014 and 2013 our Long-term restricted

investments were $5,922 and $5,718, respectively.

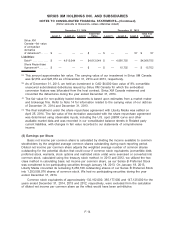

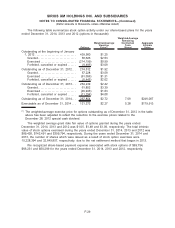

(14) Debt

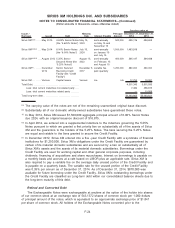

Our debt as of December 31, 2014 and 2013 consisted of the following:

Issuer /

Borrower Issued Debt

Maturity

Date Interest Payable

Principal

Amount

December 31,

2014

December 31,

2013

Carrying value at

Sirius XM(a) ...... August 2008 7% Exchangeable

Senior Subordinated

Notes (the

“Exchangeable

Notes”)

December 1,

2014

semi-annually

on June 1 and

December 1

$ — $ — $ 500,481

Sirius XM(a)(b) ..... May 2013 4.25% Senior Notes

(the “4.25% Notes”)

May 15,

2020

semi-annually

on May 15 and

November 15

500,000 495,529 494,809

Sirius XM(a)(b) ..... September

2013

5.875% Senior Notes

(the “5.875% Notes”)

October 1,

2020

semi-annually

on April 1 and

October 1

650,000 643,790 642,914

Sirius XM(a)(b) ..... August 2013 5.75% Senior Notes

(the “5.75% Notes”)

August 1,

2021

semi-annually

on February 1

and August 1

600,000 595,091 594,499

F-23

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollar amounts in thousands, unless otherwise stated)