XM Radio 2014 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

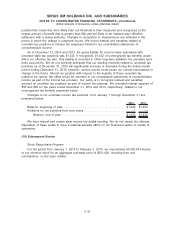

which weights observable historical volatility and implied volatility of qualifying actively traded

options on our common stock. The expected life assumption represents the weighted-average

period stock-based awards are expected to remain outstanding. These expected life assumptions

are established through a review of historical exercise behavior of stock-based award grants with

similar vesting periods. Where historical patterns do not exist, contractual terms are used. The risk-

free interest rate represents the daily treasury yield curve rate at the grant date based on the

closing market bid yields on actively traded U.S. treasury securities in the over-the-counter market

for the expected term. Our assumptions may change in future periods.

Stock-based awards granted to employees, non-employees and members of our board of

directors include warrants, stock options, and restricted stock units.

2009 Long-Term Stock Incentive Plan

In May 2009, our stockholders approved the Sirius XM Radio Inc. 2009 Long-Term Stock

Incentive Plan (the “2009 Plan”). Employees, consultants and members of our board of directors are

eligible to receive awards under the 2009 Plan. The 2009 Plan provides for the grant of stock

options, restricted stock awards, restricted stock units and other stock-based awards that the

compensation committee of our board of directors may deem appropriate. Vesting and other terms

of stock-based awards are set forth in the agreements with the individuals receiving the awards.

Stock-based awards granted under the 2009 Plan are generally subject to a vesting requirement.

Stock-based awards generally expire ten years from the date of grant. Each restricted stock unit

entitles the holder to receive one share of common stock upon vesting. As of December 31, 2014,

approximately 19,950,000 shares of common stock were available for future grants under the 2009

Plan.

Other Plans

We maintain four other share-based benefit plans—the XM 2007 Stock Incentive Plan, the

Amended and Restated Sirius Satellite Radio 2003 Long-Term Stock Incentive Plan, the XM 1998

Shares Award Plan and the XM Talent Option Plan. No further awards may be made under these

plans, and all outstanding awards are fully vested.

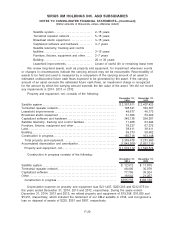

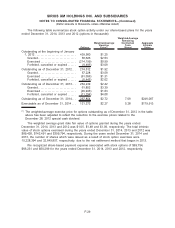

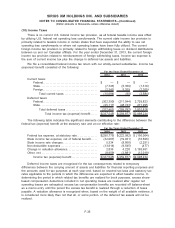

The following table summarizes the weighted-average assumptions used to compute the fair

value of options granted to employees and members of our board of directors:

2014 2013 2012

For the Years Ended December 31,

Risk-free interest rate . . . . . . . . . . . . . . . . . . . . . . . . . . 1.6% 1.4% 0.8%

Expected life of options—years . . . . . . . . . . . . . . . . . 4.72 4.73 5.06

Expected stock price volatility. . . . . . . . . . . . . . . . . . . 33% 47% 49%

Expected dividend yield . . . . . . . . . . . . . . . . . . . . . . . . 0% 0% 0%

There were no options granted to third parties during the years ended December 31, 2014,

2013 and 2012. We do not intend to pay regular dividends on our common stock. Accordingly, the

dividend yield percentage used in the Black-Scholes-Merton option value was zero for all periods.

F-28

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollar amounts in thousands, unless otherwise stated)