Square Enix 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

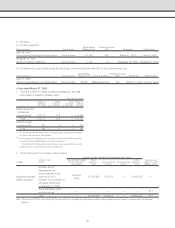

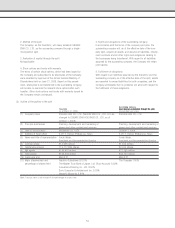

2) Non-current assets

Non-deductible portion of allowance for

employees’s retirement benefits 924

Allowance for directors’ retirement benefits 85

Expense for stock-based compensation 166

Non-deductible depreciation expense of property

and equipment 707

Loss on investments in securities 410

Non-deductible portion of allowance for

doubtful accounts 124

Research and development expense 294

Allowance for closing of game arcades 293

Loss carried forward 8,557

Other 194

Valuation allowance (10,807)

Total 952

Net deferred tax assets 4,834

Deferred tax liabilities

Current liabilities

Accrued expenses and other cost

calculation details 216

Offset to deferred tax assets (non-current assets) (216)

Total —

Total deferred tax liabilities —

Balance: Net deferred tax assets ¥ 4,834

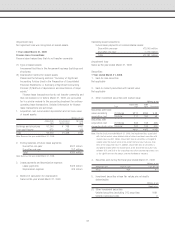

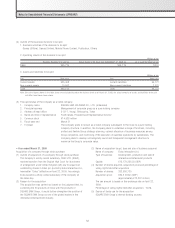

2. A reconciliation of the statutory tax rate and the effective tax

rate is as follows:

Statutory tax rate 40.70%

Permanent differences relating to entertainment

expense, etc., excluded from non-taxable expenses 1.02

Permanent differences relating to dividends received,

etc., excluded from non-taxable expenses (0.05)

Taxation on a per capita basis for inhabitants’ tax 1.69

Deduction for foreign taxes paid (0.50)

Amortization of goodwill 4.91

Valuation allowance 14.05

Special deduction for experiment and

research expenses (5.90)

Tax refund (20.11)

Differences in tax rate from

the parent company’s statutory tax rate (3.00)

Other (1.57)

Effective tax rate 31.24%

45