TJ Maxx 1997 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 1997 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

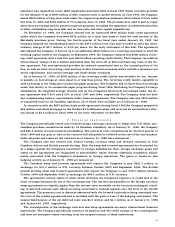

The Company’s cash payments for interest expense and income taxes, including discontinued opera-

tions, and its non-cash investing and financing activities are as follows:

Fiscal Year Ended

J a n u a r y 31, J a n u a r y 25, J a n u a r y 27,

In Thousands 1 9 9 8 1 9 9 7 1 9 9 6

(53 weeks)

Cash paid for:

I n t e re s t $ 26,359 $ 44,288 $ 41,924

Income taxes 1 9 9 , 0 2 5 1 5 9 , 2 4 5 1 7 , 2 7 5

Non-cash investing and financing activities:

Conversion of cumulative convertible pre f e rre d

stock into common stock

Series A $ – $ 25,000 $ –

Series C – 8 2 , 5 0 0 –

Series D – 2 5 , 0 0 0 –

Series E 7 7 , 0 2 0 – –

Distribution of two-for-one stock split 7 9 , 8 2 3 – –

Note receivable from sale of Chadwick’s of Boston – 2 0 , 0 0 0 –

Issuance of pre f e rred stock for acquisition of Marshalls – –1 7 5 , 0 0 0

Note receivable from sale of Hit or Miss – –1 0 , 0 0 0

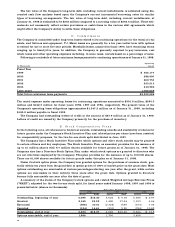

K . D i s c o n t i n u e d O p e r a t i o n s a n d R e l a t e d C o n t i n g e n t L i a b i l i t i e s

In October 1988, the Company completed the sale of its former Zayre Stores division to Ames Depart m e n t

S t o res, Inc. (“Ames”). In April 1990, Ames filed for protection under Chapter 11 of the Federal Bankru p t c y

Code and in December 1992, Ames emerged from bankruptcy under a plan of re o r ganization.

The Company remains contingently liable for the leases of most of the former Zayre stores still oper-

ated by Ames. In addition, the Company is contingently liable on a number of leases of the Hit or Miss

division, the Company’s former off-price women’s specialty stores, sold on September 30, 1995. The

Company believes that the Company’s contingent liability on these leases will not have a material eff e c t

on the Company’s financial condition.

The Company is also contingently liable on certain leases of its former warehouse club operations

( B J ’s Wholesale Club and HomeBase), which was spun off by the Company in fiscal 1990 as Waban Inc.

During fiscal 1998, Waban Inc. was renamed HomeBase, Inc. and spun-off from its BJ’s Wholesale Club

division (BJ’s Wholesale Club, Inc.). HomeBase, Inc., and BJ’s Wholesale Club, Inc. are primarily liable on

their respective leases and have indemnified the Company for any amounts the Company may have to pay

with respect to such leases. In addition HomeBase, Inc., BJ’s Wholesale Club, Inc. and the Company have

e n t e red into agreements under which BJ’s Wholesale Club, Inc. has substantial indemnification re s p o n s i-

bility with respect to such HomeBase, Inc. leases. The Company is also contingently liable on cert a i n

leases of BJ’s Wholesale Club, Inc. for which both BJ’s Wholesale Club, Inc. and HomeBase, Inc. re m a i n

liable. The Company believes that its contingent liability on the HomeBase, Inc. and B J ’s Wholesale Club,

Inc. leases will not have a material effect on the Company’s financial condition.

L . S e g m e n t I n f o r m a t i o n

For data on business segments for fiscal 1998, 1997 and 1996, see page 20.