Square Enix 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(Impairment loss)

No impairment loss was recognized on leased assets.

• Year ended March 31, 2009

Finance lease transactions

Finance lease transactions that do not transfer ownership

(1) Type of leased assets

Amusement facilities in the Amusement business (buildings and

structures)

(2) Depreciation method for leased assets

Please see the following sections: “Summary of Significant

Accounting Policies Used in the Preparation of Consolidated

Financial Statements; 4. Summary of Significant Accounting

Policies; (2) Method of depreciation and amortization of major

assets.”

Finance lease transactions that do not transfer ownership and

that commenced on or before March 31, 2008, are accounted

for in a similar manner to the accounting treatment for ordinary

operating lease transactions. Detailed information for finance

lease transactions are as follows:

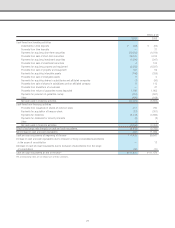

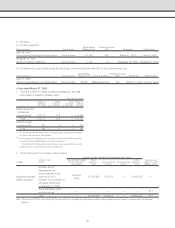

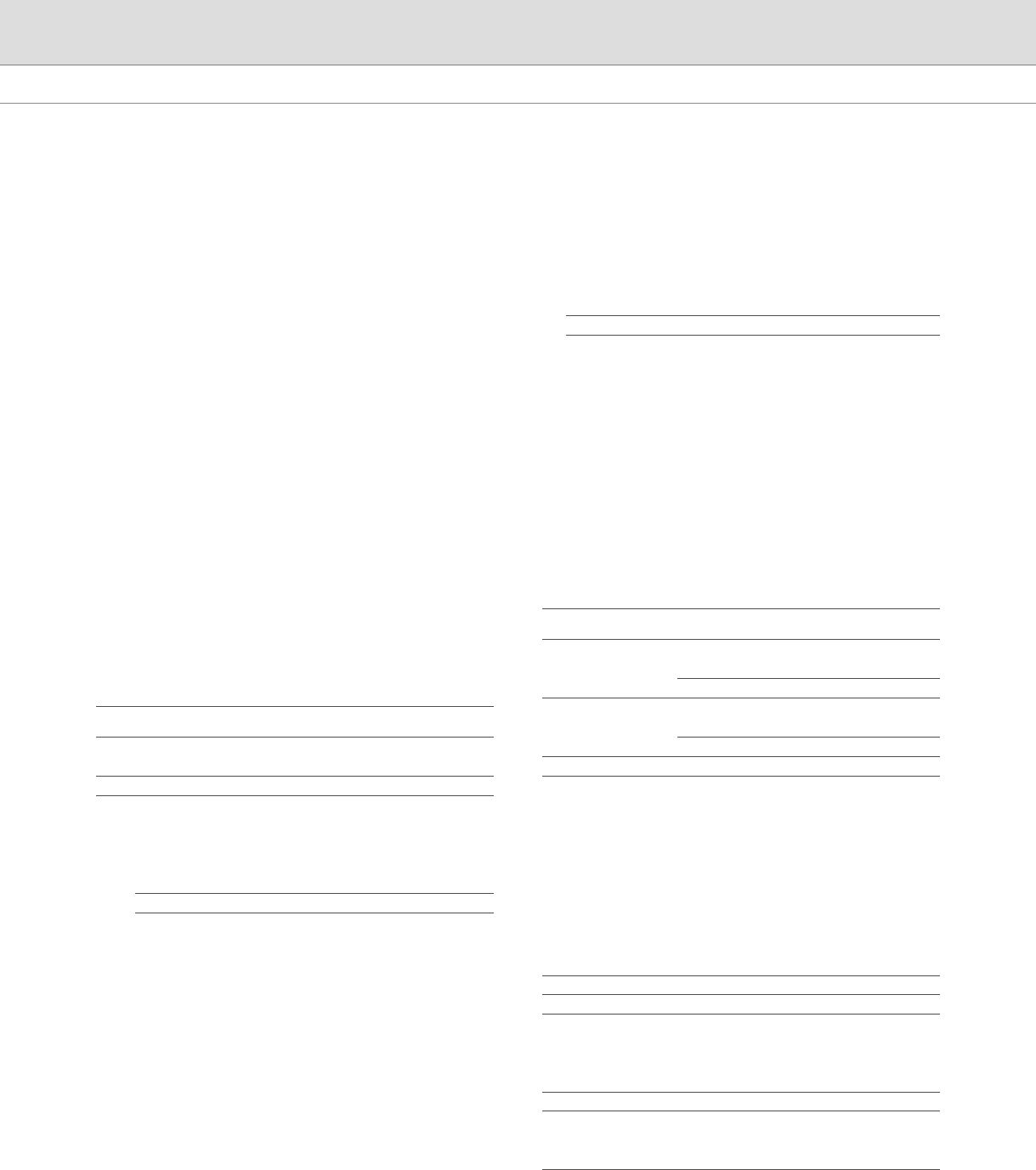

1. Acquisition cost, accumulated depreciation and net book value

of leased assets:

Millions of yen

Acquisition Accumulated Net book

cost depreciation value

Buildings and structures ¥1,246 ¥ 788 ¥457

Tools and fixtures 973 650 323

Total ¥2,219 ¥1,438 ¥781

Note: Same as the year ended March 31, 2008

2. Ending balances of future lease payments:

Due within one year ¥527 million

Due after one year 253 million

Total ¥781 million

Note: Same as the year ended March 31, 2008

3. Lease payments and depreciation expense:

Lease payments ¥426 million

Depreciation expense 426 million

4. Method of calculation for depreciation

Same as the year ended March 31, 2008

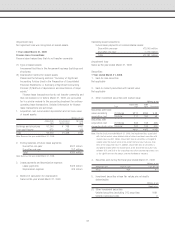

