TJ Maxx 1997 Annual Report Download

Download and view the complete annual report

Please find the complete 1997 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

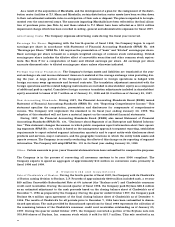

T h e T J X C o m p a n i e s , I n c .

16

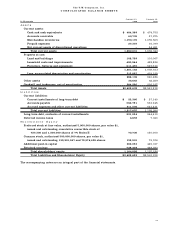

C O N S O L I D A T E D S T A T E M E N T S O F I N C O M E

Fiscal Year Ended

J a n u a r y 31, J a n u a r y 25, J a n u a r y 27,

Dollars in Thousands Except Per Share Amounts 1 9 9 8 1 9 9 7 1 9 9 6

(53 weeks)

Net sales $ 7 , 3 8 9 , 0 6 9 $ 6 , 6 8 9 , 4 1 0 $ 3 , 9 7 5 , 1 1 5

Cost of sales, including buying and occupancy costs 5 , 6 7 6 , 5 4 1 5 , 1 9 8 , 7 8 3 3 , 1 4 3 , 2 5 7

Selling, general and administrative expenses 1 , 1 8 5 , 7 5 5 1 , 0 8 7 , 1 3 7 6 6 9 , 8 7 6

S t o re closing costs – –3 5 , 0 0 0

I n t e rest expense, net 4 , 5 0 2 3 7 , 3 5 0 3 8 , 1 8 6

Income from continuing operations before

income taxes and extraord i n a ry item 5 2 2 , 2 7 1 3 6 6 , 1 4 0 8 8 , 7 9 6

P rovision for income taxes 2 1 5 , 6 7 9 1 5 2 , 3 1 4 3 7 , 2 0 7

Income from continuing operations

b e f o re extraord i n a ry item 3 0 6 , 5 9 2 2 1 3 , 8 2 6 5 1 , 5 8 9

Discontinued operations:

Income from discontinued operations,

net of income taxes – 2 9 , 3 6 1 9 , 7 1 0

Gain (loss) on disposal of discontinued

operations, net of income taxes – 1 2 5 , 5 5 6 ( 3 1 , 7 0 0 )

Income before extraord i n a ry item 3 0 6 , 5 9 2 3 6 8 , 7 4 3 2 9 , 5 9 9

E x t r a o rd i n a ry (charge), net of income taxes ( 1 , 7 7 7 ) ( 5 , 6 2 0 ) ( 3 , 3 3 8 )

Net income 3 0 4 , 8 1 5 3 6 3 , 1 2 3 2 6 , 2 6 1

P re f e rred stock dividends 1 1 , 6 6 8 1 3 , 7 4 1 9 , 4 0 7

Net income available to common share h o l d e r s $ 2 9 3 , 1 4 7 $ 349,382 $ 16,854

Basic earnings per share :

Income from continuing operations

b e f o re extraord i n a ry item $ 1 . 8 3 $ 1 . 3 3 $ .29

Net income $ 1 . 8 2 $ 2 . 3 2 $ .12

Weighted average common share s – b a s i c 1 6 0 , 7 3 7 , 0 2 3 1 5 0 , 4 6 3 , 4 5 2 1 4 4 , 8 3 0 , 3 5 2

Diluted earnings per share :

Income from continuing operations

b e f o re extraord i n a ry item $ 1 . 7 5 $ 1 . 2 2 $ .29

Net income $ 1 . 7 4 $ 2 . 0 7 $ .12

Weighted average common share s – d i l u t e d 1 7 4 , 8 0 6 , 0 9 2 1 7 5 , 3 2 5 , 0 5 0 1 4 5 , 3 9 0 , 9 5 0

Cash dividends per share $ . 2 0 $ .14 $ . 2 4 5

The accompanying notes are an integral part of the financial statements.

