TJ Maxx 1997 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 1997 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

The Company realizes an income tax benefit from the exercise or early disposition of certain stock options.

This benefit results in a decrease in current income taxes payable and an increase in additional paid-in

capital. Such benefits amounted to $6.1 million and $10.2 million for the fiscal years ended January 31,

1998 and January 25, 1997, re s p e c t i v e l y. Amounts for fiscal 1996 were immaterial.

The Company has adopted the disclosure-only provisions of Statement of Financial Accounting

S t a n d a rds (SFAS) No. 123 “Accounting for Stock-Based Compensation,” and continues to apply the pro v i-

sions of APB Opinion No. 25 “Accounting for Stock Issued to Employees” in accounting for compensation

expense under its stock option plans. The Company grants options at fair market value on the date of the

grant; accordingly, no compensation expense has been recognized for the stock options issued during fiscal

years 1998, 1997 or 1996. Had compensation expense been determined in accordance with SFAS No. 123,

the Company’s income from continuing operations, net income and related earnings per share amounts for

the fiscal years ended January 31, 1998 and January 25, 1997 would have been reduced to the unaudited

p ro forma amounts indicated below:

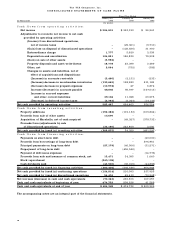

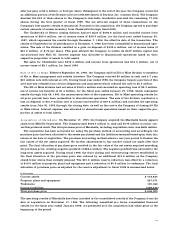

Fiscal Year Ended

As Report e d Unaudited Pro Form a

J a n u a r y 31, J a n u a r y 25, J a n u a r y 3 1, J a n u a ry 25,

Dollars in Thousands Except Per Share Amounts 1 9 9 8 1 9 9 7 1 9 9 8 1 9 9 7

(53 weeks) (53 weeks)

Income from continuing operations $ 3 0 6 , 5 9 2 $ 2 1 3 , 8 2 6 $ 3 0 1 , 1 2 9 $ 2 1 1 , 8 9 3

Diluted earnings per share $ 1 . 7 5 $ 1 . 2 2 $ 1 . 7 2 $ 1 . 2 1

Net income $ 3 0 4 , 8 1 5 $ 3 6 3 , 1 2 3 $ 2 9 9 , 3 5 2 $ 3 6 1 , 1 9 0

Diluted earnings per share $ 1 . 7 4 $ 2 . 0 7 $ 1 . 7 1 $ 2 . 0 6

For purposes of applying the provisions of SFAS No. 123 for the pro forma calculations, the fair value of

each option grant issued during fiscal 1998 and 1997 is estimated on the date of grant using the Black-

Scholes option pricing model with the following assumptions: dividend yield 1% and expected volatility of

38% in both fiscal 1998 and 1997, a risk-free interest rate of 5.8% in fiscal 1998 and 6.67% in fiscal 1997

and expected holding periods of 6 years in both fiscal periods. The weighted average fair value of options

granted during fiscal 1998 and 1997 was $11.05 and $7.75 per share, re s p e c t i v e l y.

The effects of applying SFAS No. 123 in this pro forma disclosure are not indicative of future amounts.

S FAS No. 123 does not apply to awards prior to 1995, and additional awards in future years are anticipated.

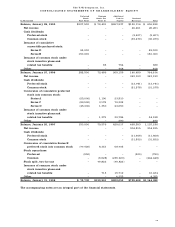

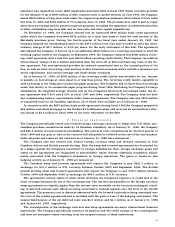

The following table summarizes information about stock options outstanding as of January 31, 1998

( s h a res in thousands):

Options Outstanding Options Exerc i s a b l e

We i g h t e d We i g h t e d We i g h t e d

Range of Av e r a g e Av e r a g e Av e r a g e

E x e rc i s e R e m a i n i n g E x e rc i s e E x e rc i s e

P r i c e s S h a re s Contract Life P r i c e S h a re s P r i c e

$ 5.1250 – $ 7 . 6 8 7 5 7 2 7 7.2 Ye a r s $ 6 . 3 6 3 9 8 $ 6 . 3 1

$ 7.6876 – $12.1875 7 7 2 5.8 Ye a r s 1 0 . 8 7 7 7 2 1 0 . 8 7

$12.1876 – $17.4375 1 , 5 9 1 7.7 Ye a r s 1 6 . 2 5 7 2 9 1 4 . 8 5

$17.4376 – $21.5000 7 0 0 9.2 Ye a r s 2 1 . 3 8 6 7 2 1 . 3 8

$21.5001 – $28.9375 1 , 4 6 3 9.5 Ye a r s 2 8 . 0 9 – –

To t a l 5 , 2 5 3 8.0 Ye a r s $ 1 8 . 0 7 1 , 9 6 6 $ 1 1 . 7 8

During fiscal 1998, a special deferred compensation award was granted to the Company’s Chief Executive

O fficer initially denominated in 450,000 shares of the Company’s stock with a fair value of $21.375 per

s h a re at the date of grant. The shares vested at the time of the grant and the Company re c o rded a deferre d

compensation charge of $9.6 million at the time of the grant. The executive may elect to have such grant

c o n v e rted into other investments. The Company does not anticipate that the shares will be issued and

t h e re f o re does not consider them for diluted earnings per share calculations and adjusts the compensation

c h a rge for changes in the market value of the stock. The Company re c o rded an additional expense of $5.6

million in fiscal 1998 due to the increase in market value of the shares from date of grant.

The Company has also issued restricted stock and perf o rmance based stock awards under the Stock

Incentive Plan. Restricted stock awards are issued at par value, or at no cost, and have restrictions which gen-

erally lapse over three to five years from date of grant. As of January 31, 1998, the perf o rmance based stock

a w a r ds have either vested or been forfeited. The market value in excess of cost is charged to income ratably

over the period during which these awards vest, such pre-tax charges amounted to $2.7 million in fiscal 1998,

$2.5 million in fiscal 1997 and $0.4 million in fiscal 1996. The market value of the awards is determined at

date of grant for restricted stock awards, and at the date shares are earned for perf o rmance based awards.