Square Enix 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

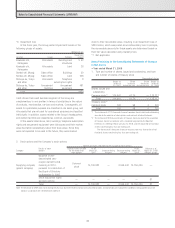

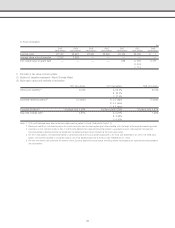

2) Price information

Yen

2002 2004 2005 2005 2007 2007

stock options stock options stock options stock options stock options stock options

Exercise price ¥2,152 ¥2,981 ¥3,365 ¥3,360 ¥3,706 ¥3,706

Average share price at exercise 3,572 3,582 — — — —

Fair market value on grant date — — — — 526 A. 526

B. 594

C. 715

Note: A, B and C indicated above refer to the three rights exercise periods A, B and C indicated in Table 2 (1).

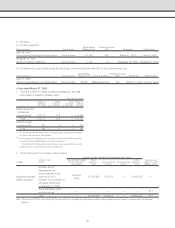

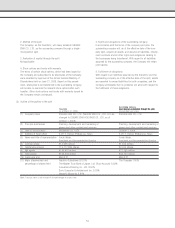

3. Estimate of fair value of stock options

(1) Method of valuation employed—Black–Scholes Model

(2) Main basic values and methods of estimation

2007 stock options 2007 stock options

Stock price volatility*2 24.0% A. 24.0%

B. 25.0%

C. 27.9%

Expected remaining period*3 3.5 years A. 3.5 years

B. 4.0 years

C. 4.5 years

Expected dividend*4 Dividend yield 0.99% Dividend yield 0.99%

Risk-free interest rate*5 0.87% A. 0.87%

B. 0.92%

C. 0.97%

Notes: 1. A, B and C indicated above refer to the three rights exercise periods A, B and C indicated in Table 2 (1).

2. Stock price volatility is calculated based on the actual stock price from the stock option grant date extending back the length of the expected remaining period.

3. Owing to a lack of sufficient historical data, it is difficult to determine the expected remaining period in a reasonable manner. Consequently, the expected

remaining period is determined to be the period from the option grant date to the mid-point of the exercisable period.

4. The expected dividend is calculated based on the actual dividend applicable to the fiscal year ended March 31, 2007.

5. The risk-free interest rate represents the interest rate of Japanese government bonds whose remaining periods correspond to the expected remaining periods of

the stock options.

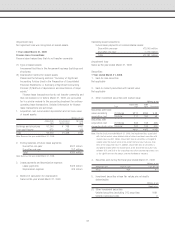

4. Method of estimating the number of vested stock options

Owing to the difficulty of estimating the number of stock options that will be forfeited in future periods, estimation of the vested number is based

upon actual forfeitures in prior periods.

• Year ended March 31, 2009

1. Expense items and amounts during the fiscal year related to stock options:

Cost of sales ¥ 16 million

Selling, general and administrative expenses 312 million

41