XM Radio 2014 Annual Report Download - page 138

Download and view the complete annual report

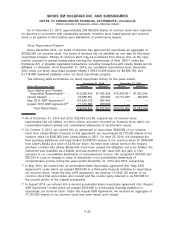

Please find page 138 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.to XM-3 and XM-4 based on the expected operating performance meeting their fifteen-year design

life. Boeing may also be entitled to additional incentive payments up to $10,000 if our XM-4 satellite

continues to operate above baseline specifications during the five years beyond the satellite’s

fifteen-year design life.

Space Systems/Loral, the manufacturer of certain of our in-orbit satellites, may be entitled to

future in-orbit performance payments with respect to XM-5, FM-5 and FM-6 based on their

expected operating performance meeting their fifteen-year design life.

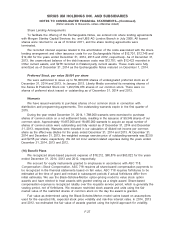

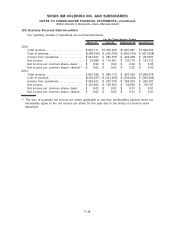

Operating lease obligations. We have entered into both cancelable and non-cancelable

operating leases for office space, equipment and terrestrial repeaters. These leases provide for

minimum lease payments, additional operating expense charges, leasehold improvements and rent

escalations that have initial terms ranging from one to fifteen years, and certain leases have options

to renew. The effect of the rent holidays and rent concessions are recognized on a straight-line

basis over the lease term, including reasonably assured renewal periods. Total rent recognized in

connection with leases for the years ended December 31, 2014, 2013 and 2012 was $45,107,

$39,228 and $37,474, respectively.

Other. We have entered into various agreements with third parties for general operating

purposes. In addition to the minimum contractual cash commitments described above, we have

entered into agreements with other variable cost arrangements. These future costs are dependent

upon many factors, including subscriber growth, and are difficult to anticipate; however, these costs

may be substantial. We may enter into additional programming, distribution, marketing and other

agreements that contain similar variable cost provisions. The cost of our stock acquired from a

third-party financial institution but not paid for as of December 31, 2014 is included in this category.

We do not have any other significant off-balance sheet financing arrangements that are

reasonably likely to have a material effect on our financial condition, results of operations, liquidity,

capital expenditures or capital resources.

Legal Proceedings

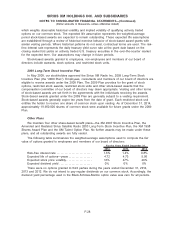

In the ordinary course of business, we are a defendant or party to various claims and lawsuits,

including those discussed below. These claims are at various stages of arbitration or adjudication.

We record a liability when we believe that it is both probable that a liability will be incurred, and

the amount of loss can be reasonably estimated. We evaluate developments in legal matters that

could affect the amount of liability that has been previously accrued and make adjustments as

appropriate. Significant judgment is required to determine both probability and the estimated amount

of a loss or potential loss. We may be unable to reasonably estimate the reasonably possible loss

or range of loss for a particular legal contingency for various reasons, including, among others,

because: (i) the damages sought are indeterminate; (ii) the proceedings are in the relative early

stages; (iii) there is uncertainty as to the outcome of pending proceedings (including motions and

appeals); (iv) there is uncertainty as to the likelihood of settlement and the outcome of any

negotiations with respect thereto; (v) there remain significant factual issues to be determined or

resolved; (vi) the relevant law is unsettled; or (vii) the proceedings involve novel or untested legal

theories. In such instances, there may be considerable uncertainty regarding the ultimate resolution

of such matters, including a possible eventual loss, if any.

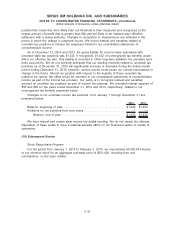

State Consumer Investigations. In December 2014, we entered into agreements with 46 States

and the District of Columbia to settle a multistate investigation into certain of our consumer

practices. The investigation focused on practices relating to the cancellation of subscriptions;

automatic renewal of subscriptions; charging, billing, collecting, and refunding or crediting of

payments from consumers; and soliciting customers. As part of the settlement agreements, we

agreed to certain changes in our consumer practices relating to: the sale and cancellation of self-

F-32

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollar amounts in thousands, unless otherwise stated)