Square Enix 2009 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2009 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

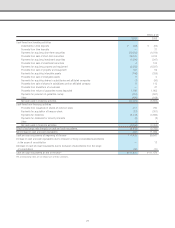

Content Production Account

Millions of yen

March 31 2008 2009 Change

¥14,793 ¥18,392 ¥3,599

As a rule, content development costs incurred during the period

from a title’s formal development authorization through to its

release are capitalized in the content production account. When the

title is released, this amount is then recorded as an expense.

The content production account is reevaluated based on the

current business environment.

Costs incurred during the pre-production phase—the phase

before development is approved—are posted as selling, general and

administrative (SG&A) expenses as they are incurred. As of March

31, 2009, the content production account totaled ¥18,392 million,

an increase of ¥3,599 million compared with the end of the prior

fiscal year.

As of March 31, 2009, the Company incurred a ¥5,368 million

loss on valuation of inventory primarily due to reevaluation of the

content production account.

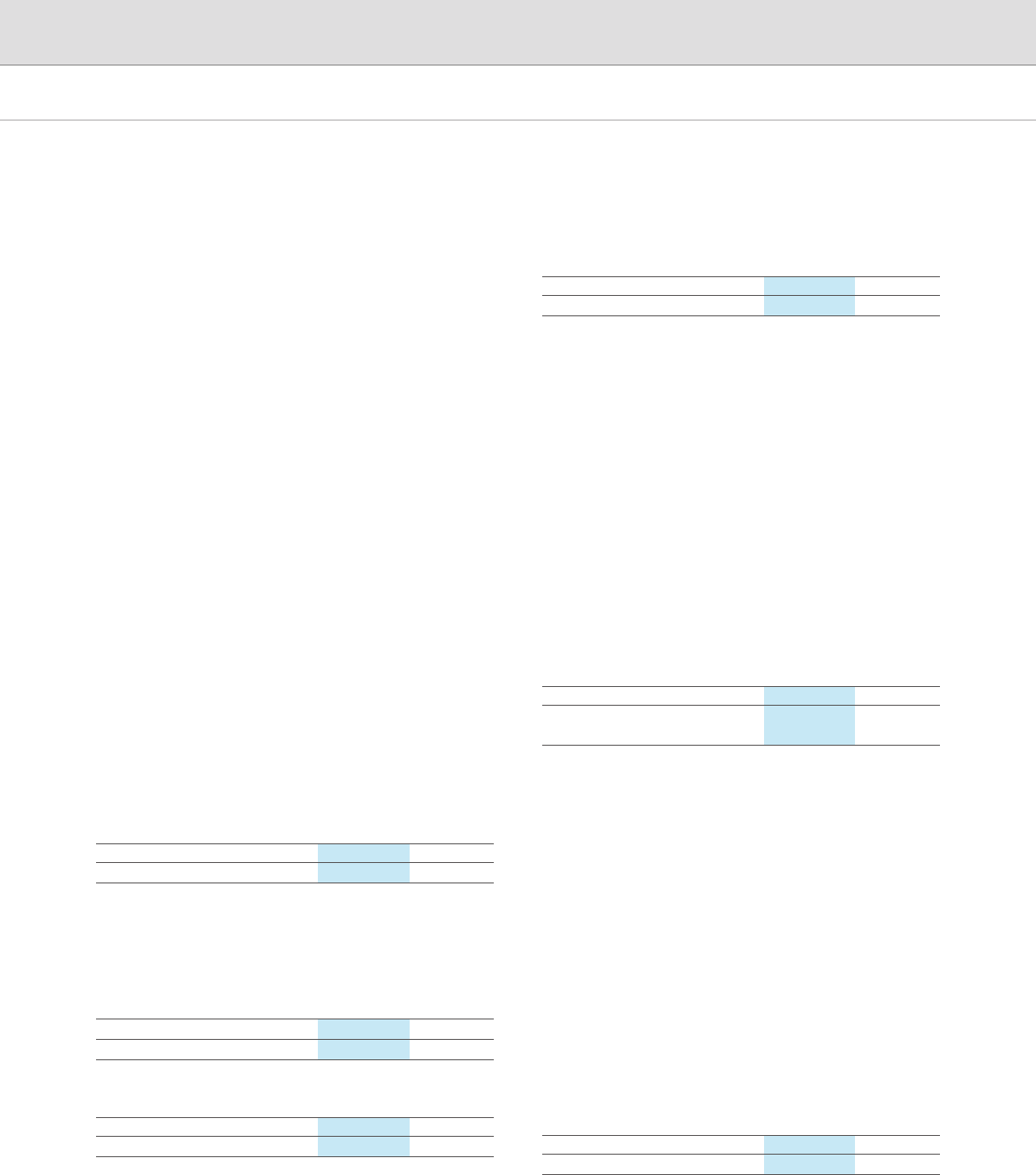

Deferred Tax Assets

Millions of yen

March 31 2008 2009 Change

Current ¥4,158 ¥3,882 ¥(276)

Non-current 852 952 100

In September 2005, the Company acquired 93.7% of the common

shares of TAITO CORPORATION via a takeover bid. Subsequently,

TAITO CORPORATION was merged with SQEX, Inc., a wholly-owned

subsidiary of the Company, resulting in TAITO CORPORATION

becoming part of a wholly-owned subsidiary of the Company. The

temporary tax differences associated with the takeover of TAITO

CORPORATION were recognized as a tax effect that the Company is

expected to recover in the future, and the expected amount to be

recovered was recorded as a deferred tax asset. As of March 31,

2009, current deferred tax assets amounted to ¥3,882 million, a

decrease of ¥276 million, and non-current tax assets totaled ¥952

million, an increase of ¥100 million. These changes were attributable

to a decrease in deferred tax assets owing to the elimination of tax

differences associated with the takeover of TAITO CORPORATION and

an increase in temporary tax differences due to a loss on inventory

valuation and other factors.

