TJ Maxx 1997 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 1997 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

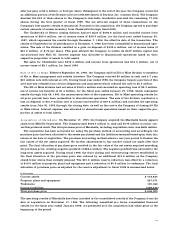

J a n u a ry 31, J a n u a r y 2 5,

In Thousands 1 9 9 8 1 9 9 7

Accumulated postre t i rement obligation:

R e t i red associates $ 8 , 8 8 2 $ 7 , 1 4 7

Fully eligible active associates 4 , 4 5 9 4 , 6 5 3

Other active associates 7 , 8 3 2 3 , 5 0 1

Accumulated postre t i rement obligation 2 1 , 1 7 3 1 5 , 3 0 1

U n recognized net (loss) due to change in assumptions ( 4 , 3 4 1 ) ( 1 , 3 7 5 )

A c c rued postre t i rement benefits included in accrued expenses $ 1 6 , 8 3 2 $ 1 3 , 9 2 6

Assumptions used in determining the actuarial present value of the accumulated postre t i rement obliga-

tion include a discount rate of 7.0% and 7.5% in fiscal years 1998 and 1997, re s p e c t i v e l y. Due to the nature

of the plan, which limits the annual benefit to $3,000, the medical inflation assumption, initially set at

4.5% in fiscal 1998 and 5% in fiscal 1997, is gradually reduced to zero. An increase of 1% in the medical

inflation assumption would increase the postre t i rement benefit obligation as of January 31, 1998 by

a p p roximately $1.7 million. Effective January 1, 1997, Marshalls associates were eligible for the

C o m p a n y ’s postre t i rement medical plan.

The Company also sponsors an employee savings plan under Section 401(k) of the Internal Revenue

Code for all eligible U.S. employees, including Marshalls associates effective January 1, 1997. Employees

may contribute up to 15% of eligible pay. The Company matches employee contributions up to 5% of eligi-

ble pay at rates ranging from 25% to 50% based upon Company perf o rmance. The Company contributed

for all 401(k) plans $5.7 million in fiscal 1998, $6.4 million in fiscal 1997 and $2.2 million in fiscal 1996.

Prior to January 1, 1997, Marshalls associates participated in a separate Section 401(k) savings plan con-

sistent with the plan Marshalls associates participated in prior to acquisition.

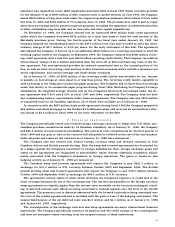

I . A c c r u e d E x p e n s e s a n d O t h e r C u r r e n t L i a b i l i t i e s

The major components of accrued expenses and other current liabilities are as follows:

J a n u a r y 31, J a n u a r y 25,

In Thousands 1 9 9 8 1 9 9 7

Employee compensation and benefits $ 1 4 2 , 9 4 5 $ 1 1 3 , 8 5 5

R e s e rve for discontinued operations 1 7 , 8 4 3 2 3 , 6 5 0

S t o re closing and re s t ructuring re s e rve, continuing operations 5 7 , 9 6 6 9 5 , 8 6 7

I n s u r a n c e 5 8 , 0 7 0 6 7 , 4 0 3

Rent, utilities, advertising and other 3 3 4 , 6 8 2 3 2 0 , 4 3 6

A c c rued expenses and other current liabilities $ 6 1 1 , 5 0 6 $ 6 2 1 , 2 1 1

The Company’s re s e rve for discontinued operations relates to obligations the Company retained or incurre d

in connection with the sale of its former Zayre, Hit or Miss and Chadwick’s operations. During fiscal 1997,

the re s e rve decreased by $1.6 million. The Company added $10.7 million to the re s e rve, relating to antic-

ipated costs associated with the sale of Chadwick’s, which was offset by reductions to the re s e rve of $12.3

million, primarily relating to lease obligations. During fiscal 1998, the reduction to the re s e rve of $5.8

million is primarily for settlement costs associated with Chadwick’s and for lease related costs associated

with the former Zayre and Hit or Miss pro p e rties. The combined remaining re s e rve balance of $17.8 million as

of January 31, 1998 is expected to be used for lease related obligations, primarily for former Zayre store s ,

which is expected to be paid out over the next ten to fifteen years, as leases are settled or terminated.

The re s e rve for store closings and re s t ructurings is primarily for costs associated with the disposition

and settlement of leases for the T.J. Maxx and Marshalls closings anticipated as a result of the Marshalls

a c q u i s i t i o n .The initial re s e rves established in fiscal 1996 were estimated at $244.1 million for a Marshalls

s t o re closing and re s t ructuring plan and $35 million for the closing of certain T.J. Maxx store s .

The Marshalls re s e rve included $44.1 million for inventory markdowns. The primary reduction to the

re s e rve in fiscal 1996 was for inventory markdowns. During fiscal 1997 and 1998, the Marshalls re s e rv e

was reduced by $85.9 million and $15.8 million, re s p e c t i v e l y, to reflect a reduction in the number of store

closings and a lower cost to settle and dispose of lease obligations. These re s e rve reductions resulted in

adjustments to the allocation of the Marshalls purchase price as discussed in Note A to the consolidated

financial statements. The adjusted re s e rve balance included $70.8 million for lease related obligations for

planned store and other facility closings, $9.6 million for pro p e rty write-offs, $44.1 million for inventory