XM Radio 2014 Annual Report Download - page 38

Download and view the complete annual report

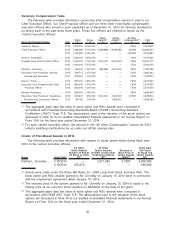

Please find page 38 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.compensation, thus ensuring that our executives have a continuing stake in our success, aligning

their interests with that of our stockholders and supporting the goal of retention through vesting

requirements and forfeiture provisions.

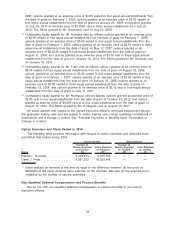

Stock options have an exercise price equal to the fair market value of our common stock on

the date of grant, and therefore reward the executives only if the price of our stock increases after

the date of grant. In 2014, the Compensation Committee determined that, in light of current market

conditions, long-term incentive compensation for our named executive officers would consist of both

stock options and RSUs. The Compensation Committee believes that the use of RSUs, as a form

of equity-based compensation, provides predictable retention value and alignment of employee

interests with stockholder interests, particularly in volatile equity markets. Stock options generally

vest over a period of three or four years in equal annual installments and RSUs vest on varying

schedules. Both stock options and RSUs generally vest subject to the executive’s continued

employment, which incentivizes the executives to sustain increases in stockholder value over

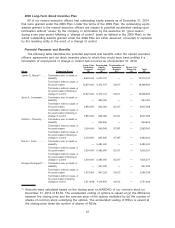

extended periods of time. The specific number of options and RSUs granted is determined either as

part of an employment agreement or by the Compensation Committee with the assistance of our

Chief Executive Officer (other than in the case of any equity awards to himself) and by using their

informed judgment, taking into account the executive’s role and responsibilities and our overall

performance and the performance of our common stock, and is not based on any specific

quantitative or qualitative factors.

Retirement and Other Employee Benefits

We maintain broad-based benefits for all employees, including health and dental insurance, life

and disability insurance and a 401(k) savings plan, including a matching component for that plan.

Our named executive officers are eligible to participate in all of our employee benefit plans on the

same basis as other employees. We do not sponsor or maintain any other retirement or deferred

compensation plans for any of our named executive officers other than our 401(k) savings plan.

Our 401(k) savings plan allows eligible employees to voluntarily contribute from 1% to 50% of

their pre-tax eligible earnings, subject to certain defined limits. We match 50% of an employee’s

voluntary contributions per pay period on the first 6% of an employee’s pre-tax salary up to a

maximum of 3% of eligible compensation. Employer matching contributions under the plan vest at a

rate of 33.33% for each year of employment and are fully vested after three years of employment

for all current and future contributions.

Perquisites and Other Benefits for Named Executive Officers

The Compensation Committee supports providing other benefits to named executive officers

that are almost identical to those offered to our other full time employees and are provided to

similarly situated executives at companies with which we compete for executive talent.

In limited circumstances, a named executive officer may receive certain tailored benefits. For

example, in 2013, Mr. Rodriguez, due to his principal residence being in the State of Washington,

was reimbursed for the reasonable costs of coach class air fare from his home to our various

offices, along with reasonable hotel and meal expenses. The costs of these benefits for

Mr. Rodriguez constituted less than 10% of his compensation in 2013.

Payments to Named Executive Officers Upon Termination or Change in Control

The employment agreements with our named executive officers provide for severance

payments upon an involuntary termination of employment without “cause” or for “good reason” (as

each term is defined in their employment agreement). These arrangements vary from executive to

executive due to individual negotiations. None of the employment agreements for the named

executive officers provide for any special payments solely due to a change in control. Under the

terms of both the Sirius XM Radio Inc. 2009 Long-Term Stock Incentive Plan and, if approved by

stockholders, the Sirius XM Holdings Inc. 2015 Long-Term Stock Incentive Plan (collectively, the

“Plans”), if the employment of any of our named executive officers is terminated by us without

31