United Healthcare 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

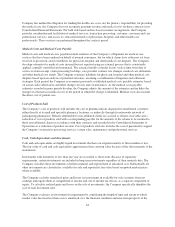

Pharmacy benefit costs and administrative costs under the contract are expensed as incurred and are recognized

in medical costs and operating costs, respectively, in the Consolidated Statements of Operations.

The final 2015 risk-share amount is expected to be settled during the second half of 2016, and is subject to the

reconciliation process with CMS.

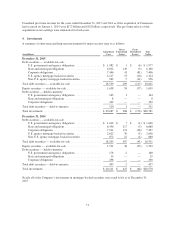

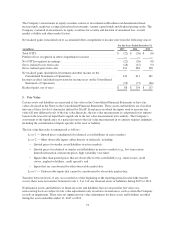

The Consolidated Balance Sheets include the following amounts associated with the Medicare Part D program:

December 31, 2015 December 31, 2014

(in millions) Subsidies Drug Discount Risk-Share Subsidies Drug Discount Risk-Share

Other current receivables .......... $ 1,703 $ 423 $ — $ 1,801 $ 719 $ 20

Other policy liabilities ............. — 58 496 — 302 —

Property, Equipment and Capitalized Software

Property, equipment and capitalized software are stated at cost, net of accumulated depreciation and

amortization. Capitalized software consists of certain costs incurred in the development of internal-use software,

including external direct costs of materials and services and applicable payroll costs of employees devoted to

specific software development.

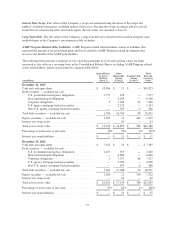

The Company calculates depreciation and amortization using the straight-line method over the estimated useful

lives of the assets. The useful lives for property, equipment and capitalized software are:

Furniture, fixtures and equipment ......................................... 3to7years

Buildings ............................................................. 35to40years

Capitalized software .................................................... 3to5years

Leasehold improvements are depreciated over the shorter of the remaining lease term or their estimated useful

economic life.

Goodwill

To determine whether goodwill is impaired, annually or more frequently if needed, the Company performs a

multi-step impairment test. First, the Company estimates the fair values of its reporting units using discounted

cash flows. To determine fair values, the Company must make assumptions about a wide variety of internal and

external factors. Significant assumptions used in the impairment analysis include financial projections of free

cash flow (including significant assumptions about operations, capital requirements and income taxes), long-term

growth rates for determining terminal value and discount rates. Comparative market multiples are used to

corroborate the results of the discounted cash flow test. If the fair value is less than the carrying value of the

reporting unit, then the implied value of goodwill would be calculated and compared to the carrying amount of

goodwill to determine whether goodwill is impaired.

During 2015, the Company changed its annual quantitative goodwill impairment testing date from January 1 to

October 1 of each year. The change in the goodwill impairment test date better aligns the impairment testing

procedures with the timing of the Company’s long-term planning process, which is a significant input to the

testing. This change in testing date did not delay, accelerate, or avoid a goodwill impairment charge.

There was no impairment of goodwill during the year ended December 31, 2015.

Intangible Assets

The Company’s intangible assets are subject to impairment tests when events or circumstances indicate that an

intangible asset (or asset group) may be impaired. The Company’s indefinite lived intangible assets are also

tested for impairment annually. There was no impairment of intangible assets during the year ended

December 31, 2015.

66