TJ Maxx 1997 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 1997 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

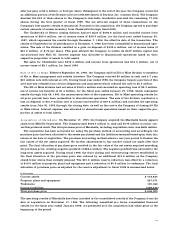

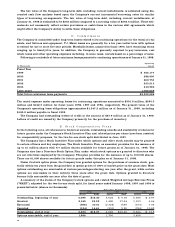

The Company had a net deferred tax liability as follows:

J a n u a r y 31, J a n u a r y 25,

In Thousands 1 9 9 8 1 9 9 7

D e f e rred tax assets:

Capital loss carry f o rw a rd $ – $ 4 , 5 0 0

F o reign net operating loss carry f o rw a rd 3 4 , 5 5 4 3 4 , 5 0 0

R e s e rve for discontinued operations 6 , 7 2 3 9 , 3 9 7

R e s e rve for closed stores and re s t ructuring costs 2 3 , 5 7 1 3 8 , 4 2 1

Insurance costs not currently deductible for tax purposes 1 5 , 0 4 9 2 4 , 3 4 2

Pension, postre t i rement and employee benefits 3 4 , 1 7 3 2 3 , 2 6 7

L e a s e s 9 , 3 5 0 6 , 4 7 8

O t h e r 1 8 , 7 8 9 1 7 , 9 8 1

Valuation allowance ( 3 4 , 6 0 3 ) ( 3 9 , 0 8 4 )

Total deferred tax assets $ 1 0 7 , 6 0 6 $ 1 1 9 , 8 0 2

D e f e rred tax liabilities:

P ro p e rt y, plant and equipment $ 1 4 , 7 3 6 $ 2 0 , 0 9 6

Safe harbor leases 3 7 , 9 4 5 4 4 , 6 0 3

Tr a d e n a m e 4 8 , 6 5 9 5 2 , 3 0 2

O t h e r 1 3 , 1 2 5 1 0 , 1 2 1

Total deferred tax liabilities $ 1 1 4 , 4 6 5 $ 1 2 7 , 1 2 2

Net deferred tax liability $ 6 , 8 5 9 $ 7 , 3 2 0

The Company had a capital loss carry f o rw a rd of $139 million as of January 27, 1996 which was fully

utilized to offset the capital gain recognized on the sale of Chadwick’s.

The Company does not provide for U.S. deferred income taxes on the undistributed earnings of its for-

eign subsidiaries as the earnings are considered to be permanently reinvested. The undistributed earn i n g s

of its foreign subsidiaries as of January 31, 1998 were immaterial.

The Company has a United Kingdom net operating loss carryforward of approximately $50 million for tax

and financial reporting purposes. The United Kingdom net operating loss does not expire under current

United Kingdom tax law. The Company also has a Puerto Rico net operating loss carryforward of approxi-

mately $49 million at January 31, 1998, for tax and financial reporting purposes, which was acquired in the

Marshalls acquisition and expires in fiscal 1999 through fiscal 2003. Future utilization of these operating

loss carryforwards is dependent upon future earnings of the Company’s foreign subsidiaries.

The Company’s worldwide effective tax rate was 41% for the fiscal year ended January 31, 1998, and 42%

for fiscal years ended January 25, 1997 and January 27, 1996. The diff e rence between the U.S. federal

s t a t u t o ry income tax rate and the Company’s worldwide effective income tax rate is summarized as follows:

Fiscal Year Ended

J a n u a r y 31, J a n u a r y 25, J a n u a r y 27,

1 9 9 8 1 9 9 7 1 9 9 6

U.S. federal statutory income tax rate 3 5 % 3 5 % 3 5 %

E ffective state income tax rate 5 5 5

Impact of foreign operations – 1 3

All other 1 1( 1 )

Worldwide effective income tax rate 4 1 % 4 2 % 4 2 %

H . P e n s i o n P l a n s a n d O t h e r R e t i r e m e n t B e n e f i t s

The Company has a non-contributory defined benefit re t i rement plan covering the majority of full-time

U.S. employees. Effective in fiscal 1998, Marshalls associates are included in the plan with credit for ser-

vice prior to the acquisition. Employees who have attained twenty-one years of age and have completed

one year of service are covered under the plan. Benefits are based on compensation earned in each year of

s e rvice. The Company also has an unfunded supplemental re t i rement plan which covers certain key

employees of the Company and provides additional re t i rement benefits based on average compensation.