TJ Maxx 1997 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 1997 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22

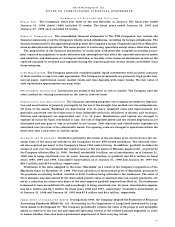

As a result of the acquisition of Marshalls, and the development of a plan for the realignment of the distri-

bution center facilities at T.J. Maxx and Marshalls, certain distribution center assets have been written down

to their net estimated realizable value in anticipation of their sale or disposal. The plan is expected to be imple-

mented over the next several years. The amounts impacting Marshalls have been reflected in the final alloca-

tion of purchase price (see Note A) and those related to T.J. Maxx have been reflected as a $12.2 million

i m p a i rment charge which has been re c o rded in selling, general and administrative expenses for fiscal 1997.

A d v e r t i s i n g C o s t s : The Company expenses advertising costs during the fiscal year incurre d .

E a r n i n g s P e r S h a r e : Beginning with the fourth quarter of fiscal 1998, the Company began to re p o rt

e a rnings per share in accordance with Statement of Financial Accounting Standards (SFAS) No. 128

“ E a rnings per Share.” SFAS No. 128 re q u i res the presentation of “basic” and “diluted” earnings per share .

Basic earnings per share is based on a simple weighted average of common stock outstanding. Diluted

e a rnings per share includes the dilutive effect of convertible securities and other common stock equiva-

lents. See Note F for a computation of basic and diluted earnings per share. All earnings per share

amounts discussed refer to diluted earnings per share unless otherwise indicated.

F o r e i g n C u r r e n c y T r a n s l a t i o n :The Company’s foreign assets and liabilities are translated at the year-

end exchange rate and income statement items are translated at the average exchange rates prevailing dur-

ing the year. A large portion of the Company’s net investment in foreign operations is hedged with

foreign currency swap agreements and forward contracts. The translation adjustment associated with the

foreign operations and the related hedging instruments are included in shareholders’ equity as a component

of additional paid-in capital. Cumulative foreign currency translation adjustments included in shareholders’

equity amounted to losses of $1.7 million as of January 31, 1998 and $1.0 million as of January 25, 1997.

N e w A c c o u n t i n g S t a n d a r d s : During 1997, the Financial Accounting Standards Board (FASB) issued

Statement of Financial Accounting Standards (SFAS) No. 130, “Reporting Comprehensive Income.” This

statement specifies the computation, presentation and disclosures for components of compre h e n s i v e

income. The Company will implement the standard in its fiscal year ending January 30, 1999. The

adoption of this standard will not have a material impact on the consolidated financial statements.

During 1997, the Financial Accounting Standards Board (FASB) also issued Statement of Financial

Accounting Standards (SFAS) No. 131, “Disclosure about Segments of an Enterprise and Related Informa-

tion.” This statement changes the manner in which public companies report information about their operat-

ing segments. SFAS No. 131, which is based on the management approach to segment reporting, establishes

requirements to report selected segment information quarterly and to report entity-wide disclosures about

products and services, major customers, and the geographic locations in which the entity holds assets and

reports revenue. The Company is currently evaluating the effects of this change on its reporting of segment

information. The Company will adopt SFAS No. 131 in its fiscal year ending January 30, 1999.

O t h e r : Certain amounts in prior years’ financial statements have been reclassified for comparative purposes.

The Company is in the process of converting all necessary systems to be year 2000 compliant. The

Company expects to spend an aggregate of approximately $10 million on conversion costs, primarily in

fiscal 1998 and 1999.

A . D i s p o s i t i o n s a n d A c q u i s i t i o n s

S a l e o f C h a d w i c k ’ s o f B o s t o n : During the fourth quarter of fiscal 1997, the Company sold its Chadwick’s

of Boston catalog division to Brylane, L.P. Proceeds of approximately $300 million included cash, a 10 year

$20 million Convertible Subordinated Note at 6% interest (the “Brylane note”) and Chadwick’s consumer

c redit card receivables. During the second quarter of fiscal 1998, the Company paid Brylane $28.8 million

as an estimated adjustment to the cash proceeds based on the closing balance sheet of Chadwick’s as of

December 7, 1996 as pre p a red by the Company. During the quarter ended October 1997, the Company paid

B rylane $4.4 million upon agreement of the final closing balance sheet of Chadwick’s as of December 7,

1996. The results of Chadwick’s for all periods prior to December 7, 1996 have been reclassified to discon-

tinued operations. The cash provided by discontinued operations for fiscal 1998 re p resents the collection of

the remaining balance of the Chadwick’s consumer credit card receivables outstanding as of January 25,

1997. During the quarter ended October 1997, the Company converted a portion of the Brylane note into

352,908 shares of Brylane, Inc. common stock which it sold for $15.7 million. This sale resulted in an