TJ Maxx 1997 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 1997 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

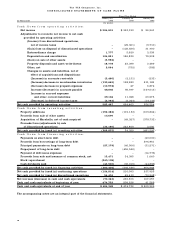

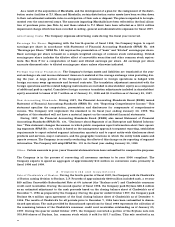

24

Dollars in Thousands Except Per Share Amounts Fiscal Year Ended January 27, 1996

Net sales $6 , 0 8 5 , 5 0 9

Income from continuing operations $2 0 , 8 3 8

Average shares outstanding for diluted earnings per share calculations 1 4 7 , 5 5 7 , 9 6 1

Income from continuing operations per share, diluted $. 0 2

The foregoing unaudited pro forma consolidated financial results give effect to, among other pro form a

adjustments, the following:

( i ) I n t e rest expense and amortization of the related debt expenses on debt incurred to finance

the acquisition.

( i i ) D e p reciation and amortization adjustments related to fair market value of assets acquire d .

( i i i )A m o rtization of tradename over 40 years.

( i v ) Adjustments to income tax expense related to the above.

( v ) Impact of pre f e rred stock issued on earnings per share calculations.

The foregoing unaudited pro forma consolidated financial information is provided for illustrative pur-

poses only and does not purport to be indicative of results that actually would have been achieved had the

acquisition taken place on the first day of the period presented or of future re s u l t s .

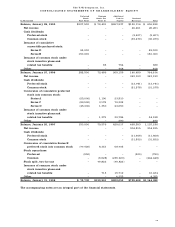

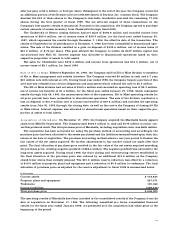

B . L o n g - T e r m D e b t a n d C r e d i t L i n e s

At January 31, 1998 and January 25, 1997, long-term debt, exclusive of current installments, consisted

of the following:

J a n u a ry 31, J a n u a r y 25,

In Thousands 1 9 9 8 1 9 9 7

Real estate mortgages, interest at 10.48% maturing November 1, 1998 $ – $ 22,391

Equipment notes, interest at 11% to 11.25% maturing

December 12, 2000 to December 30, 2001 1,127 2 , 1 3 5

General corporate debt:

Medium term notes, interest at 5.87% to 7.97%, $15 million maturing on

October 21, 2003 and $5 million on September 20, 2004 2 0 , 0 0 0 2 0 , 0 0 0

65⁄8% unsecured notes, maturing June 15, 2000 1 0 0 , 0 0 0 1 0 0 , 0 0 0

7% unsecured notes, maturing June 15, 2005 (effective interest rate of 7.02%

after reduction of the unamortized debt discount of $103,000 and $116,000

in fiscal 1998 and 1997, re s p e c t i v e l y ) 9 9 , 8 9 7 9 9 , 8 8 4

Total general corporate debt 2 1 9 , 8 9 7 2 1 9 , 8 8 4

L o n g - t e rm debt, exclusive of current installments $ 2 2 1 , 0 2 4 $ 2 4 4 , 4 1 0

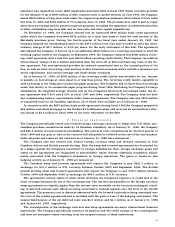

The aggregate maturities of long-term debt, exclusive of current installments, at January 31, 1998 are as follows:

G e n e r a l

C o r p o r a t e

In Thousands Equipment Notes D e b t To t a l

Fiscal Ye a r

2 0 0 0 $ 6 9 7 $ – $ 6 9 7

2 0 0 1 4 3 0 1 0 0 , 0 0 0 1 0 0 , 4 3 0

2 0 0 2 – – –

2 0 0 3 – – –

Later years – 1 1 9 , 8 9 7 1 1 9 , 8 9 7

A g g r egate maturities of long-term debt, exclusive of current installments $ 1 , 1 2 7 $ 2 1 9 , 8 9 7 $ 2 2 1 , 0 2 4

Real estate mortgages are collateralized by land and buildings. While the parent company is not dire c t l y

obligated with respect to the real estate mortgages, it or a wholly-owned subsidiary has either guaranteed

the debt or has guaranteed a lease, if applicable, which has been assigned as collateral for such debt.

On September 16, 1996, pursuant to a call for redemption, the Company prepaid $88.8 million of its

91⁄2% sinking fund debentures. The Company recorded an after-tax extraordinary charge of $2.9 million, or

$.02 per common share, related to the early re t i rement of this debt. The Company paid the outstanding

balance of $8.5 million during fiscal 1998 utilizing an optional sinking fund payment under the indenture.

In June 1995, the Company filed a shelf registration statement with the Securities and Exchange

Commission which provided for the issuance of up to $250 million of long-term debt. This shelf registration