United Healthcare 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

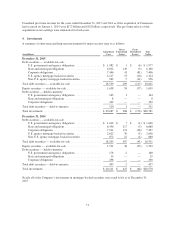

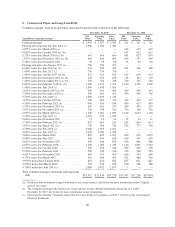

The Company’s long-term debt obligations also included $164 million and $150 million of other financing

obligations, of which $47 million and $34 million were current as of December 31, 2015 and 2014, respectively.

Maturities of commercial paper and long-term debt for the years ending December 31 are as follows:

(in millions)

2016 .............................................................................. $ 6,630

2017 .............................................................................. 3,491

2018 .............................................................................. 2,607

2019 .............................................................................. 1,024

2020 .............................................................................. 1,952

Thereafter .......................................................................... 16,432

Commercial Paper and Revolving Bank Credit Facilities

Commercial paper consists of short-duration, senior unsecured debt privately placed on a discount basis through

broker-dealers. As of December 31, 2015, the Company’s outstanding commercial paper had a weighted-average

annual interest rate of 0.7%.

The Company has $3.0 billion five-year, $2.0 billion three-year and $1.0 billion 364-day revolving bank credit

facilities with 23 banks, which mature in December 2020, December 2018, and November 2016, respectively.

These facilities provide liquidity support for the Company’s commercial paper program and are available for

general corporate purposes. As of December 31, 2015, no amounts had been drawn on any of the bank credit

facilities. The annual interest rates, which are variable based on term, are calculated based on the London

Interbank Offered Rate (LIBOR) plus a credit spread based on the Company’s senior unsecured credit ratings. If

amounts had been drawn on the bank credit facilities as of December 31, 2015, annual interest rates would have

ranged from 1.2% to 1.7%.

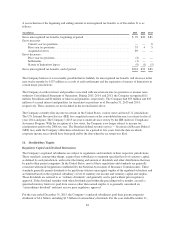

Debt Covenants

The Company’s bank credit facilities contain various covenants, including requiring the Company to maintain a

debt to debt-plus-stockholders’ equity ratio of not more than 55%. The Company was in compliance with its debt

covenants as of December 31, 2015.

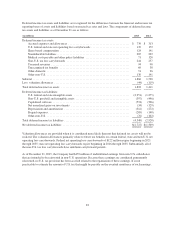

Interest Rate Swap Contracts

The Company uses interest rate swap contracts to convert a portion of its interest rate exposure from fixed rates

to floating rates to more closely align interest expense with interest income received on its variable rate financial

assets. The floating rates are benchmarked to LIBOR. The swaps are designated as fair value hedges on the

Company’s fixed-rate debt. Since the critical terms of the swaps match those of the debt being hedged, they are

considered to be highly effective hedges and all changes in the fair values of the swaps are recorded as

adjustments to the carrying value of the related debt with no net impact recorded on the Consolidated Statements

of Operations. Both the hedge fair value changes and the offsetting debt adjustments are recorded in interest

expense on the Consolidated Statements of Operations. The following table summarizes the location and fair

value of the interest rate swap fair value hedges on the Company’s Consolidated Balance Sheet:

Type of Fair Value Hedge Notional Amount Fair Value Balance Sheet Location

(in billions) (in millions)

December 31, 2015

Interest rate swap contracts ........... $ 5.1 $ 93 Other assets

11 Other liabilities

December 31, 2014

Interest rate swap contracts ........... $ 10.7 $ 62 Other assets

55 Other liabilities

81