Table of contents

-

Page 1

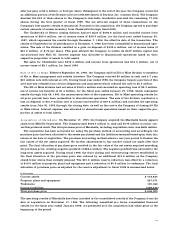

... Per Share Amounts J a n u a ry 31, 1998 (53 weeks) J a n u a ry 27, 1996 Net sales Cost of sales, including buying and occupancy costs Selling, general and administrative expenses Store closing costs Interest expense, net Income from continuing operations before income taxes and extraordinary... -

Page 2

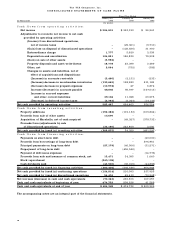

... ry 25, 1997 Assets Current assets: Cash and cash equivalents Accounts receivable Merchandise inventories Prepaid expenses Net current assets of discontinued operations Total current assets Property at cost: Land and buildings Leasehold costs and improvements Furniture, fixtures and equipment Less... -

Page 3

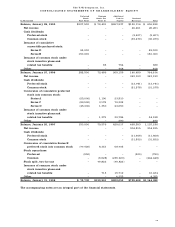

... of acquisitions and dispositions: (Increase) in accounts receivable (Increase) decrease in merchandise inventories (Increase) decrease in prepaid expenses Increase (decrease) in accounts payable Increase in accrued expenses and other current liabilities (Decrease) in deferred income taxes Net cash... -

Page 4

... D Issuance of common stock under stock incentive plans and related tax benefits Other Balance, January 25, 1997 Net income Cash dividends: Preferred stock Common stock Conversion of cumulative Series E preferred stock into common stock Stock repurchase: Preferred Common Stock split, two-for-one... -

Page 5

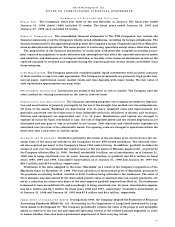

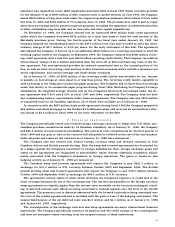

The TJX Companies, Inc. SE LECT ED INFO RM ATION BY MA JOR B US INE SS SEG ME NT The following selected information by major business segment reflects the results of Marshalls in the off-price family apparel segment for the periods following its acquisition on November 17, 1995. Fiscal Year Ended ... -

Page 6

...the Company's acquisition of the Marshalls chain on November 17, 1995. The final allocation of the purchase price of Marshalls, pursuant to the purchase accounting method, resulted in $130.0 million being allocated to the tradename. The value of the tradename was determined by the discounted present... -

Page 7

...report earnings per share in accordance with Statement of Financial Accounting Standards (SFAS) No. 128 "Earnings per Share." SFAS No. 128 requires the presentation of "basic" and "diluted" earnings per share. Basic earnings per share is based on a simple weighted average of common stock outstanding... -

Page 8

... the Company acquired the Marshalls family apparel chain from Melville Corporation. The Company paid $424.3 million in cash and $175 million in junior convertible preferred stock. The total purchase price of Marshalls, including acquisition costs, was $606 million. The acquisition has been accounted... -

Page 9

..., or $.02 per common share, related to the early retirement of this debt. The Company paid the outstanding balance of $8.5 million during fiscal 1998 utilizing an optional sinking fund payment under the indenture. In June 1995, the Company filed a shelf registration statement with the Securities and... -

Page 10

... portion of the Marshalls purchase price. During the fourth quarter of the fiscal year ended January 25, 1997, the Company prepaid the outstanding balance of the $375 million term loan and recorded an after-tax extraordinary charge of $2.7 million, or $.02 per share, for the early retirement of this... -

Page 11

... directors become fully exercisable one year after the date of grant. A summary of the status of the Company's stock options and related Weighted Average Exercise Prices ("WAEP"), adjusted for the two-for-one stock split, for fiscal years ended January 1998, 1997 and 1996 is presented below (shares... -

Page 12

The Company realizes an income tax benefit from the exercise or early disposition of certain stock options. This benefit results in a decrease in current income taxes payable and an increase in additional paid-in capital. Such benefits amounted to $6.1 million and $10.2 million for the fiscal years ... -

Page 13

... date was $21.79, $12.00 and $6.44 for fiscal 1998, 1997 and 1996, respectively. During fiscal 1998, the Company formed a deferred stock compensation plan for its outside directors which replaced the Company's retirement plan for directors. Deferred shares were issued equal to the current obligation... -

