Square Enix 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

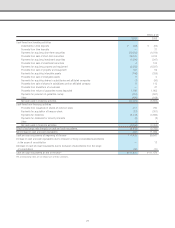

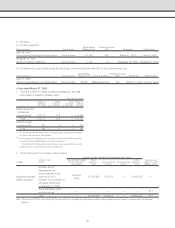

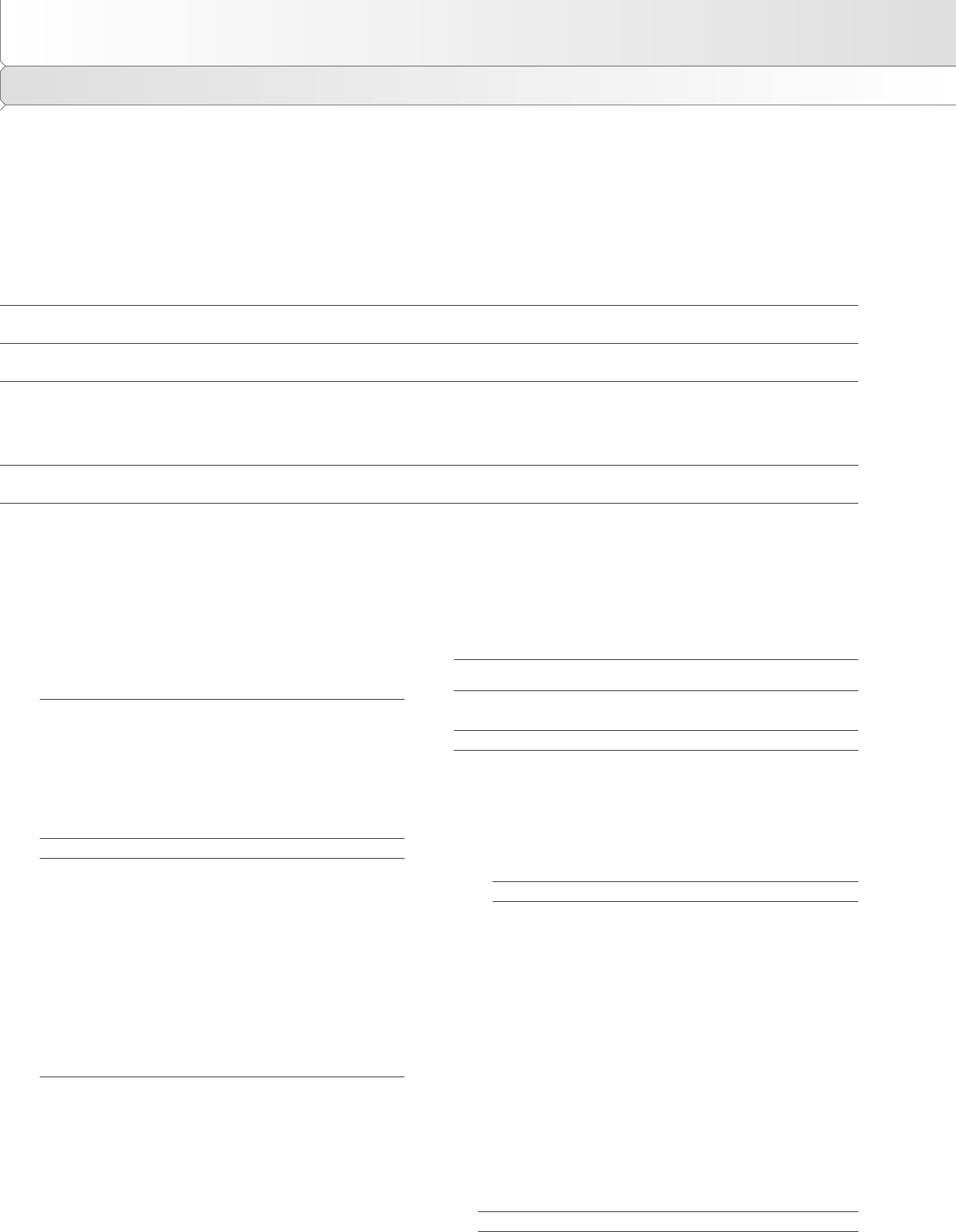

Notes to Consolidated Statements of Cash Flows

• Year ended March 31, 2008

*1 A reconciliation of cash and cash equivalents in the consolidated

statement of cash flows to the corresponding amount disclosed in

the consolidated balance sheet is as follows:

