TJ Maxx 1997 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 1997 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

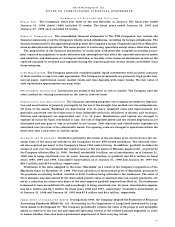

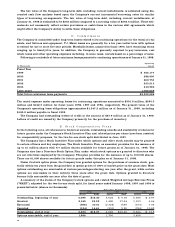

T h e re has been a combined total of 511,917 shares, 35,000 shares and 20,000 shares for deferre d ,

restricted and perf o rmance based awards issued for the fiscal years ended January 1998, 1997 and 1996,

re s p e c t i v e l y. There were 150,000 and 7,000 shares forfeited for the fiscal years ended January 1998 and

J a n u a ry 1996, respectively (no shares were forfeited for the fiscal year ended January 1997). The

weighted average market value per share of these stock awards at grant date was $21.79, $12.00 and

$6.44 for fiscal 1998, 1997 and 1996, re s p e c t i v e l y.

During fiscal 1998, the Company formed a deferred stock compensation plan for its outside dire c t o r s

which replaced the Company’s re t i rement plan for directors. Deferred shares were issued equal to the cur-

rent obligation under the re t i rement plan as of December 31, 1997. Additional share awards valued at

$10,000 will be issued annually to each eligible dire c t o r. Currently there are 8,771 deferred shares out-

standing, actual shares will be issued at re t i r ement. The Company has 50,000 shares held in tre a s u ry fro m

which the Company will issue such shares.

F . C a p i t a l S t o c k a n d E a r n i n g s P e r S h a r e

C a p i t a l S t o c k : The Company distributed a two-for-one stock split, effected in the form of a 100% stock

dividend, on June 26, 1997 to shareholders of re c o rd on June 11, 1997, which resulted in the issuance

of 79.8 million shares of common stock and a corresponding decrease of $79.8 million in additional

paid-in capital. All historical earnings per share amounts have been restated to reflect the two-for- o n e

stock split. Reference to common stock activity before the distribution of the split has not been re s t a t-

ed unless otherwise noted. All activity after the distribution date reflects the two-for-one stock split.

In April 1992, the Company issued 250,000 shares of Series A cumulative convertible pre f e rred stock

in a private offering. As of June 1996, pursuant to a call for redemption, the Series A pre f e rred stock was

c o n v e rted into 1,190,475 shares of common stock.

In August 1992, the Company issued 1,650,000 shares of Series C cumulative convertible pre f e rre d

stock in a public offering. As of September 1996, pursuant to a call for redemption, the Series C pre f e rre d

stock was converted into 3,177,844 shares of common stock.

On November 17, 1995, the Company issued its Series D and Series E convertible pre f e rred stock as part

of the purchase price for Marshalls. The 250,000 shares of Series D pre f e rred stock, with a face value of

$25 million, carried an annual dividend rate of $1.81 per share and was automatically converted into

1,349,527 shares of common stock on November 17, 1996.

The shares of Series E pre f e rred stock, with 1,500,000 shares initially issued at a face value of $150

million, carry an annual dividend rate of $7.00 per share and is mandatorily converted into common

s h a res on November 17, 1998 unless converted earlier. Through January 31, 1998, shareholders con-

v e rted 770,200 shares of Series E pre f e rred stock into 8.3 million shares of common stock and 2,500

s h a res were re p u rchased by the Company. The Company paid $3.8 million to induce conversion of the

p re f e rred shares. The common shares issuable on conversion of the outstanding Series E pre f e rred stock

will vary depending on the market price of common stock at the time of conversion and ranges from a

minimum of 7.9 million shares to a maximum of 9.4 million shares of common stock. Based on the mar-

ket price of the common stock as of January 31, 1998, the minimum number of shares would be issued.

The 727,300 shares of the Company’s outstanding Series E pre f e rred stock at January 31, 1998 has an

a g g regate liquidation pre f e rence of $72.7 million. There is an aggregate of 9,422,513 common share s

re s e rved for the conversion of Series E pre f e rred stock, the maximum number of shares that may be

issued. The Series E pre f e r red stock is senior to the common stock of the Company with respect to pay-

ment of dividends and upon liquidation. There are no voting rights for pre f e rred stock unless dividends

a re in arrears for a specified number of periods.

Dividends on the outstanding Series E pre f e rred stock are paid quarterly on the first business day of

each calendar quart e r, the Company accrues dividends evenly throughout the year. In addition, the induce-

ment fees paid on the conversion of the Series E pre f e rred stock during fiscal 1998 have been classified as

p re f e rred dividends. The Company re c o rded aggregate dividends on its pre f e rred stock of $11.7 million in

fiscal 1998, $13.7 million in fiscal 1997 and $9.4 million in fiscal 1996. The pre f e rred dividends re d u c e

net income in computing net income available to common share h o l d e r s .

During fiscal 1997, the Company replaced the June 1995 shelf registration statement with another

shelf registration statement which currently provides for the issuance of up to $600 million of debt, com-

mon stock or pre f e rred stock.