United Healthcare 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

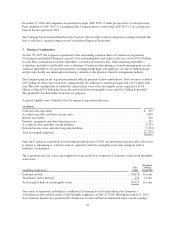

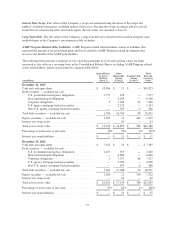

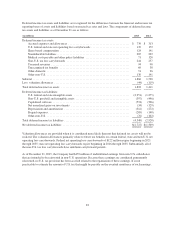

The acquisition date fair values and weighted-average useful lives assigned to finite-lived intangible assets

acquired in business combinations consisted of the following by year of acquisition:

2015 2014

(in millions, except years)

Fair

Value

Weighted-

Average

Useful Life

Fair

Value

Weighted-

Average

Useful Life

Customer-related ............................................ $5,518 19 years $314 14 years

Trademarks and technology .................................... 194 4years 148 6 years

Other ...................................................... — 2 14years

Total acquired finite-lived intangible assets ....................... $5,712 19 years $464 11 years

Estimated full year amortization expense relating to intangible assets for each of the next five years ending

December 31 is as follows:

(in millions)

2016 ................................................................................. $808

2017 ................................................................................. 772

2018 ................................................................................. 668

2019 ................................................................................. 612

2020 ................................................................................. 543

Amortization expense relating to intangible assets for December 31, 2015, 2014 and 2013 was $650 million,

$524 million and $519 million, respectively.

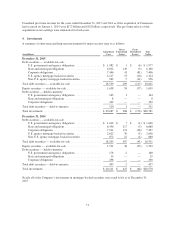

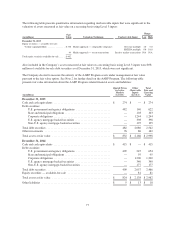

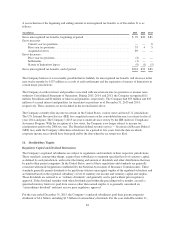

8. Medical Costs Payable

The following table shows the components of the change in medical costs payable for the years ended

December 31:

(in millions) 2015 2014 2013

Medical costs payable, beginning of period ............................ $ 12,040 $ 11,575 $ 11,004

Reported medical costs:

Current year ................................................ 104,195 94,053 90,339

Prior years ................................................. (320) (420) (680)

Total reported medical costs ....................................... 103,875 93,633 89,659

Claim payments:

Payments for current year ..................................... (90,630) (82,750) (79,358)

Payments for prior year ....................................... (10,955) (10,418) (9,730)

Total claim payments ............................................. (101,585) (93,168) (89,088)

Medical costs payable, end of period ................................. $ 14,330 $ 12,040 $ 11,575

For the years ended December 31, 2015 and 2014, the favorable medical cost reserve development was due to a

number of individual factors that were not material. The net favorable development for the year ended

December 31, 2013 was primarily driven by lower than expected health system utilization levels.

79