(As of March 31, 2008)

Cash and deposits ¥111,515 million

Time deposits with maturity

periods over three months (36 million)

Cash and cash equivalents ¥111,479 million

*2 Important non-cash transactions

The Company had the following important non-cash transactions:

Increase in common stock due to

conversion of convertible bonds ¥ 6,499 million

Increase in capital surplus due to

conversion of convertible bonds 6,499 million

Total ¥12,999 million

Decrease in convertible bonds due to

their conversion ¥13,000 million

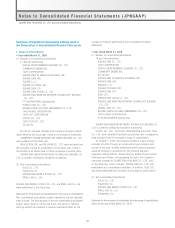

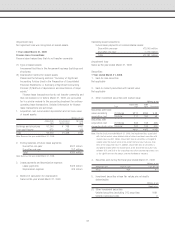

• Year ended March 31, 2009

*1 A reconciliation of cash and cash equivalents in the consolidated

statements of cash flows to the corresponding amount disclosed in

the consolidated balance sheets is as follows:

(As of March 31, 2009)

Cash and deposits ¥111,981 million

Time deposits with maturity

periods over three months (106 million)

Cash and cash equivalents ¥111,875 million

*2 Not applicable

Lease Transactions

• Year ended March 31, 2008

Information related to finance leases other than those that transfer

ownership to the lessee

1. Acquisition cost, accumulated depreciation and net book value

of leased assets:

Millions of yen

Acquisition Accumulated Net book

cost depreciation value

Buildings and structures ¥1,246 ¥ 589 ¥ 657

Tools and fixtures 1,037 527 510

Total ¥2,283 ¥1,116 ¥1,167

Note: The total amount of future lease payments at the end of the year constituted

an insignificant portion of net property and equipment at the end of the year.

Accordingly, total acquisition cost included the interest portion thereon.

2. Ending balances of future lease payments:

Due within one year ¥ 421 million

Due after one year 746 million

Total ¥1,167 million

Note: The total future lease payments at the end of the year constituted an

insignificant portion of total property and equipment at the end of the year.

Accordingly, total future lease payments included the interest portion thereon.

3. Lease payments and depreciation expense:

Lease payments ¥455 million

Depreciation expense ¥455 million

4. Method of calculation for depreciation

Depreciation is calculated using the straight-line method over a

useful life with no residual value.

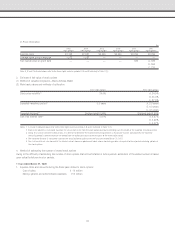

Operating lease transactions

Future lease payments:

Due within one year ¥1,729 million

Due after one year 2,477 million

Total ¥4,207 million

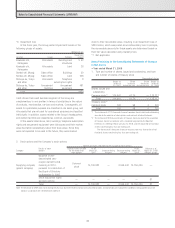

3. Dividends

(1) Dividend payments

Total dividends Dividends per share

Date of approval Type of shares (Millions of yen) (Yen) Record date Effective date

June 21, 2008

(Annual General Meeting of Shareholders) Common stock ¥2,296 ¥20 March 31, 2008 June 23, 2008

November 17, 2008

(Board of Directors’ Meeting) Common stock 1,149 10 September 30, 2008 December 5, 2008

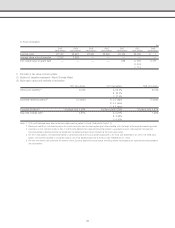

(2) Dividends with a record date during this fiscal year, but whose effective date falls in the following fiscal year

Total dividends Dividends per share

Date of approval Type of shares (Millions of yen) Source of dividends (Yen) Record date Effective date

June 24, 2009

(Annual General Meeting of Shareholders) Common stock ¥2,300 Retained earnings ¥20 March 31, 2009 June 25, 2009

Notes to Consolidated Financial Statements (JPNGAAP)

36