United Healthcare 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

December 15, 2016 and companies are permitted to apply ASU 2015-17 either prospectively or retrospectively.

Early adoption of ASU 2015-17 is permitted. The Company plans to early adopt ASU 2015-17 on a prospective

basis in the first quarter of 2016.

The Company has determined that there have been no other recently issued or adopted accounting standards that

had, or will have, a material impact on its Consolidated Financial Statements.

3. Business Combination

On July 23, 2015, the Company acquired all of the outstanding common shares of Catamaran Corporation

(Catamaran) and funded Catamaran’s payoff of its outstanding debt and credit facility for a total of $14.3 billion

in cash. This combination diversifies OptumRx’s customer and business mix, while enhancing OptumRx’s

technology capabilities and flexible service offerings. Catamaran offers pharmacy benefits management services

similar to OptumRx to a broad client portfolio, including health plans and employers serving 35 million people,

and provides health care information technology solutions to the pharmacy benefits management industry.

The Company paid for the acquisition primarily with the proceeds of new indebtedness. Debt issuances included

$10.5 billion of senior unsecured notes, approximately $2.4 billion of commercial paper and a $1.5 billion term

loan. The total consideration exceeded the estimated fair value of the net tangible assets acquired by $15.6

billion, of which $5.4 billion has been allocated to finite-lived intangible assets and $10.2 billion to goodwill.

The goodwill is not deductible for income tax purposes.

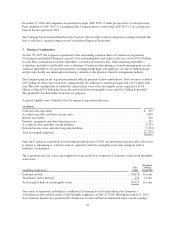

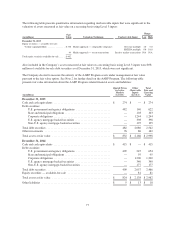

Acquired tangible assets (liabilities) for Catamaran at acquisition date were:

(in millions)

Cash and cash equivalents ............................................................. $ 299

Accounts receivable and other current assets ............................................... 2,005

Rebates receivable ................................................................... 602

Property, equipment and other long-term assets ............................................. 215

Accounts payable and other current liabilities .............................................. (2,525)

Deferred income taxes and other long-term liabilities ........................................ (1,923)

Total net tangible liabilities ............................................................ $(1,327)

Since the Catamaran acquisition closed during the third quarter of 2015, the preliminary purchase price allocation

is subject to adjustment as valuation analyses, primarily related to intangible assets and contingent and tax

liabilities, are finalized.

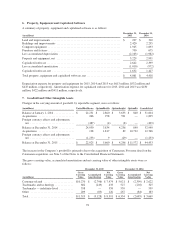

The acquisition date fair values and weighted-average useful lives assigned to Catamaran’s finite-lived intangible

assets were:

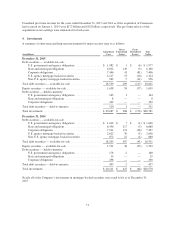

(in millions, except years)

Fair

Value

Weighted-

Average

Useful Life

Customer-related ............................................................ $5,278 19 years

Trademarks and technology ................................................... 159 4years

Total acquired finite-lived intangible assets ....................................... $5,437 19 years

The results of operations and financial condition of Catamaran have been included in the Company’s

consolidated results and the results of the OptumRx segment as of July 23, 2015. Through December 31, 2015,

the Catamaran business has generated $12.4 billion in revenue and had an immaterial impact on net earnings.

70