Square Enix 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6. Redemption schedule of other securities with maturities and

held-to-maturity securities

Not applicable

• Year ended March 31, 2009

1. Held-for-sale securities

Not applicable

2. Held-to-maturity securities with market value

Not applicable

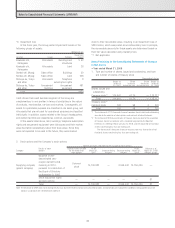

3. Other investment securities with market value:

Millions of yen

Acquisition Book

Type cost value Difference

Securities with book

value exceeding (1) Stocks ¥ 0 ¥ 0 ¥ 0

acquisition cost Subtotal 0 0 0

Securities with

acquisition cost (1) Stocks 1,997 1,881 (115)

exceeding book value Subtotal 1,997 1,881 (115)

Total ¥1,998 ¥1,882 ¥(115)

Note: For the fiscal year ended March 31, 2009, the impairment loss associated

with the fair market value determination of other investment securities with

market value was ¥15 million. Impairment loss on securities is charged to

income when the market price at the end of the fiscal year falls less than

50% of the acquisition cost. In addition, impairment loss on securities is

charged to income when the market price at the end of the fiscal year falls

between 30% and 50% of the acquisition cost after considering factors such

as the significance of the amount and the likelihood of recovery.

4. Securities sold during the fiscal year ended March 31, 2009

Millions of yen

Amount of sale Gain on sale Loss on sale

¥4 ¥0 ¥17

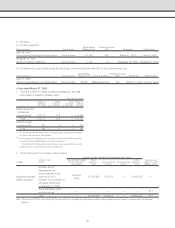

5. Investment securities whose fair values are not readily

determinable:

Millions of yen

Book value

(1) Other investment securities

Unlisted securities (excluding OTC securities) ¥180

Unlisted overseas bonds 0

6. Redemption schedule of other securities with maturities and

held-to-maturity securities

Not applicable

Derivative Transactions

• Year ended March 31, 2008

1. Terms of transactions

(1) Types and purposes of transactions

In principle, the Company does not engage in derivative trans-

actions. However, from time to time, the Company enters into

forward foreign exchange contracts for the purpose of reducing

the risk of exposure to foreign exchange rate fluctuations.

(2) Transaction policy

The Company enters into forward foreign exchange contracts to

cover anticipated transactions denominated in foreign currencies

but does not enter into such contracts for speculative purposes.

(3) Risks

Forward foreign exchange contracts are subject to market risk

arising from fluctuations in foreign exchange rates. The Company

deems the risk of nonperformance by the counterparties to

forward foreign exchange contracts to be low because the

Company only enters into such contracts with financial

institutions that have high credit ratings.

(4) Risk management

Contracts are approved by a representative director and the

director with responsibility for this area. The Accounting and

Finance Division administers risk management.

2. Market valuation of transactions

Not applicable

• Year ended March 31, 2009

Same as the year ended March 31, 2008

Retirement Benefits

• Year ended March 31, 2008

1. Overview of retirement benefit plan

The Company and its domestic consolidated subsidiaries have a

lump-sum retirement payment plan in accordance with their

internal bylaws.

The projected benefits are allocated to periods of service on

a straight-line basis. The Company’s domestic consolidated

subsidiaries apply a simplified method in the calculation of the

retirement benefit obligations. In addition, certain of the

Company’s overseas subsidiaries maintain defined contribution

retirement pension plans.

Notes to Consolidated Financial Statements (JPNGAAP)

38