Property and Equipment

Millions of yen

March 31 2008 2009 Change

¥19,939 ¥19,082 ¥(857)

Net property and equipment decreased by ¥857 million to ¥19,082

million. Although land increased, amusement equipment decreased

from ¥5,906 million to ¥2,590 million.

¥7,527 million compared to the year ended March 31, 2008), lower

depreciation expense (a decrease of ¥2,955 million compared to

the year ended March 31, 2008) and lower accounts receivable (a

decrease of ¥1,371 million compared to the year ended March 31,

2008), while inventories increased by ¥1,907 million and accounts

payable increased by ¥4,589 million compared to the year ended

March 31, 2008.

(2) Net cash used in investing activities

Net cash used in investing activities totaled ¥10,991 million, an

increase of ¥5,186 million compared to the previous fiscal year.

The main item within this was payments for acquiring property and

equipment of ¥9,983 million.

(3) Net cash used in financing activities

Net cash used in financing activities amounted to ¥3,044 million,

an increase of ¥359 million compared with the previous fiscal year.

The largest item within this was payments for dividends of ¥3,443

million.

The Group believes that it will be possible to procure the funds

required for working capital and capital investments in the future

to maintain growth based on its sound financial standing and ability

to generate cash through operating activities.

3. Analysis of Business Performance in the Fiscal Year

Ended March 31, 2009

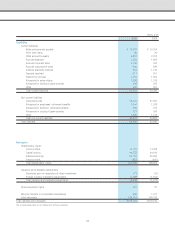

Assets

Total Assets

Millions of yen

March 31 2008 2009 Change

¥212,134 ¥213,194 ¥1,060

Total assets as of March 31, 2009 amounted to ¥213,194 million,

an increase of ¥1,060 million compared with the previous fiscal

year-end. The main factors contributing to this change were as follows:

Cash and Deposits

Millions of yen

March 31 2008 2009 Change

¥111,515 ¥111,981 ¥466

Notes and Accounts Receivable

Millions of yen

March 31 2008 2009 Change

¥17,738 ¥15,432 ¥(2,306)

The year-end balance of notes and accounts receivable varies

greatly depending on the timing of new game title releases. Notes

and accounts receivable at year-end were ¥15,432 million, a

decrease of 2,306 million compared with the previous year end.

17