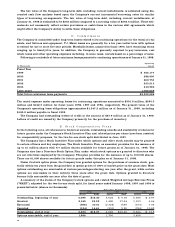

Page 14

... common stock. E a r n i n g s P e r S h a r e : The Company calculates earnings per share in accordance with SFAS No. 128 which requires the presentation of basic and diluted earnings per share. The following schedule presents the calculation of basic and diluted earnings per share for income from... -

Page 15

... Worldwide effective income tax rate 35% 5 - 1 41% 35% 5 1 1 42% 35% 5 3 (1) 42% H. Pension Plans and Other Retirement Benefits The Company has a non-contributory defined benefit retirement plan covering the majority of full-time U.S. employees. Effective in fiscal 1998, Marshalls associates... -

Page 16

... each of the fiscal years 1998 and 1997, and the expected long-term rate of return on assets was 9.0% in each of the fiscal years 1998 and 1997. The Company's funding policy is to contribute annually an amount allowable for federal income tax purposes. Pension plan assets consist primarily of fixed... -

Page 17

... employee savings plan under Section 401(k) of the Internal Revenue Code for all eligible U.S. employees, including Marshalls associates effective January 1, 1997. Employees may contribute up to 15% of eligible pay. The Company matches employee contributions up to 5% of eligible pay at rates ranging... -

Page 18

...a ry 25, 1998 1997 In Thousands Balance, beginning of the year Reserve adjustments: Adjust Marshalls restructuring reserve Adjust T.J. Maxx store closing reserve Charges against the reserve: Lease related obligations Inventory markdowns Severance and all other cash charges Net activity relating to... -

Page 19

... of the former Zayre stores still operated by Ames. In addition, the Company is contingently liable on a number of leases of the Hit or Miss division, the Company's former off-price women's specialty stores, sold on September 30, 1995. The Company believes that the Company's contingent liability on... -

Page 20

... employees of the Company, meets periodically with management, internal auditors and the independent public accountants to review matters relating to the Company's financial reporting, the adequacy of internal accounting controls and the scope and results of audit work. The Committee is responsible... -

Page 21

... closing certain T.J . Maxx store s in connection with the acquisition of Ma rshalls. PRICE RANGE OF COMMON STOCK The following per share data reflects the two-for-one stock split distributed in June 1997. The common stock of the Company is listed on the New York Stock Exchange (Symbol: TJX). The... -

Page 22

...in apparel sales industry-wide. Following the acquisition of Marshalls, the Company replaced Marshalls frequent promotional activity with an everyday low price strategy and also implemented a more timely markdown policy. These changes conformed the Marshalls operation to that of the T.J. Maxx stores... -

Page 23

.... The Company recorded an estimated pre-tax charge of $35 million in fiscal 1996 for the closing of certain T.J. Maxx stores in connection with the acquisition of Marshalls, which consists primarily of estimated costs associated with subletting stores or otherwise disposing of store leases and non... -

Page 24

... costs associated with the restructuring plan. Property write-offs were the only non-cash charge to the reserve. In connection with the Marshalls acquisition, the Company also established a reserve for the closing of certain T.J. Maxx stores. The Company recorded an initial pre-tax charge to income... -

Page 25

...price was subject to a final adjustment based on the net assets of Chadwick's as of the sale date resulting in a payment to Brylane of $33.2 million during fiscal 1998. As part of the sale of Chadwick's, the Company retained the consumer credit card receivables of the division as of the closing date... -

Page 26

... employee stock options. The proceeds include $6.1 million and $10.2 million for related tax benefits in fiscal 1998 and fiscal 1997, respectively. The Company has traditionally funded its seasonal merchandise requirements through short-term bank borrowings and the issuance of short-term commercial... -

Page 27

...earnings equal net sales less co st of sales, includin g buyi ng and occupan cy costs. Net income for the third quarter of fiscal 1998 includes an after-tax extraordinary charge of $1.8 million for the write-off of deferred financing costs associated with the early termination of a revolving credit...