Operating lease transactions

Future lease payments on noncancellable leases:

Due within one year ¥2,045 million

Due after one year 1,115 million

Total ¥3,161 million

(Impairment loss)

Same as the year ended March 31, 2008

Securities

• Year ended March 31, 2008

1. Held-for-sale securities

Not applicable

2. Held-to-maturity securities with market value

Not applicable

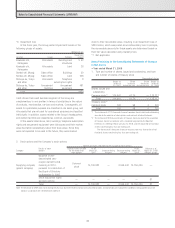

3. Other investment securities with market value:

Millions of yen

Acquisition Book

Type cost value Difference

Securities with book

value exceeding (1) Stocks ¥217 ¥266 ¥ 48

acquisition cost Subtotal 217 266 48

Securities with

acquisition cost (1) Stocks 263 198 (65)

exceeding book value Subtotal 263 198 (65)

Total ¥481 ¥465 ¥(16)

Note: For the fiscal year ended March 31, 2008, the impairment loss associated

with the fair market value determination of other investment securities with

market value was ¥31 million. Impairment loss on securities is charged to

income when the market price at the end of the fiscal year falls less than

50% of the acquisition cost. In addition, impairment loss on securities is

charged to income when the market price at the end of the fiscal year falls

between 30% and 50% of the acquisition cost after considering factors such

as the significance of the amount and the likelihood of recovery.

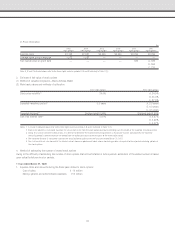

4. Securities sold during the fiscal year ended March 31, 2008

Millions of yen

Amount of sale Gain on sale Loss on sale

¥155 ¥64 ¥—

5. Investment securities whose fair values are not readily

determinable:

Millions of yen

Book value

(1) Other investment securities

Unlisted securities (excluding OTC securities) ¥191

Unlisted overseas bonds 0

37