United Healthcare 2015 Annual Report Download - page 63

Download and view the complete annual report

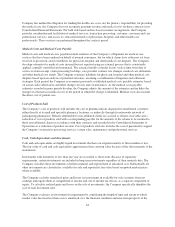

Please find page 63 of the 2015 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UnitedHealth Group

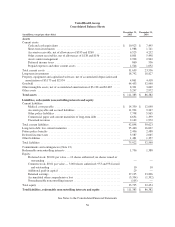

Notes to the Consolidated Financial Statements

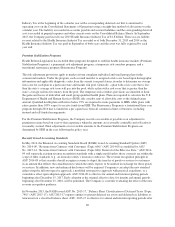

1. Description of Business

UnitedHealth Group Incorporated (individually and together with its subsidiaries, “UnitedHealth Group” and

“the Company”) is a diversified health and well-being company dedicated to helping people live healthier lives

and making the health system work better for everyone.

Through its diversified family of businesses, the Company leverages core competencies in advanced, enabling

technology; health care data, information and intelligence; and clinical care management and coordination to

help meet the demands of the health system.

2. Basis of Presentation, Use of Estimates and Significant Accounting Policies

Basis of Presentation

The Company has prepared the Consolidated Financial Statements according to U.S. Generally Accepted

Accounting Principles (GAAP) and has included the accounts of UnitedHealth Group and its subsidiaries.

Use of Estimates

These Consolidated Financial Statements include certain amounts based on the Company’s best estimates and

judgments. The Company’s most significant estimates relate to estimates and judgments for medical costs

payable and revenues, valuation and impairment analysis of goodwill and other intangible assets, estimates of

other policy liabilities and other current receivables and valuations of certain investments. Certain of these

estimates require the application of complex assumptions and judgments, often because they involve matters that

are inherently uncertain and will likely change in subsequent periods. The impact of any change in estimates is

included in earnings in the period in which the estimate is adjusted.

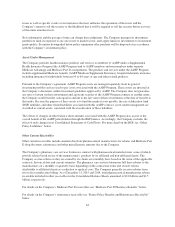

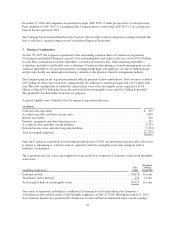

Reclassification

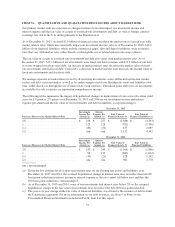

During the fourth quarter of 2015, the Company changed its accounting policy for the presentation of certain

pharmacy fulfillment costs related to its OptumRx business. These costs are now included in medical costs and

cost of products sold, whereas they were previously included in operating costs. Prior periods have been

reclassified to conform to the current period presentation. The reclassification increased medical expenses by

$376 million and $369 million, decreased operating costs by $418 million and $421 million and increased cost of

products sold by $42 million and $52 million for the years ended December 31, 2014 and 2013, respectively. The

reclassification had no impact on total operating costs, earnings from operations, net earnings, earnings per share

or total equity.

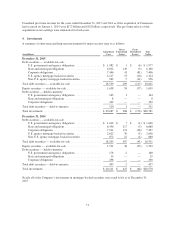

Reincorporation

On July 1, 2015, UnitedHealth Group Incorporated changed its state of incorporation from Minnesota to

Delaware pursuant to a plan of conversion. The reincorporation was approved by the Company’s stockholders at

its 2015 Annual Meeting of Shareholders held on June 1, 2015. Upon reincorporation, the affairs of UnitedHealth

Group Incorporated became subject to the Delaware General Corporation Law, a new certificate of incorporation

and new bylaws, and each previously outstanding share of UnitedHealth Group Incorporated’s common stock as

a Minnesota corporation (UNH Minnesota) converted into an outstanding share of common stock of

UnitedHealth Group Incorporated as a Delaware corporation after the reincorporation (UNH Delaware). The

reincorporation was a tax-free reorganization under the U.S. Internal Revenue Code and did not affect the

Company’s business operations.

61