XM Radio 2014 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

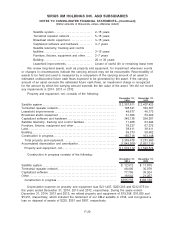

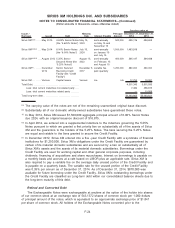

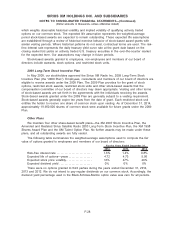

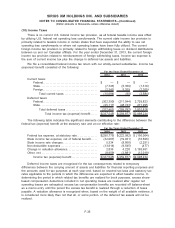

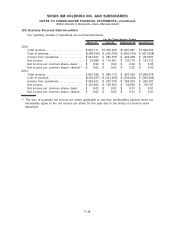

The following table summarizes the nonvested restricted stock unit activity under our share-

based plans for the years ended December 31, 2014, 2013 and 2012 (shares in thousands):

Shares

Grant Date

Fair Value

Nonvested as of January 1, 2012. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 421 $1.46

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 $ —

Vested......................................................... — $ —

Forfeited . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — $ —

Nonvested as of December 31, 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 429 $3.25

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,873 $3.59

Vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (192) $3.27

Forfeited . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (126) $3.61

Nonvested as of December 31, 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,984 $3.58

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,108 $3.38

Vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,138) $3.62

Forfeited . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (379) $3.52

Nonvested as of December 31, 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,575 $3.47

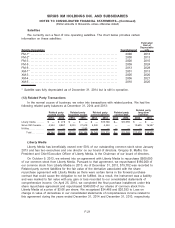

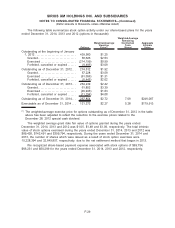

The weighted average grant date fair value of restricted stock units granted during the years

ended December 31, 2014 and 2013 was $3.38 and $3.59, respectively. The total intrinsic value of

restricted stock units that vested during the years ended December 31, 2014, 2013 and 2012 was

$4,044, $605 and $0, respectively. In connection with the special cash dividend paid in December

2012, we granted 8,000 incremental restricted stock units to prevent the economic dilution of the

holders of our restricted stock units. This grant did not result in any additional incremental share-

based payment expense being recognized in 2012.

We recognized share-based payment expense associated with restricted stock units of $8,458,

$2,645 and $0 during the years ended December 31, 2014, 2013 and 2012, respectively. During

the years ended December 31, 2014 and 2013, the number of shares which were issued as a

result of restricted stock units that vested were 731,626 and 191,524, respectively.

Total unrecognized compensation costs related to unvested share-based payment awards for

stock options and restricted stock units granted to employees and members of our board of

directors at December 31, 2014 and 2013, net of estimated forfeitures, were $162,985 and

$164,292, respectively. The total unrecognized compensation costs at December 31, 2014 are

expected to be recognized over a weighted-average period of 3 years.

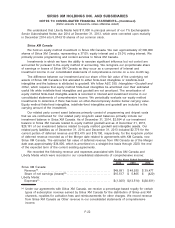

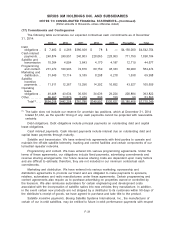

401(k) Savings Plan

Sirius XM sponsors the Sirius XM Radio Inc. 401(k) Savings Plan (the “Sirius XM Plan”) for

eligible employees. The Sirius XM Plan allows eligible employees to voluntarily contribute from 1%

to 50% of their pre-tax eligible earnings, subject to certain defined limits. We match 50% of an

employee’s voluntary contributions per pay period on the first 6% of an employee’s pre-tax salary

up to a maximum of 3% of eligible compensation. Employer matching contributions under the Sirius

XM Plan vest at a rate of 33.33% for each year of employment and are fully vested after three

years of employment for all current and future contributions. Beginning in January 2014, our cash

employer matching contributions were no longer used to purchase shares of our common stock on

the open market, unless the employee elects our common stock as their investment option for this

contribution. Prior to January 2014, the cash from employer matching contributions was used to

purchase shares of our common stock on the open market. We contributed $5,385 and $4,181

during the years ended December 31, 2014 and 2013, respectively, to the Sirius XM Plan in

fulfillment of our matching obligation. During the year ended December 31, 2012, employer

matching contributions were made in the form of shares of our common stock, resulting in share-

based payment expense of $3,523.

F-30

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollar amounts in thousands, unless otherwise stated)