TJ Maxx 1997 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 1997 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

markdowns and $17.9 million for severance, professional fees and all other costs associated with the

re s t ructuring plan. The only non-cash charge portion of the re s e rve was for pro p e rty write-off s .

The Company also established a re s e rve for the closing of certain T.J. Maxx stores. The Company

re c o rded an initial charge to income from continuing operations of $35 million in fiscal 1996 and a cre d i t

to income from continuing operations of $8 million in fiscal 1997 to reflect a lower than anticipated cost

of the T.J. Maxx closings. The adjusted re s e rve balance includes $15.6 million for lease related obligations

of the closed stores, non-cash charges of $9.8 million for pro p e rty write-offs and $2.3 million for

severance, professional fees and all other costs associated with the closings.

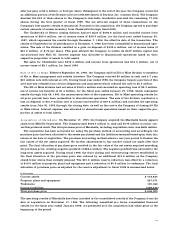

The following is a summary of the activity in the store closing and re s t ructuring re s e rve for the last

two fiscal years:

Fiscal Year Ended

J a n u a r y 31, J a n u a r y 25,

In Thousands 1 9 9 8 1 9 9 7

Balance, beginning of the year $ 95,867 $ 2 5 1 , 5 6 6

R e s e rve adjustments:

Adjust Marshalls re s t ructuring re s e rv e ( 1 5 , 8 4 3 ) ( 8 5 , 9 0 0 )

Adjust T.J. Maxx store closing re s e rv e 7 0 0 ( 8 , 0 0 0 )

C h a rges against the re s e rv e :

Lease related obligations ( 1 3 , 5 9 3 ) ( 2 1 , 2 7 7 )

I n v e n t o ry markdowns – ( 1 5 , 8 8 6 )

Severance and all other cash charg e s ( 1 , 8 7 6 ) ( 1 3 , 9 0 1 )

Net activity relating to HomeGoods closings ( 1 , 8 8 7 ) 329

Non-cash pro p e rty write-off s ( 5 , 4 0 2 ) ( 1 1 , 0 6 4 )

Balance, end of year $ 57,966 $ 95,867

All the Marshalls and T.J. Maxx pro p e rties for which re s e rves were provided have been closed. The re m a i n-

ing re s e rve balance as of January 31, 1998 of $58 million is almost entirely for the estimated cost of future

obligations of the closed store and other facility leases. It includes estimates and assumptions as to how

the leases will be disposed of and could change; however, the Company believes it has adequate re s e rves to

deal with these obligations. The use of the re s e rve will reduce operating cash flows in varying amounts

over the next ten to fifteen years as the related leases expire or are settled.

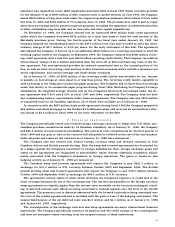

J . S u p p l e m e n t a l C a s h F l o w s I n f o r m a t i o n

The Company classifies the cash flows associated with the operating results of its discontinued operations

t h rough the date of sale, as “net cash provided by (used in) discontinued operations.” The following is a

reconciliation of the “income from discontinued operations, net of income taxes” to the “net cash pro v i d e d

by (used in) discontinued operations.”

Fiscal Year Ended

J a n u a r y 31, J a n u a r y 25, J a n u a r y 27,

1 9 9 8 1 9 9 7 1 9 9 6

(53 weeks)

Income from discontinued operations, net of income taxes $ – $2 9 , 3 6 1 $ 9 , 7 1 0

( I n c rease) decrease in net assets of discontinued

operations during the period:

Net assets of discontinued operations –

beginning of period 5 4 , 4 5 1 1 2 8 , 5 8 6 9 3 , 3 9 7

L e s s :

Net assets of discontinued operations – sold during period – 5 4 , 0 8 3 4 4 , 7 8 9

Net assets of discontinued operations – end of period – 5 4 , 4 5 1 1 2 8 , 5 8 6

( I n c rease) decrease in net assets of discontinued operations 5 4 , 4 5 1 2 0 , 0 5 2 ( 7 9 , 9 7 8 )

Net cash provided by (used in) discontinued operations $ 5 4 , 4 5 1 $ 4 9 , 4 1 3 $ ( 7 0 , 2 6 8 )

The Company is also responsible for certain leases related to, and other obligations arising from, the sale

of these operations, for which re s e rves have been provided in its re s e rve for discontinued operations, and

is included in accrued expenses. The cash flow impact of these obligations is reflected as a component

of cash provided by operating activities in the statements of cash flows.