TJ Maxx 1997 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 1997 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

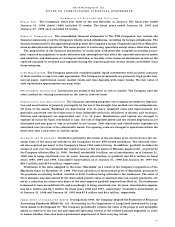

23

a f t e r-tax gain of $3.6 million, or $.02 per share. Subsequent to the end of the year, the Company convert e d

an additional portion of the Brylane note into 258,836 shares of Brylane, Inc. common stock. The Company

donated 181,818 of these shares to the Company’s charitable foundation and sold the remaining 77,018

s h a res during the first quarter of fiscal 1999. The net after-tax impact of these transactions on the

C o m p a n y ’s first quarter results is immaterial. Pursuant to the acquisition, the Company agreed to purc h a s e

c e rtain amounts of excess inventory from Chadwick’s through fiscal 2000.

The Chadwick’s of Boston catalog division had net sales of $464.8 million and re c o rded income fro m

operations of $29.4 million, net of income taxes of $20.9 million, for the fiscal year ended January 25,

1997, which re p resents the results through December 7, 1996, the effective date of the transaction. The

results of Chadwick’s for all periods prior to December 7, 1996 have been reclassified to discontinued oper-

ations. The sale of the division resulted in a gain on disposal of $125.6 million, net of income taxes of

$15.2 million, or $.72 per share. This gain allowed the Company to utilize its $139 million capital loss

c a rry f o rw a rd (see Note G). Interest expense was allocated to discontinued operations based on their

respective pro p o rtion of assets to total assets.

Net sales for Chadwick’s were $472.4 million and income from operations was $12.0 million, net of

income taxes of $8.1 million, for fiscal 1996.

S a l e o f H i t o r M i s s : E ffective September 30, 1995, the Company sold its Hit or Miss division to members

of Hit or Miss management and outside investors. The Company received $3 million in cash and a 7 year

$10 million note with interest at 10%. During fiscal year ended 1998, the Company forgave a portion of this

note and was released from certain obligations and guarantees which reduced the note to $5.5 million.

The Hit or Miss division had net sales of $165.4 million and re c o rded an operating loss of $2.3 million,

net of income tax benefits of $1.4 million, for the fiscal year ended January 27, 1996, which re p re s e n t s

results through July 29, 1995, the measurement date of the transaction. Hit or Miss’ operating results for

all prior periods have been reclassified to discontinued operations. The sale of the division resulted in a

loss on disposal of $31.7 million (net of income tax benefits of $19.8 million) and includes the operating

results from July 30, 1995 through the closing date, as well as the cost to the Company of closing 69 Hit

or Miss stores. Interest expense was allocated to discontinued operations based on their respective pro-

p o rtion of assets to total assets.

A c q u i s i t i o n o f Ma r s h a l l s : On November 17, 1995, the Company acquired the Marshalls family apparel

chain from Melville Corporation. The Company paid $424.3 million in cash and $175 million in junior con-

vertible preferred stock. The total purchase price of Marshalls, including acquisition costs, was $606 million.

The acquisition has been accounted for using the purchase method of accounting and accord i n g l y, the

p u rchase price has been allocated to the assets purchased and the liabilities assumed based upon their fair

values at the date of acquisition. The purchase accounting method allows a one year period to finalize the

fair values of the net assets acquired. No further adjustments to fair market values are made after that

point. The final allocation of purchase price resulted in the fair value of the net assets acquired exceeding

the purchase price, creating negative goodwill of $86.4 million. The negative goodwill was allocated to the

l o n g - t e rm assets acquired. During fiscal 1998, the store closing and re s t ructuring re s e rve established in

the final allocation of the purchase price was reduced by an additional $15.8 million as the Company

closed fewer stores than initially planned. The $15.8 million re s e rve reduction was offset by a re d u c t i o n

of $10.0 million to pro p e rt y, plant and equipment and a reduction of $5.8 million to tradename. The final

allocation of purchase price as adjusted for the re s e rve adjustment in fiscal 1998 is summarized below:

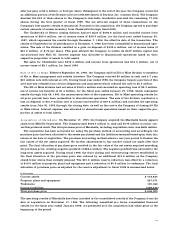

In Thousands

C u rrent assets $ 718,627

P ro p e rt y, plant and equipment 2 2 7 , 0 7 1

Tr a d e n a m e 1 3 0 , 0 4 6

C u rrent liabilities ( 4 6 9 , 7 4 4 )

Total purchase price $ 606,000

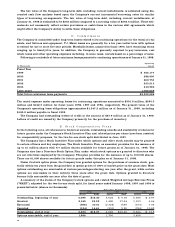

The operating results of Marshalls have been included in the consolidated results of the Company from the

date of acquisition on November 17, 1995. The following unaudited pro forma consolidated financial

results for the fiscal year ended January 1996, are presented as if the acquisition had taken place at the

beginning of the period: