United Healthcare 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.sold to individuals for which some of the premium received in the earlier years is intended to pay benefits to

be incurred in future years. See Note 2 of Notes to the Consolidated Financial Statements included in Part II,

Item 8, “Financial Statements” for more detail.

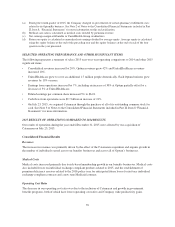

(d) As the timing of future settlements is uncertain, the long-term portion has been classified as “Thereafter.”

(e) Includes obligations associated with contingent consideration and other payments related to business

acquisitions, certain employee benefit programs and various other long-term liabilities. Due to uncertainty

regarding payment timing, obligations for employee benefit programs, charitable contributions and other

liabilities have been classified as “Thereafter.”

(f) Includes remaining capital commitments for venture capital funds and other funding commitments.

(g) Includes commitments for redeemable shares of our subsidiaries.

We do not have other significant contractual obligations or commitments that require cash resources. However,

we continually evaluate opportunities to expand our operations, which include internal development of new

products, programs and technology applications and may include acquisitions.

OFF-BALANCE SHEET ARRANGEMENTS

As of December 31, 2015, we were not involved in any off-balance sheet arrangements, which have or are

reasonably likely to have a material effect on our financial condition, results of operations or liquidity.

RECENTLY ISSUED ACCOUNTING STANDARDS

See Note 2 of Notes to the Consolidated Financial Statements in Part II, Item 8 “Financial Statements” for a

discussion of new accounting pronouncements that affect us.

CRITICAL ACCOUNTING ESTIMATES

Critical accounting estimates are those estimates that require management to make challenging, subjective or

complex judgments, often because they must estimate the effects of matters that are inherently uncertain and may

change in subsequent periods. Critical accounting estimates involve judgments and uncertainties that are

sufficiently sensitive and may result in materially different results under different assumptions and conditions.

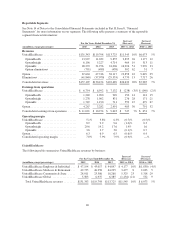

Medical Costs Payable

Each reporting period, we estimate our obligations for medical care services that have been rendered on behalf of

insured consumers but for which claims have either not yet been received or processed and for liabilities for

physician, hospital and other medical cost disputes. We develop estimates for medical care services incurred but

not reported using an actuarial process that is consistently applied, centrally controlled and automated. The

actuarial models consider factors such as time from date of service to claim receipt, claim processing backlogs,

seasonal variances in medical care consumption, health care professional contract rate changes, medical care

utilization and other medical cost trends, membership volume and demographics, the introduction of new

technologies, benefit plan changes and business mix changes related to products, customers and geography.

Depending on the health care professional and type of service, the typical billing lag for services can be up to 90

days from the date of service. Substantially all claims related to medical care services are known and settled

within nine to twelve months from the date of service. As of December 31, 2015, our days outstanding in medical

payables was 50 days, calculated as total medical payables divided by total medical costs times 365 days.

Each period, we re-examine previously established medical costs payable estimates based on actual claim

submissions and other changes in facts and circumstances. As more complete claim information becomes

available, we adjust the amount of the estimates and include the changes in estimates in medical costs in the

period in which the change is identified. Therefore, in every reporting period, our operating results include the

effects of more completely developed medical costs payable estimates associated with previously reported

periods. If the revised estimate of prior period medical costs is less than the previous estimate, we will decrease

reported medical costs in the current period (favorable development). If the revised estimate of prior period

47