United Healthcare 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

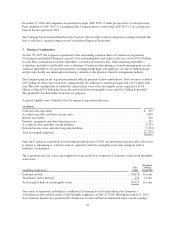

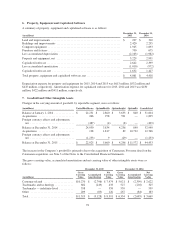

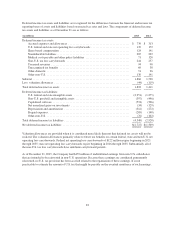

6. Property, Equipment and Capitalized Software

A summary of property, equipment and capitalized software is as follows:

(in millions)

December 31,

2015

December 31,

2014

Land and improvements ................................................. $ 237 $ 310

Buildings and improvements ............................................. 2,420 2,295

Computer equipment ................................................... 1,945 1,693

Furniture and fixtures ................................................... 790 675

Less accumulated depreciation ........................................... (2,163) (1,982)

Property and equipment, net ............................................. 3,229 2,991

Capitalized software .................................................... 2,642 2,399

Less accumulated amortization ........................................... (1,010) (972)

Capitalized software, net ................................................ 1,632 1,427

Total property, equipment and capitalized software, net ........................ $ 4,861 $ 4,418

Depreciation expense for property and equipment for 2015, 2014 and 2013 was $613 million, $532 million and

$445 million, respectively. Amortization expense for capitalized software for 2015, 2014 and 2013 was $430

million, $422 million and $411 million, respectively.

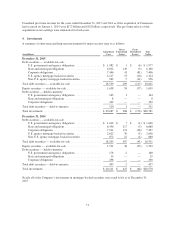

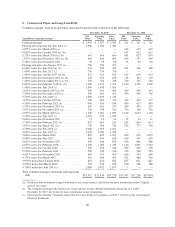

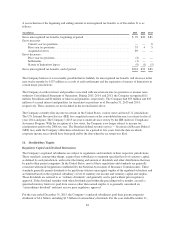

7. Goodwill and Other Intangible Assets

Changes in the carrying amount of goodwill, by reportable segment, were as follows:

(in millions) UnitedHealthcare OptumHealth OptumInsight OptumRx Consolidated

Balance at January 1, 2014 .............. $ 24,251 $ 2,860 $ 3,653 $ 840 $ 31,604

Acquisitions ......................... 266 978 591 — 1,835

Foreign currency effects and adjustments,

net ............................... (487) (4) (8) — (499)

Balance at December 31, 2014 ........... 24,030 3,834 4,236 840 32,940

Acquisitions ......................... 128 1,817 89 10,732 12,766

Foreign currency effects and adjustments,

net ............................... (1,233) 9 (29) — (1,253)

Balance at December 31, 2015 ........... $ 22,925 $ 5,660 $ 4,296 $ 11,572 $ 44,453

The increase in the Company’s goodwill is primarily due to the acquisition of Catamaran. For more detail on the

Catamaran acquisition, see Note 3 of the Notes to the Consolidated Financial Statements.

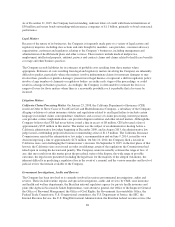

The gross carrying value, accumulated amortization and net carrying value of other intangible assets were as

follows:

December 31, 2015 December 31, 2014

(in millions)

Gross

Carrying

Value

Accumulated

Amortization

Net

Carrying

Value

Gross

Carrying

Value

Accumulated

Amortization

Net

Carrying

Value

Customer-related ..................... $10,270 $ (2,796) $ 7,474 $ 5,021 $ (2,399) $ 2,622

Trademarks and technology ............. 682 (249) 433 527 (202) 325

Trademarks — indefinite-lived .......... 358 — 358 539 — 539

Other .............................. 209 (83) 126 267 (84) 183

Total ............................... $11,519 $ (3,128) $ 8,391 $ 6,354 $ (2,685) $ 3,669

78