TJ Maxx 1997 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 1997 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

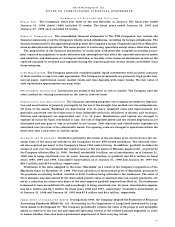

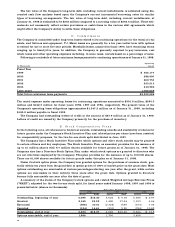

Net periodic pension cost (including discontinued operations) of the Company’s defined benefit and sup-

plemental re t i rement plans includes the following components:

Fiscal Year Ended

J a n u a r y 31, J a n u a r y 25, J a n u a r y 27,

1 9 9 8 1 9 9 7 1 9 9 6

(53 weeks)

S e rvice cost $ 8,372 $ 4,699 $ 3,920

I n t e rest cost on projected benefit obligation 8 , 3 9 8 7 , 2 6 6 6 , 9 1 5

Actual re t u rn on assets ( 2 2 , 2 7 8 ) ( 1 6 , 9 8 1 ) ( 1 5 , 2 1 5 )

Net amortization and deferr a l s 1 5 , 4 5 9 1 0 , 8 7 9 9 , 3 8 4

Net periodic pension cost $ 9,951 $ 5,863 $ 5,004

Net pension cost includes $0.4 million and $0.5 million allocated to discontinued operations in fiscal years

1997 and 1996, re s p e c t i v e l y. The increase in pension cost for fiscal 1998 is primarily due to the inclusion

of Marshalls associates.

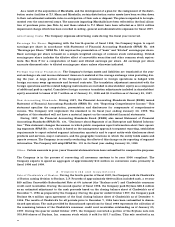

The following table sets forth the funded status of the Company’s pension, defined benefit and supple-

mental re t i rement plans (including discontinued operations) and the amounts recognized in the

C o m p a n y ’s statements of financial position:

J a n u a ry 31, J a n u a r y 2 5,

In Thousands 1 9 9 8 1 9 9 7

Accumulated benefit obligation, including vested benefits

of $111,116 and $89,533 in fiscal 1998 and 1997, re s p e c t i v e l y $ 1 1 5 , 2 5 0 $ 9 3 , 3 8 3

P rojected benefit obligation $ 1 2 7 , 1 4 8 $ 1 0 0 , 4 6 5

Plan assets at fair market value 1 1 0 , 2 3 4 8 9 , 7 0 4

P rojected benefit obligation in excess of plan assets 1 6 , 9 1 4 1 0 , 7 6 1

U n recognized net gain from past experience, diff e rent

f rom that assumed and effects of changes in assumptions 5 , 2 4 3 5 , 9 2 9

Prior service cost not yet recognized in net periodic pension cost ( 8 6 1 ) ( 9 5 0 )

U n recognized prior service cost ( 5 9 6 ) ( 6 7 0 )

A c c rued pension cost included in accrued expenses $ 2 0 , 7 0 0 $ 1 5 , 0 7 0

The projected benefit obligation in excess of plan assets as of January 31, 1998, is due to the Company’s

unfunded supplemental re t i rement plan.

The weighted average discount rate used in determining the actuarial present value of the pro j e c t e d

benefit obligation was 7.0% and 7.5% for fiscal years 1998 and 1997, re s p e c t i v e l y. The rate of increase on

f u t u re compensation levels was 4.0% in each of the fiscal years 1998 and 1997, and the expected long-term

rate of re t u rn on assets was 9.0% in each of the fiscal years 1998 and 1997. The Company’s funding pol-

icy is to contribute annually an amount allowable for federal income tax purposes. Pension plan assets

consist primarily of fixed income and equity securities.

The Company’s postre t i rement benefit plan is unfunded and provides limited postre t i rement medical

and life insurance benefits to associates who participate in the Company’s re t i rement plan and who re t i re

at age fifty-five or older with ten or more years of serv i c e .

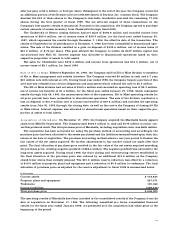

Net periodic postre t i rement benefit cost of the Company’s plan includes the following components:

Fiscal Year Ended

J a n u a r y 31, J a n u a r y 25, J a n u a r y 27,

1 9 9 8 1 9 9 7 1 9 9 6

(53 weeks)

S e rvice cost $ 1 , 3 6 6 $ 671 $ 757

I n t e rest cost on accumulated benefit obligation 1 , 6 4 9 1 , 0 8 1 1 , 0 4 6

Net amort i z a t i o n 7 4 9 5 5 –

Net periodic postre t i rement benefit cost $ 3 , 7 6 4 $ 1 , 8 0 7 $ 1 , 8 0 3

Net periodic postre t i rement benefit costs include $0.1 million in fiscal year 1997 and $0.3 million in

fiscal year 1996 allocated to discontinued operations. The increase in cost for fiscal 1998 is primarily due

to the inclusion of Marshalls associates.

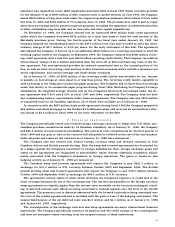

The components of the accumulated postre t i r ement benefit obligation (including discontinued

operations) and the amount recognized in the Company’s statements of financial position are as follows: