Square Enix 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

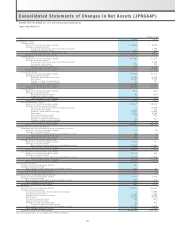

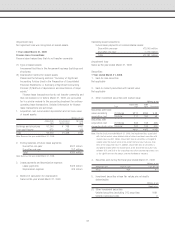

presented in the fiscal year ended March 31, 2008. Those two items

were “change due to increase in consolidation,” which amounted to

¥(63) million, and “increase in retained earnings due to exclusion of

subsidiaries from the scope of consolidation,” which amounted to

¥731 million, in the fiscal year ended March 31, 2008. In the fiscal

year ended March 31, 2009, “increase in retained earnings due to

exclusion of subsidiaries from the scope of consolidation” amounted

to ¥16 million.

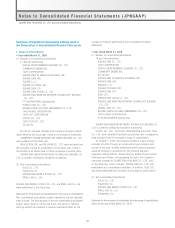

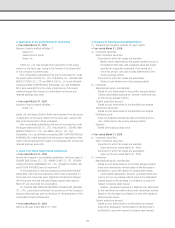

Notes to Consolidated Balance Sheets

• Year ended March 31, 2008

*1 Investments in non-consolidated subsidiaries and affiliates:

Investments and other assets ¥173 million

*2 Contingent liabilities for guarantees:

The Company’s consolidated subsidiary, TAITO CORPORATION,

has issued a guarantee of ¥1 million covering its lease obligations

to Diamond Asset Finance Co., Ltd., one of the Company’s sales

partners.

• Year ended March 31, 2009

*1 Investments in non-consolidated subsidiaries and affiliates:

Investments and other assets ¥127 million

*2 Contingent liabilities for guarantees:

Not applicable

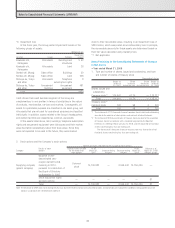

Notes to Consolidated Statements of Income

• Year ended March 31, 2008

*1 Not applicable

*2 Selling, general and administrative

expenses include R&D costs of ¥1,581 million

*3 Breakdown of loss on sale of property and equipment

Tools and fixtures ¥145 million

*4 Breakdown of loss on disposal of property and equipment

Buildings and structures ¥ 62 million

Tools and fixtures 131 million

Amusement equipment 741 million

Other 15 million

Total ¥950 million

*5 Loss on revaluation of investment securities was due to a

significant decline in market prices of marketable securities.

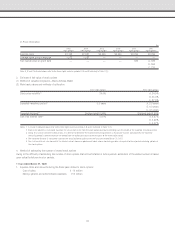

*6 Impairment loss

In this fiscal year, the Group posted impairment losses on the

following asset group:

Millions of yen

Impairment

Location Usage Category amount

Shibuya-ku, Tokyo Idle assets Telephone ¥9

and other subscription rights

Total ¥9

Cash inflows from business segments of the Group are complementary

to one another in terms of similarities in the nature of products,

merchandise, services and markets. Consequently, all assets for

operational purposes are classified in one asset group, and idle

assets which are not used for operational purposes are classified

individually. In addition, assets related to the Group’s headquarters

and welfare facilities are classified as common-use assets.

Telephone subscription rights in the above table were idle assets

and their market value fell substantially below their respective book

value. Since they were not expected to be used in the future, they

were marked down to their respective recoverable value, resulting

in an impairment loss of ¥9 million, which was posted as an

extraordinary loss.

In principle, the recoverable amounts for these assets are

determined based on their respective fair value calculated using

market prices.

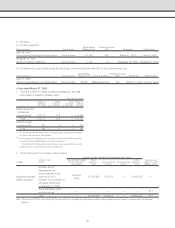

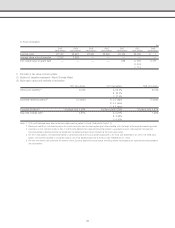

*7 A breakdown of loss on disposal and write-downs of assets

associated with business restructuring is as follows:

Inventories ¥ 658 million

Current assets 249 million

Other 394 million

Total ¥1,302 million

• Year ended March 31, 2009

*1 Inventories at fiscal year-end are stated after writing down

inventory based on its decrease in profitability. The following

amount is included within cost of sales as loss on valuation of

inventories ¥5,368 million

*2 Selling, general and administrative expenses include research

and development expenses of ¥1,525 million

*3 Breakdown of loss on sale of property and equipment

Tools and fixtures ¥ 7 million

Amusement equipment 19 million

Total ¥26 million

*4 Breakdown of loss on disposal of property and equipment

Buildings and structures ¥102 million

Tools and fixtures 216 million

Amusement equipment 342 million

Software 9 million

Other 118 million

Total ¥790 million

*5 Same as the year ended March 31, 2008

33