TJ Maxx 1997 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 1997 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.T h e T J X C o m p a n i e s , I n c .

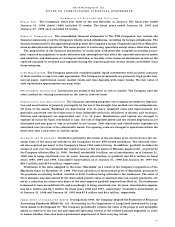

N O T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S

S u m m a r y o f A c c o u n t i n g P o l i c i e s

F i s c a l Ye a r : The Company’s fiscal year ends on the last Saturday in January. The fiscal year ended

J a n u a ry 31, 1998 (fiscal 1998) included 53 weeks. The fiscal years ended January 25, 1997 and

J a n u a ry 27, 1996 each included 52 weeks.

B a s i s o f P r e s e n t a t i o n : The consolidated financial statements of The TJX Companies, Inc. include the

financial statements of all the Company’s wholly-owned subsidiaries, including its foreign subsidiaries. The

financial statements for the applicable periods present the Company’s former Chadwick’s and Hit or Miss divi-

sions as discontinued operations. The notes pertain to continuing operations except where otherwise noted.

The preparation of the financial statements, in conformity with generally accepted accounting princi-

ples, re q u i res management to make estimates and assumptions that affect the re p o rted amounts of assets

and liabilities, and disclosure of contingent liabilities, at the date of the financial statements as well as the

re p o rted amounts of revenues and expenses during the re p o rting period. Actual results could differ fro m

those estimates.

C a s h E q u i v a l e n t s : The Company generally considers highly liquid investments with an initial maturity

of three months or less to be cash equivalents. The Company’s investments are primarily high grade com-

m e rcial paper, institutional money market funds and time deposits with major banks. The fair value of

cash equivalents approximates carrying value.

M e r c h a n d i s e I n v e n t o r i e s : Inventories are stated at the lower of cost or market. The Company uses the

retail method for valuing inventories on the first-in first-out basis.

D e p r e c i a t i o n a n d A m o r t i z a t i o n : For financial re p o rting purposes, the Company provides for depre c i a-

tion and amortization of pro p e rty principally by the use of the straight-line method over the estimated use-

ful lives of the assets. Buildings are depreciated over 33 years, leasehold costs and improvements are

generally amortized over the lease term or their estimated useful life, whichever is short e r, and furn i t u re ,

f i x t u res and equipment are depreciated over 3 to 10 years. Maintenance and repairs are charged to

expense as incurred. Upon re t i rement or sale, the cost of disposed assets and the related depreciation are

eliminated and any gain or loss is included in net income. Debt discount and related issue expenses are

a m o rtized over the lives of the related debt issues. Pre-opening costs are charged to operations within the

fiscal year that a new store or facility opens.

G o o d w i l l a n d T r a d e n a m e : Goodwill is primarily the excess of the purchase price incurred over the car-

rying value of the minority interest in the Company’s former 83%-owned subsidiary. The minority inter-

est was acquired pursuant to the Company’s fiscal 1990 re s t r ucturing. In addition, goodwill includes the

excess of cost over the estimated fair market value of the net assets of Winners Apparel Ltd., acquired by

the Company effective May 31, 1990. Goodwill totaled $82.0 million, net of amortization, as of January 31,

1998 and is being amortized over 40 years. Annual amortization of goodwill was $2.6 million in fiscal

years 1998, 1997 and 1996. Cumulative amortization as of January 31, 1998 and January 25, 1997 was

$22.5 million and $19.9 million, re s p e c t i v e l y.

Tradename is the value assigned to the name “Marshalls” as a result of the Company’s acquisition of the

Marshalls chain on November 17, 1995. The final allocation of the purchase price of Marshalls, pursuant to

the purchase accounting method, resulted in $130.0 million being allocated to the tradename. The value of

the tradename was determined by the discounted present value of assumed after-tax royalty payments, off-

set by a reduction for its pro-rata share of the total negative goodwill acquired (see Note A). The tradename

is deemed to have an indefinite life and accordingly is being amortized over 40 years. Amortization expense

was $3.4 million and $3.7 million for fiscal years 1998 and 1997, respectively. Cumulative amortization as

of January 31, 1998 and January 25, 1997 was $7.8 million and $4.4 million, respectively.

I m p a i r m e n t o f L o n g - L i v e d A s s e t s : During fiscal 1997, the Company adopted the Statement of Financial

Accounting Standards (SFAS) No. 121 “Accounting for the Impairment of Long-Lived Assets and for Long-

Lived Assets to Be Disposed Of.” The Company periodically reviews the value of its pro p e rty and intangible

assets in relation to the current and expected operating results of the related business segments in ord e r

to assess whether there has been a permanent impairment of their carrying values.

21