Square Enix 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

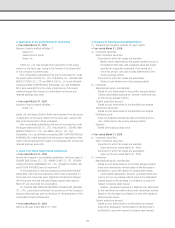

2. Retirement benefit obligation:

Millions of yen

Retirement benefit obligation ¥(11,343)¥(11,343)(11,343)11,343)

Fair value of plan assets 8,8308,830

Net unfunded obligation (2,513)2,513)

Unrecognized prior service cost (805)805)

Unrecognized actuarial loss 1,7901,790

Allowance for retirement benefits ¥¥ (1,528)1,528)

3. Retirement benefit expenses:

Millions of yen

Service cost ¥ 509¥ 509

Interest cost 180180

Expected return on plan assets (158)158)

Amortization of prior service cost (333)333)

Amortization of net actuarial gain (201)201)

Retirement benefit expenses ¥¥ (3)

4. Assumptions used in accounting for the above plans:

Periodic allocation method for projected benefits Straight-line basis

Discount rates 1.700%–2.026%

Expected rate of return on plan assets 1.700%

Period over which prior service cost is amortized 1–5 years

Period over which net actuarial gain or loss

is amortized 1–5 years

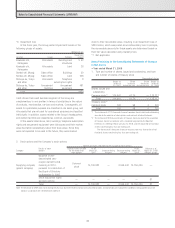

• Year ended March 31, 2009

1. Overview of retirement benefit plan

The Company and its domestic consolidated subsidiaries have a

lump-sum retirement payment plan in accordance with their

internal bylaws.

The projected benefits are allocated to periods of service on

a straight-line basis. The Company’s domestic consolidated

subsidiaries apply a simplified method in the calculation of the

retirement benefit obligations. In addition, certain of the

Company’s overseas subsidiaries maintain defined contribution

retirement pension plans.

2. Retirement benefit obligation:

Millions of yen

Retirement benefit obligation ¥(12,003)¥(12,003)(12,003)12,003)

Fair value of plan assets 6,8586,858

Net unfunded obligation (5,145)5,145)

Unrecognized prior service cost (472)472)

Unrecognized actuarial loss 3,9733,973

Allowance for retirement benefits ¥¥ (1,644)1,644)

3. Retirement benefit expenses:

Millions of yen

Service cost ¥ 518¥ 518

Interest cost 197197

Expected return on plan assets (144)144)

Amortization of prior service cost (333)333)

Amortization of net actuarial gain 244244

Retirement benefit expenses ¥ 482¥ 482

4. Assumptions used in accounting for the above plans:

Periodic allocation method for projected benefits Straight-line basis

Discount rates 1.300–2.099%

Expected rate of return on plan assets 1.300%

Period over which prior service cost is amortized 1–5 years

Period over which net actuarial gain or loss

is amortized 1–5 years

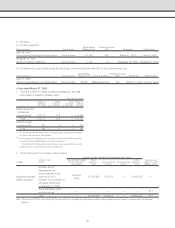

Stock Options

• Year ended March 31, 2008

1. Expense items and amounts during the fiscal year related to

stock options:

Cost of sales ¥ 6 million

Selling, general and administrative

expenses 67 million

39