XM Radio 2014 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

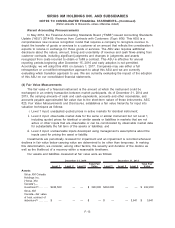

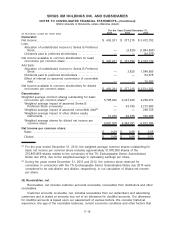

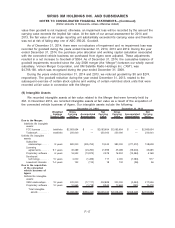

as the amount by which the carrying amount of the asset exceeds its fair value. No impairment was

recorded to our intangible assets with definite lives in 2014, 2013 or 2012.

Subscriber relationships are amortized on an accelerated basis over 9 years, which reflects the

estimated pattern in which the economic benefits will be consumed. Other definite life intangible

assets include certain licensing agreements, which are amortized over a weighted average useful

life of 9.1 years on a straight-line basis. The fair value of the OEM relationships and proprietary

software acquired from the acquisition of the connected vehicle business of Agero are being

amortized over their estimated weighted average useful lives of 15 and 10 years, respectively.

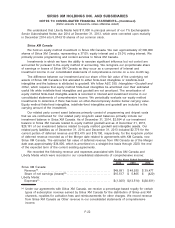

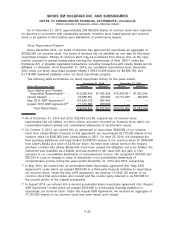

Amortization expense for all definite life intangible assets was $55,016, $50,011 and $53,620

for the years ended December 31, 2014, 2013 and 2012, respectively. Expected amortization

expense for each of the fiscal years 2015 through 2019 and for periods thereafter is as follows:

Years ending December 31, Amount

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 51,700

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48,545

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34,882

2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19,463

2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19,026

Thereafter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 137,776

Total definite life intangible assets, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $311,392

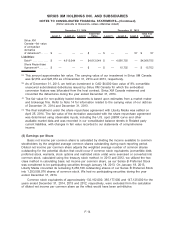

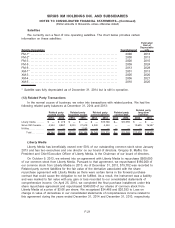

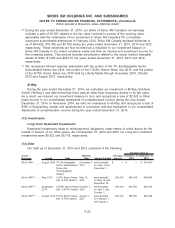

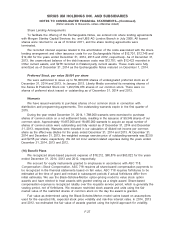

(10) Interest Costs

We capitalized a portion of the interest on funds borrowed as part of the cost of constructing

our satellites and related launch vehicles. We primarily capitalized interest associated with our FM-6

satellite and related launch vehicle for the years ended December 31, 2013 and 2012. We also

incurred interest costs on our debt instruments and on our satellite incentive agreements. The

following is a summary of our interest costs:

2014 2013 2012

For the Years Ended December 31,

Interest costs charged to expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $269,010 $204,671 $265,321

Interest costs capitalized . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 480 26,445 31,982

Total interest costs incurred. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $269,490 $231,116 $297,303

Included in interest costs incurred is non-cash interest expense, consisting of amortization

related to original issue discounts, premiums and deferred financing fees, of $21,039, $21,698 and

$35,924 for the years ended December 31, 2014, 2013 and 2012, respectively.

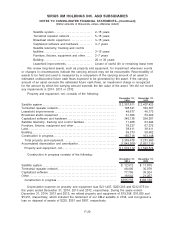

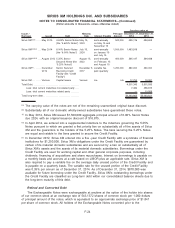

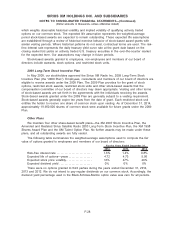

(11) Property and Equipment

Property and equipment, including satellites, are stated at cost, less accumulated depreciation.

Equipment under capital leases is stated at the present value of minimum lease payments.

Depreciation is calculated using the straight-line method over the following estimated useful life of

the asset:

F-19

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollar amounts in thousands, unless otherwise stated)