TJ Maxx 1997 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 1997 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

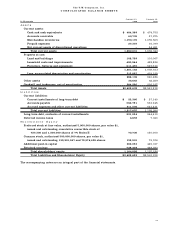

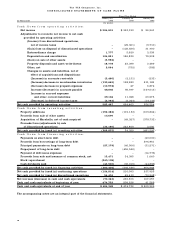

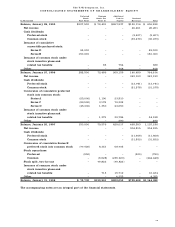

T h e T J X C o m p a n i e s , I n c .

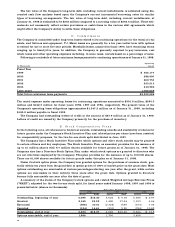

S E L E C T E D I N F O R M A T I O N B Y M A J O R B U S I N E S S S E G M E N T

The following selected information by major business segment reflects the results of Marshalls in the

o ff-price family apparel segment for the periods following its acquisition on November 17, 1995.

Fiscal Year Ended

J a n u a r y 31, J a n u a r y 25, J a n u a r y 27,

In Thousands 1 9 9 8 1 9 9 7 1 9 9 6

(53 weeks)

Net sales:

O ff-price family apparel store s $ 7 , 2 9 0 , 9 5 9 $ 6 , 6 0 2 , 3 9 1 $ 3 , 8 9 6 , 7 1 0

O ff-price home fashion store s 9 8 , 1 1 0 8 7 , 0 1 9 7 8 , 4 0 5

$ 7 , 3 8 9 , 0 6 9 $ 6 , 6 8 9 , 4 1 0 $ 3 , 9 7 5 , 1 1 5

Operating income (loss):

O ff-price family apparel stores ( 1 ) $5 9 6 , 9 0 8 $ 4 6 3 , 4 1 9 $ 1 8 7 , 9 7 4

O ff-price home fashion stores ( 2 ) ( 8 , 6 1 5 ) ( 1 4 , 0 1 8 ) ( 1 3 , 3 7 5 )

5 8 8 , 2 9 3 4 4 9 , 4 0 1 1 7 4 , 5 9 9

General corporate expense ( 3 ) 5 8 , 9 0 6 4 3 , 2 9 7 4 5 , 0 0 3

Goodwill amort i z a t i o n 2 , 6 1 4 2 , 6 1 4 2 , 6 1 4

I n t e rest expense, net 4 , 5 0 2 3 7 , 3 5 0 3 8 , 1 8 6

Income from continuing operations

b e f o re income taxes and extraord i n a ry item $ 5 2 2 , 2 7 1 $ 3 6 6 , 1 4 0 $ 8 8 , 7 9 6

Identifiable assets:

O ff-price family apparel store s $ 2 , 0 3 3 , 9 4 5 $ 1 , 8 0 1 , 7 7 9 $ 2 , 1 1 6 , 1 2 7

O ff-price home fashion store s 3 9 , 0 7 4 3 6 , 4 9 3 4 6 , 8 6 1

Corporate, primarily cash and goodwill ( 4 ) 5 3 6 , 6 1 3 6 6 8 , 4 8 9 3 8 2 , 1 3 7

$ 2 , 6 0 9 , 6 3 2 $ 2 , 5 0 6 , 7 6 1 $ 2 , 5 4 5 , 1 2 5

Capital expenditure s :

O ff-price family apparel store s $ 1 9 0 , 7 2 0 $ 1 0 4 , 9 5 5 $ 8 7 , 0 3 7

O ff-price home fashion store s 1 , 6 6 2 7 3 1 7 , 9 3 2

Corporate ( 4 ) –1 3 , 4 6 7 1 0 , 8 9 5

$1 9 2 , 3 8 2 $ 1 1 9 , 1 5 3 $ 1 0 5 , 8 6 4

D e p reciation and amort i z a t i o n :

O ff-price family apparel store s $ 1 1 5 , 9 6 7 $ 1 1 3 , 4 7 9 $ 6 9 , 5 9 6

O ff-price home fashion store s 3 , 1 8 6 2 , 1 0 4 1 , 7 7 7

Corporate, including goodwill ( 4 ) 5 , 7 3 8 1 1 , 2 4 7 7 , 8 5 9

$1 2 4 , 8 9 1 $ 1 2 6 , 8 3 0 $ 7 9 , 2 3 2

( 1 ) The period ended January 27, 1996 includes a charge of $35 million relating to the closing of certain T.J. Maxx store s .

( 2 ) The periods ended January 31, 1998, January 25, 1997 and January 27, 1996 include a charge of $1.5 million, $3.1

million and $3.8 million, re s p e c t i v e l y, for certain store closings and other re s t r ucturing costs relating to HomeGoods.

( 3 ) General corporate expense for the fiscal year ended January 31, 1998, includes a pre-tax charge of $15.2 million for costs

associated with a deferred compensation arrangement with the Company’s Chief Executive Officer and a pre-tax gain of

$6 million for the sale of Brylane, Inc. common stock. General corporate expense for the fiscal years ended January 25,

1997 and January 27, 1996 include the net operating results of T.K. Maxx. Fiscal year 1998 includes T.K. Maxx re s u l t s

in off-price family apparel stores.

( 4 ) Periods prior to January 31, 1998 include assets and activity of T.K. Maxx. Fiscal year 1998 includes T.K. Maxx in

o f f-price family apparel stores.

20